机构:中信建投

评级:买入

目标价:11港元

China Resources Cement (CRC)’s daily sales growth slowed in Jun-18, though it still exceeded our expectation due to the historically low month.

From a longer-term perspective, we believe CRC will continue to benefit from the deepening supply-side reform and long term business transition. In anticipation of increasing visibility on the Greater Bay Area development, we believe market will regain interest in CRC.

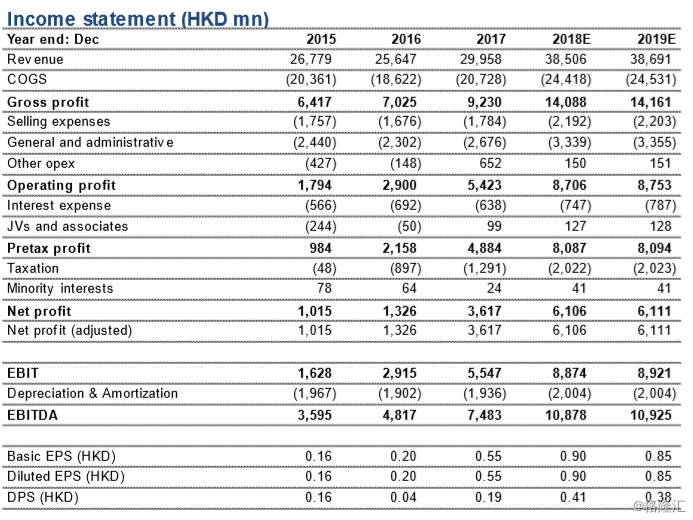

After the recent pullback, CRC is trading at 8.6/9.1x FY18E/FY19E diluted PER and 4.8% FY18E yield, which are very attractive from a historical perspective and should have reflected the negatives stemming from its unexpected share placement and the weak seasonality, in our view. After revising upwards our FY18E/19E earnings estimates by 14.6%/14.7% respectively, we raised our DCF-based PT to HKD11.0 (from HKD10.0) Upgrade to BUY from Hold.

Share placement to boost market free-float and longer sustainable growth. CRC has issued 450mn shares at the price of HKD9.29 apiece, raising net proceeds of HKD4.18bn which will be used for prefabricated construction and aggregate business development as well as debts repayment and general working capital. Subsequent to the share issuance, the market free-float of CRC’s shares has increased to 31.28% from 26.55%. We believe the share placement will strengthen the company’s financial position, which will be beneficial for its drive towards sustainable development and self-sufficiency improvement of its concrete operations. As the expansion of cement capacity will be strictly off-limits in China in 2018 and CRC has only one 2mtpa cement capacity project under construction in Guizhou that is scheduled to commence commercial operation in 2Q19, we believe new business developments would have meaningful contribution by 2020.

Positive interim results alerted. The company expects unaudited profit attributable to the owners for the six months ended-Jun to have increased significantly as compared to the same period a year ago, on the back of the 33.4% hike in its product prices. In anticipation of the traditional weak demand season for the South China market during the 3Q, we expect cement sales to slow before picking up again in the high demand season from late-August. Based on our latest update, daily cement delivery during majority of June has come down by 10-15% versus May, though it has still exceeded our expectation, with the average selling prices largely remaining stable. Meanwhile, average coal procurement costs have continued to slip, driving margin enhancement.

Policy-driven catalyst intact – a long-term beneficiary of Greater Bay Area and “Hainan free port” development. The HKSAR government has commenced to conduct preparation work for the mega region development plan in the Greater Bay Area. CRC believes more details of the development plan would be announced by the year-end. As the Chinese government has planned to develop Hainan as an International Tourism Island and a free-trade port, forging closer cooperation within the Greater Bay Area, we believe such strategic policies would bring positive impact on cement consumption, in anticipation of acceleration in infra project investments and the future real estate development needs. Both Guangdong Province and the Guangxi region have planned to boost infra-related investment during the 13th Five-Year plan period. Cement consumption of the two provinces had seen positive growth year to-date.

Correction makes valuation more attractive. CRC is currently trading at merely 8.6x/9.1x FY18E/FY19E PER respectively, at the lower-end of its historical forward PER range with a dividend yield of 4.8%, and thus we deem its valuation attractive. Accordingly, we have raised our PT to HKD11.0, representing 42.0% upside potential, and hence we upgrade our rating to BUY from Hold.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员