机构:中信建投

评级:买入

目标价:4.5港元

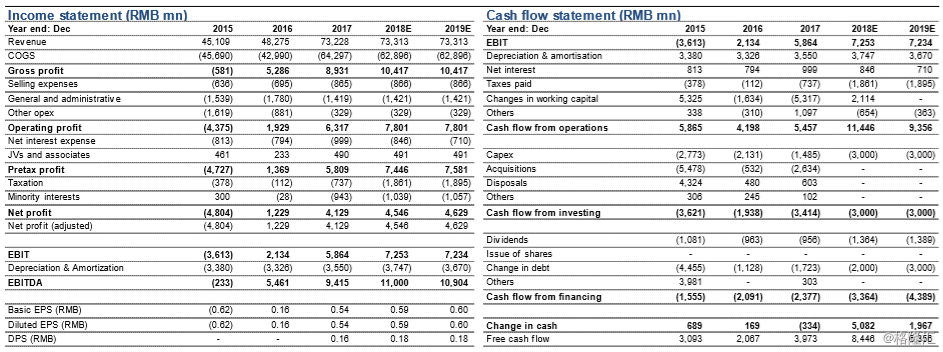

Magang’s positive earnings growth in the first quarter, driven by higher unit gross dollar margins, reaffirms our view that the industry earnings uptrend remains intact. In our view, we believe the outlook for China’s steel industry would remain stable amid the current supply-side industry reforms. We have revised up our FY18E revenue and net profit estimates slightly by 3.2%/1.0%, respectively, on anticipation of higher steel product prices to outweigh cost pressure. Our price target remains unchanged at HKD4.5, based on 1.0x FY18E BVPS; maintain BUY.

Another year of solid growth amid deepening supply-side reforms. As the Chinese government has planned to shut down 30mn tons of obsolete capacity, whereas the apparent consumption of steel is expected to remain stable from 2018 to 2020. On the production front, the latest operating rate of China’s national blast furnace has rebounded to the level of the pre-winter closure period. China’s steel inventory has continued to come down since mid-Mar with downstream consumption picking up. Meanwhile, stabilisation in Asean hot rolled coil import and Middle East rebar spot prices reflects the impact of the U.S. tariffs on steel is diminishing. And in spite of the rebound in the iron ore import price led by the growing demand for higher grade materials and upsurge in coking coal prices amid insufficient domestic supply, the price spread between steel products and raw materials has recovered towards the Jan year-high.

Prudent business plan bearing fruits. Management guided that the company aims to maintain the scale of its production at last year’s level, with crude and steel production to be maintained at 19.85mn tons and 18.82mn tons, respectively. Since 4Q16, Magang has seen a substantial rebound in the ex-factory prices for most of its products, which boded well for margin expansion in 2017. We believe the uptrend would be sustainable through this year. In view of Magang’s management’s effort in optimising the product mix towards higher-end steel, we believe Magang would continue to benefit from higher steel prices, leading to higher unit dollar margins from RMB330/ton last year.

Continuously improving free cash flow. Magang’s FY18E capex has been reduced from the FY17 level, with majority of the capex set aside for production upgrade and environmental protection related investment. As such, we foresee Magang to return to a net cash position by year-end, from ND/E at 27.7% end-17.

Room for further re-rating. Magang currently trades at 5.2x FY18E PER, which in our view looks attractive in light of its improving growth prospects. In terms of PBR and ROE, as our price target represents 1.0x FY18E PBR and given our expectation that its ROE will recover to c.16.8% in 2018, i.e. the level equivalent to the period between 2003 and 2005, we deem its current valuation undemanding, and thus, maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员