机构:德意志银行

评级:买入

目标价:8.30港元

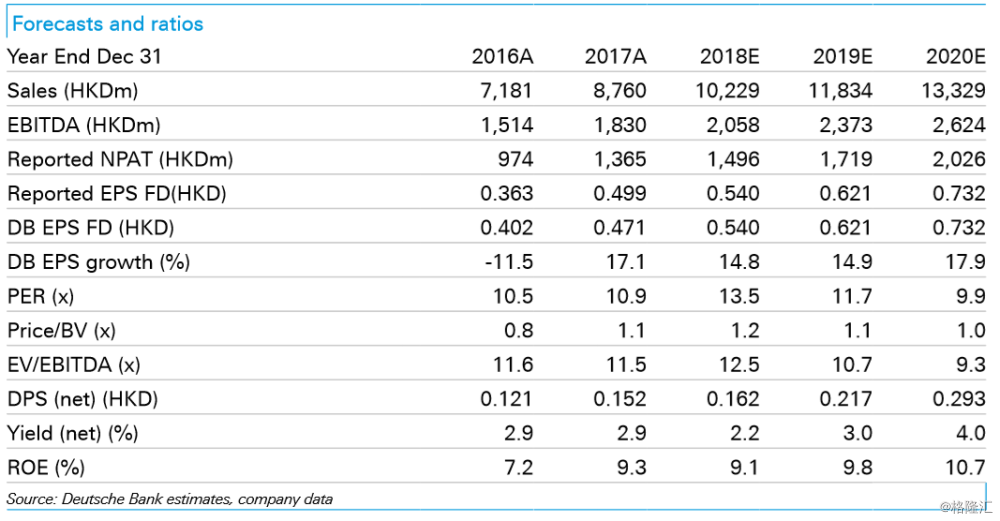

1H18 recurring profit is slightly below DBe Towngas reported net profit rose by 10% to HKD663mn in 1H18. After adjusting for HKD102mn in one-off items (mainly FV loss of financial assets and FX loss), recurring net profit was HKD765mn, up 10% yoy and 4% below DBe mainly on lower-than-expected new connections which is flattish yoy on a consolidated basis. Recurring profits in 1H18 account for 51% of our full year earnings forecast. On an EBIT level, gas sales segment profit grew strongly by 37% yoy driven by 18% volume growth and increasing operating leverage, partially offset by a Rm6cents/cm (or 9%) dollar margin yoy decline. Connection segment profit increased slightly by 5%, contributing 47% of total EBIT.

Volume growth on track with margin recovered hoh The gas volume growth in 1H18 remains robust at 18%, similar to 2017. By segment, the volume growth is mainly driven by a 23% increase in industrial volume and 14% yoy growth in residential, followed by an 11% improvement in commercial. Subsidiary/Asso and JCE/Chengdu project (investments) recorded volume growth of 27%/18%/7% respectively.

Dollar margin dropped by Rmb6cents/cm yoy to Rmb0.61/cm (incl. VAT) but recovered by Rmb2cents/cm hoh, which is mainly because of the winter gas shortage impacts. Gas shortage was most severe in 4Q17 when the high procurement cost dragged down the gas sales margins significantly. Along with the ease of supply shortage, margin start to recover sequentially since 1Q18. We expect a similar trends for peers.

Valuation and risks

Our TP is based on DCF methodology with a WACC of 8.1% and 1% terminal growth rate (based on long-term economic growth). Key risks include lower-thanexpected volume/new connection/margins, policy uncertainties on connection fee and distribution margins.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员