机构:光大证券

评级:买入

目标价:4.3港元

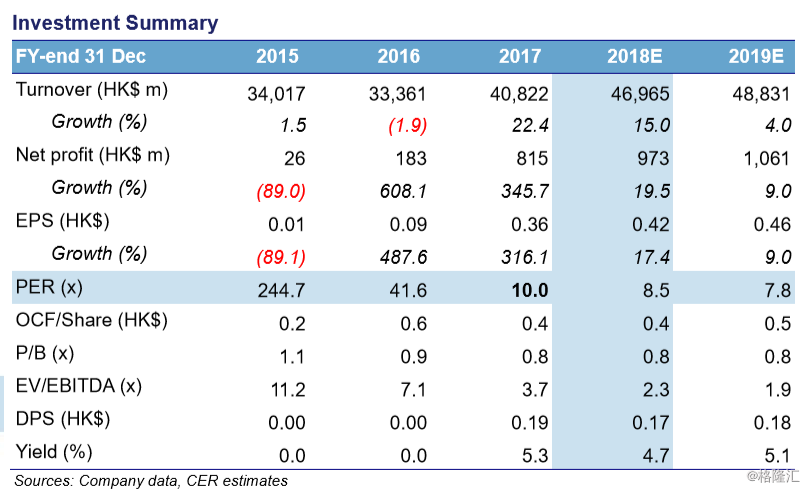

TCL Electronics (TCL) announced a set of strong 1H18 results with turnover and net profit increasing by 23.7% and 278.6% YoY to HK$21,050m and HK$573m respectively. The results were better than our expectation. TCL declared an interim dividend of HK$0.098 per share. In view of the strong results, we raise our 2018&19 earnings estimates by 25% and 25% respectively. Based on 10% discount to its 5-year average P/B of 1.1x, we set our target price at HK$4.3, equivalent to 1.0x 2018E PB. Upgrade to Buy.

Strong 1H18 results. TCL Electronics (TCL) announced a set of strong 1H18 results with turnover and net profit increasing by 23.7% and 278.6% YoY to HK$21,050m and HK$573m respectively. The results were better than our expectation. The strong results were primarily attributable to its effective cost control measures. Its overall expense ratio decreased from 13.7% in 1H17 to 12.6% in 1H18, which also hit a record low since 2003.

Outperform the PRC industry average. According to CMM’s omni-channel data, the overall TV sales volume in the PRC TV market rose by 0.7% YoY in 1H18. TCL managed to grow its LCD TV sales volume by 26.4% YoY to 4.89 million sets in 1H18, significantly outperforming the industry average.

Solid growth in overseas market. In the overseas markets, total LCD TV sales volume grew by 44.4% YoY to 8.3 million sets in 1H18. The strong performance was mainly attributable to the outstanding shipment growth in the European markets, especially France, Spain and Poland. Moreover, the North American market maintained steady growth while the emerging markets developed rapidly.

Market leader remained. According to the latest Sigmaintell data, TCL ranked No.3 in the global TV market with a market share of 11.8% in terms of sales volume in 1H18. According to CMM omni-channel data, TCL ranked No.3 in the PRC TV market with a market share of 11.4% and 12.9% in terms of sales volume and turnover respectively.

Earnings revised upward. In view of better-than-expected 1H18 results, we lower our expenses assumptions and raise our 2018&19 earnings estimates by 25% and 25% respectively.

Upgrade to Buy. Based on 10% discount to its 5-year average P/B of 1.1x, we set our target price at HK$4.3, equivalent to 1.0x 2018E PB. In view of over 20% upside potential, we upgrade our recommendation to Buy from Accumulate.

Key risks

include 1) rapid change in technologies and customer preference, 2) keen competition, 3) fluctuation of raw material prices, 4) economic slowdown and 5) currency risk.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员