机构:德意志银行

评级:Hold

目标价:80港币

Solid FY17 results but in-line dividend and unattractive yield

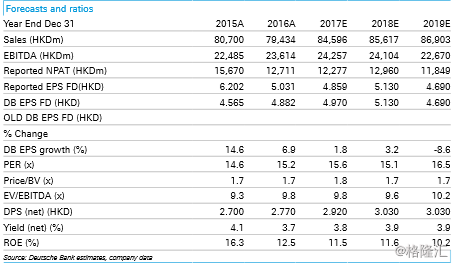

CLP reported solid FY17 results during lunch time on 26 Feb, beating consensus by 4% on Australia and India. CLP declared in-line FY17 dividend of HKD2.9/sh (up 4% yoy), indicating a payout ratio of 55% (based on recurring earnings) and a dividend yield of 3.7% in 2017. With a rising outlook for the US treasury yield and CLP trading at only 0.97 ppt above US 10-year treasury yield (lower than historical average of 1.71 ppt) on a 12-month forward basis, we believe CLP is fully valued. Maintain Hold.

Solid FY17 earnings with surprises from Australia and India

Stripping out one-offs (HKD573m of reversal of tax provision and HKD369m of property revaluation), recurring profit was up 8% yoy to HKD13.3bn, 4% above consensus (6% above DBe). Major surprises were from Australia (+48% yoy) and India (+38% yoy). ACOI (Adjusted Current Operating Income) from the wholesales business in Australia in 2H17 rose by 145% HoH to HKD2.1bn (after stripping out the impacts from fair value changes), driven by high wholesale prices and high availability factor. Earnings from India were stronger than expected on better operating efficiency and higher utilization of Jhajjar, steady performance of Paguthan and lower interest cost. The company expects the availability of Jhajjar to exceed 80% by March 2018, recovering from an extended planned maintenance outage in 1H17. Hong Kong and HK-related business represented 66% of CLP's operating earnings in 2017, followed by Australia (20%) and Mainland China (9%). CLP incurred capex of HKD15.3bn in 2017 (up from 10.9bn in 2016) and free cashflow was HKD22.9bn in 2017 (flat compared to HKD22.5bn in 2016).

Key takeaways from the briefing

Management mentioned that the Australia business has achieved its value restoration target: having its ROIC reaching its WACC for FY17. Management believes that there is further upside for the Australia business in 2018 compared to 2017, driven by Mount Piper. Long-term plan remains unchanged on the IPO of the Australia business, although there is no detailed timeline and the near-term focus is still on the value restoration.

Management plans to keep Mainland China and India to be CLP's major growth markets in the longer term. In India, CLP will continue to focus on transmission projects, and is open to distribution projects if the government allows private investment in the sector. The current power purchase agreement (PPA) for Paguthan will expire in December 2018. Management does not expect the PPA

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员