机构:招商证券

评级:买入

目标价:37港元

■ Mgmt. is confident to achieve its FY19-21E rural connection guidance

■ Long-term growth of VAS is sustainable supported by replacement needs of residential households

■ Reiterate BUY and TP at HK$37.0

Key beneficiary of the newly announced anti-pollution action plan

On 27 Jun 2018, Chinese government lifted its combat against pollution by releasing “Three year action plans for fighting for the blue sky”. The government is expanding rural coal-to-gas conversion program to FenWei Plain and Yangtze River Delta and increasing financial supports. Being the first mover in rural coal-to-gas market, China Gas has forayed into provinces, e.g. Shaanxi and Anhui. The company will continue to sign more contracts going forward and has confidence to meet its rural connection rollout guidance of 2.0-3.6mn households in FY19-21.

Limited earnings impact from the recent city gate price hike for residential households

On 10 Jun 2018, NDRC announced to raise the city gate price with a maximum RMB0.35/cu m for residential households. Projects of China Gas in 24 provinces are being affected, among which gas cost hike in 8 provinces is automatically passed through. For the remaining 16 provinces, the company has already submitted the application to the local governments. With a 1-2 month time lag for cost passing through, mgmt. expects the earnings impact to be around HK$30-40mn in FY19, around 0.4-0.5% of net profit.

Growth of VAS is sustainable in the long run

In FY18, China Gas recorded a remarkable result for its VAS business with an operating profit growth of 162% YoY. Management guides an operating profit growth of 40-50% YoY in FY19-21 annually driven by the robust demand for gas appliance, especially the wall-hung gas heaters sold to rural households. Beyond FY21, based on a customer base of 41mn households, assuming 10% of the households with replacement needs each year and China Gas taking up 50% of market share, gas appliance replacement will create ~RMB8bn revenue to the company per year, which would support the segment’s growth in the long term.

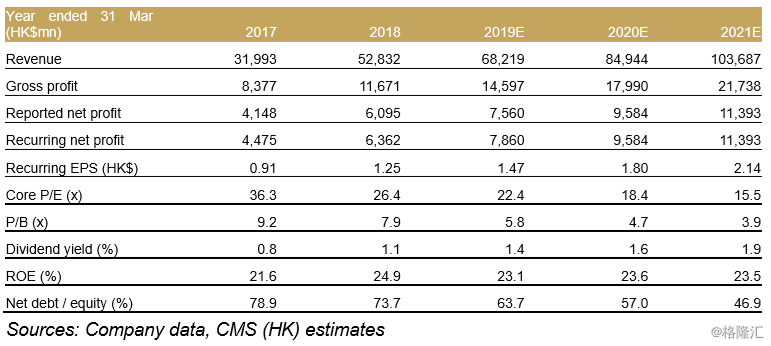

Financials

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员