作者:Matthew Peterso

编者按:本文的作者为美国著名私募基金经理Matthew Peterson。他在华尔街是个绝对的另类,“逆向投资”是他最鲜明的标签——或许也正是这一点令他的投资业绩出类拔萃,傲视华尔街。

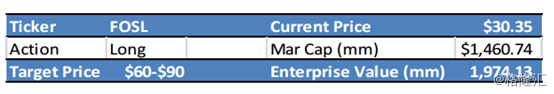

Fossil Group Inc. (FOSL) is a vertically integrated (from design, all the way topoint-of-sale) global consumer fashion accessories company that offers men’sand women’s fashion watches, jewelry, handbags, leather goods, belts, and sunglasses. The current valuation fails to account for the new opportunity that lies ahead of FOSL. Insiders and management own significant stakes, ensuring incentives are aligned. Camera shy CEO, Kosta N. Kartsotis, owns 13% of outstanding common stocks, and he earns no salary. The current share price offers investors the opportunity to buy a good business at a double-digit normalized free cash flow yield.

福斯尔集团(Fossil Group Inc.股票代码FOSL)是一个垂直一体化的国际消费者时尚配饰集团。其设计、营销和销售的产品包括男女时尚手表、首饰、手提包、皮革制品、皮带和太阳眼镜等。从现在福斯尔的股价来看,市场显然并没有意识到它的新机遇。另一方面,集团高管手上有大量的公司股票,他们想要把公司做好的动力毋庸置疑。比如不常在媒体镜头下露面的CEO, Kosta N. Kartsotis手上就有公司13%的普通股,而他平时是不拿工资的。现在买入的Normalized(正常化的)自由现金流收益率高达两位数,而公司现在较低的股价则给了投资者一个绝佳的“上车”机会。

A new trend that arises from smart watches,strong currency headwind, increased marketing and advertisement related expenses (54% increase in last 5 years), and increased growth investments, led to margin compression, but the market fails to recognize the new expansion into the growth markets like China and new product development, Smart watches. Based on my sleuthing, newly introduced 2nd generation smart watches (Q Wander &Q Marshal) are sold out in multiple locations. 1st generation watches are no longer available in Fossil stores or online via Fossil’s website. I have received good reviews from sales people. They either have the 2nd generation watch or are planning to buy one in the near future. I believe that FOSL placed itself in a unique situation to capture the new trend: wearable devices that fit technology, fashion, and fitness altogether.

智能手表的兴起,汇率下行,都使福斯尔在销售、广告相关的支出在过去的五年里足足涨了54%。投资增加,利润就会受到挤压。但是现阶段市场却忽略了这个集团在成长性市场(如中国)上的扩张,也忽略了它的新产品——智能手表所带来的增长潜力。福斯尔之前的第一代智能手表产品在官方网站和门店都已经停止销售,第二代智能手表Q Wander和Q Marshal取而代之。而根据我的实地调查,几个有这个新产品销售的门店里,销售人员都给出了不错的评价,他们表示自己已经买了或者打算买一块这个新手表。在我看来,福斯尔已经在智能手表的新浪潮里找到了自己的位置:生产集技术、时尚和健康于一身的可穿戴设备。

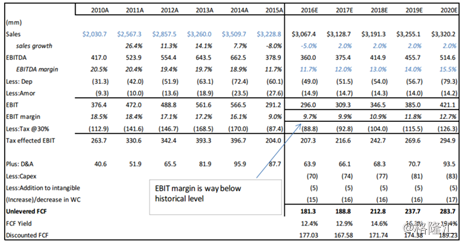

Although the current market price assumes that the revenue will continue to decline, I believe this is not the case for FOSL. Currently, the company trades for 7X 2015’s FCF. New long-term growth-relatedinvestments and liquidation of excess inventory compressed the margin and truecash flow potential. As these costs go away, margin will expand and so will the FCF. Historically, EBITDA margins float around ~20%. If the EBITDA margin goes to 18% FOSL will generate $7.28/Share,implying a 23% FCF yield.

福斯尔现在的股价反映了市场对其利润会进一步下跌的预期,但我不认为这个预期会发生。目前公司估值仅仅只有2015年自由现金流的7倍。新增的长期成长相关投资和过量存货的折价甩卖挤掉了公司的利润,也掩盖了公司真实的现金流潜能。如果把这些因素都刨掉,利润和自由现金流都会增加。从历史数据看,福尔斯的EBITDA利润率一直在20%左右波动。如果它的EBITDA利润率到达18%,每股将会产生7.28美元的获利,自由现金流收益率为23%。

The sleuth analyst:

FOSLis one of the highest shorted stocks, measured by short interest offloat(36.37%). I have been visiting multiple Fossil store over the past two weeks. I believe wall street is wrong.

调查分析

福斯尔(FOSL)是被做空最多的股票之一,当前卖空的股数占已发行的总股数的36.37%。但我在过去的两周走访了好一些福尔斯的门店之后发现,华尔街对这家公司的看法是错误的。

FOSL is selling lots of smart watches. I have talked to more than 15 sales associates at different locations. They all said the same story, good very positive story. Some stores even ran out of stocks. I have talked to customers those who wear them right now; they are happy with the generation-2 watches, especially about the battery life. I also visited the same location multiple times in the past two weeks to talk to different salespeople at the same location, and I didn’t find any inconsistencies among them.

福斯尔的智能手表其实成绩很好。我和不同地点的15个销售人员聊过,他们给出的说法都惊人地一致,就是卖得特别好,有的地方甚至断货。为了验证这个说法的一致性,我还挑选了在不同时间造访同一家门店,结果那些值班时间不同的销售人员也给出了同样乐观的说法。另外,我还询问了正在使用这些智能手表的顾客,他们都很喜欢新的智能手表,尤其满意电池的续航时间。

Rose gold is the mostpopular among them; some locations didn’t even have any stock.

其中又属玫瑰金的智能手表卖得最好,有些点已经完全没有存货了。

Thesis:

Competitive Advantage/Industry Highlight:

- Barriers to entry seem to be low in plain sight, but it is hard to break into the industry and run a profitable business operation. It is very difficult to grow one brand globally since it is required to have critical mass to have a successful operation.

投资逻辑分析:

竞争优势/行业概要

行业的准入门槛看起来低,但要真正打入并盈利却很难,因为只有高超的运营能力才能把一个品牌打造得世界闻名,而我们知道,这种生意要想经营成功,首先就要达到“群聚效应”的临界点。

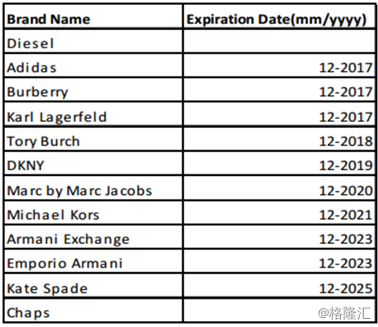

- A higher start-up cost with higher uncertainty doesn’t justify the huge initial investment. It is necessary to spend a huge amount of money on advertising to communicate the brand value. FOSL spends close to $250 million on advertisement every year. It is also necessary to create a brand image, even before you start selling through department stores or other channels. When the brand goes through distributors, the brand will not be able to communicate the image unless it has already been established. FOSL has enough brand names in its portfolio to expand its operation globally. FOSL’s licensing business is seven times larger than the closest competitor (MOV). It makes FOSL a natural partner for other brands. Guess even tried to join FOSL, but Callanen International (Guess watch maker) sued FOSL, claiming it violated the antitrust and unfair competition law. I don’t anticipate any risk that comes from one brand will leave from FOSL to another manufacturer.

然而启动成本和不确定性的“双高”也不足以解释为什么进入行业所需要的起始投资会高得如此离谱。其中的另外一个原因,就是需要花费巨额的广告费用去传播品牌价值。福斯尔每年花在广告上的钱近2.5亿美元。另外,品牌形象的树立也很重要,而且树立时间一定要尽早,甚至在产品进入百货商店或其他渠道之前就得建立起自己的品牌形象,否则在销售的过程中就无法起到传播品牌的作用。但福斯尔在获取国际知名度这一方面有着天然优势,因为它为许多像Adidas, Burberry, Michael Kors和Emporio Armani等等这样的国际知名品牌设计和制作时尚配饰。福斯尔的代理业务规模比最接近它的竞争对手(MOV)大了整整七倍。Guess之前也想加入福斯尔,只是后来被Guess品牌手表的生产商,Callanen International以违反反垄断和反不正当竞争法为由告上法庭,这件事情才最后作罢。所以,我不认为福斯尔现有的合作品牌中,会有任何一个愿意离开它而转投其他生产商。

- The vertically integrated nature of Fossil’s business helps it to understand the new market trend and adapt itself quickly to new fashions/trends. It has seven weeks lead time while its closest competitor, Movado, has six months lead time. Fossil can even run some experimental products, which it normally does, before producing on a larger scale.

福斯尔垂直一体化的特点让其可以及时、快速地发现并适应新的市场趋势和时尚潮流。紧随其后的Movado生产周期为六个月,但福斯尔只要七周。因此,它总是可以先“任性”地先发布实验性的新品试试水,再决定之后是否要量产。

- Unlike many of Fossil’s competitors, FOSL sells fashion watches along with luxury watches. Fashion watches tend to have shorter shelf/store time, indicated by the inventory days. Fashion watches are less sensitive to the economy as compared to luxury watches.

和它的竞争对手不同,福斯尔除了卖名贵腕表,也卖时尚型腕表。时尚腕表的存货周转天数更短,卖得更快。而且,时尚腕表也不像名贵腕表,对整体经济的好坏那么敏感。

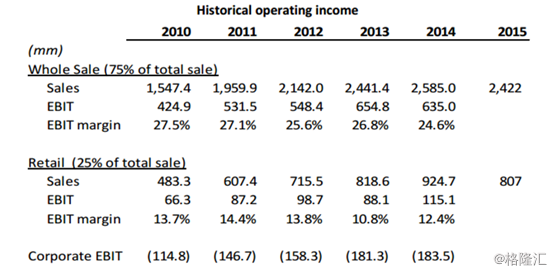

- FOSL generates revenue through wholesale (~75%) and retail operations (~25%). The wholesale business comprises a large portion of EBIT. Having multi-brand watches at various price levels has a significant advantage when it comes to wholesale business. Since department stores are more concerned about how much money they could make per square foot when selling watches, they tend to carry all the watches at various price ranges to attract more customers of all levels.

福斯尔的收入来源有两个,一个是通过批发手表给百货商场,这占总利润的大头,75%,剩下的利润则全部来自于零售。前文提到,福斯尔手上握着不同品牌的腕表,覆盖各种价位,这对批发业务极其有利——因为百货商场里在销售手表时,他们更关注每一平方米能带来多少盈利。为了能吸引尽量多的顾客,他们就会各种价位的表都进一点,这样不同消费能力的顾客都可以成为他们的潜在购买者。

Investment highlights:

- FOSL is heavily shorted stock for a variety of reasons: I don’t believe that short sellers will continue to be right.

投资亮点

由于一系列的原因导致现在福斯尔被严重做空,但我不认为做空的人会一直对下去,原因有几个:

1)The threat from the smart watches: I think FOSL is wellprepared to face the new trend. Their new wearable watches are a very hotproduct in the market. They are close enough to iWatch in terms offunctionality, even though IOS has blocked certain features. Based on thecommunication that I had with sales associates, it will be rectified through3rd party apps in the near future.

1)之前观点都认为智能手表的兴起会严重威胁福斯尔,但事实上,它早就做好了应 对的准备,现在已成了这股趋势的“玩家”之一——他们新出的第二代智能手表销量喜人。从功能来看,它们的智能手表和iWatch并没有太大区别,其搭载的安卓系统也可以连接iPhone。虽然iOS平台限制了部分功能,但店员告诉我,这个问题会在不久的将来由第三方软件解决。

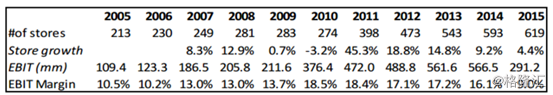

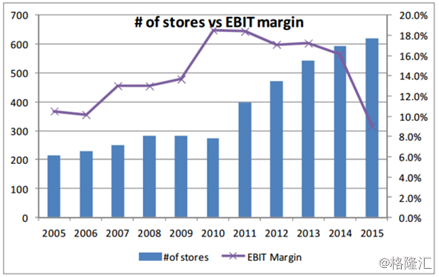

2)Margin compression: The market fails to recognize the growth investments, an increase in advertising and marketing expenses, and currency headwinds. I believe the margin will recover as the new investment starts to work out. FOSL is spending a huge amount of money on expanding its international business, as they tend to be high margin businesses rather than the businesses it has in the USA. Opening new stores tends to cost EBIT margin in the short run as indicated by the below graphs. I believe sell side analysts are more focused with margin than the possibility that comes in the near future. Most of the new stores in Asia are concession, and they don’t have fixed rent payments, but rather a % of revenue. I don’t believe this will have a negative effect, even if the market crashes.

“Our international marginsare higher than our U.S. margins on the wholesale side, primarily due to thefact that we are afforded the luxury of selling at higher prices. We don’t havethe same competitive landscape in the watch business in most of the marketsinternationally as we find here in the U.S., and therefore, the — we can pricemuch more sharply. Our gross margin sort of generally anywhere from probably 5to 10% higher in the international wholesale segment than they are in the U.S.segment on a like-per-like product perspective.” – Mike Kovar – Fossil, Inc. – CFO, 2008-Q2, CCT

2)现阶段公司利润率压缩,其实是因为增长性投资支出、广告及市场费用增加,以及汇率降低所致。我相信等到这些新投资开始起作用时,利润率就会恢复到原来的水平。福斯尔现在投入大量资金扩张国际业务,不断在亚洲地区开新店,所以短期来看,开店成本的确会让EBIT利润率降低(如下图所示)。由此看来,卖方分析师们关心的只是福斯尔短期的利润率。但是这里有一点要注意了,福斯尔在亚洲开店的绝大 多数地点是特批的,所以这些店几乎不用缴纳店铺租金,只会源源不断地产生利润。就算市场崩溃,也不会对这个几乎是“只进不出”的状况有什么影响。

而且,福斯尔在国际市场上的利润率会比美国本土市场的高,正如MikeKovar,集团的、CFO所说,“国际上大部分市场的名贵表竞争都没有美国的激烈,所以我们在国际商场 、上给名贵表的定价就可以更激进。”根据他的粗略估计,以名贵表为例,福斯尔在国际市场批发这一块的利润率会比美国的高5-10%。

- FOSL’s new acquisition, Misfit, and the new licensing agreement with Kate Spade will open up new channels to market its products, wearable technology, through consumer electronic stores (CE). Misfit and Kate Spade already have self-spaces in multiple CEs, even though both of them don’t have good enough products to compete with Fitbit. Management is positive that it will change soon.

福斯尔在2015年底收购了Misfit,另外从它和Kate Spade去年签订的授权协议来看,福斯尔新推出的智能穿戴设备将会在KateSpade的店里出售,从此打开新的销售渠道。Misfit和KateSpade在很多消费类电子(consumer electronic,简称CE)的店里都有自己独立的销售柜台。虽然这两者的产品都暂时无法与Fitbit(第一家上市的可穿戴设备公司)相匹敌,但管理层表示这个局面将很快被改变。

- FOSL only generates 17% of its total sales from Asia; management believes that its recent investment will increase the sales volume in Asia where Swatch is a market leader.

Swatch是亚洲腕表市场的“领头羊”。目前,亚洲市场贡献的销售额只占福斯尔的17%,管理层认为公司对国际市场上的投入将会提升亚洲的销售额。

- FOSL has experienced management, and it has experience dealing with negative watch demand. In fact, the company still runs by one of the founders.

“ For fiscal 2014, Mr. Kartsotis, our CEO, continued to refuse all forms of compensation, expressing his belief that, given his level of stock ownership, his primary compensation is met by continuing to drive stock price growth, thereby aligning his interests with stockholders’ interests. As a result, the following references to Named Executive Officers in this Compensation Discussion and Analysis do not include Mr. Kartsotis. – Definitive Proxy, 2015”

福斯尔的创立者之一,Kartsotis,依然是公司的CEO。另外,管理层经验丰富,完全可以应对腕表需求下滑。有意思的是,Kartsotis一直拒绝各种形式的补贴。他觉得既然他手上握着大量的公司股票,那他最大的补贴来源就是集团股价上涨,那样的话,他只要不断地推动股价上涨就可以了,这又和众多集团股票持有者的利益是一致的。

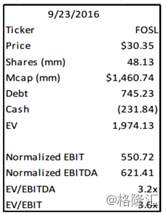

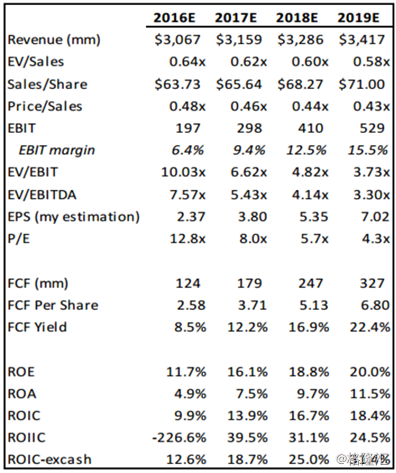

- Capitalization and Multiples: with very conservative assumption.

资本总额比率和各项指标(非常保守的估计)

Valuation

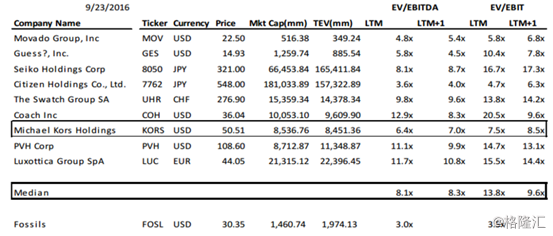

PUBLIC COMP

- Trades at the lower end of the peer group. FOSL generates 25% of its revenue through Michael Kors brands and 75% comes from other brands. As such, I believe FOSL should trade above Michael Kors, or at the very least, it should trade on par with Michael Kors. If it does, FOSL would be worth $60 on a normalized earning basis. If it trades at the median, FOSL will be at $65.

- 估值

行业对比

公司目前在同业中的价格偏低。福斯尔收入的25%来自于销售Michael Kors的手表,其余75%来自于其他品牌。所以我认为福斯尔的价格理应在Michael Kors之上,或者再怎么样都应该和它在同一水平线上。如果按照这个标准,福斯尔的股价保守估计应该值60美元,中等标准的话则应值65美元。

EQUITY FAIR VALUE UNDER SELECTEDVALUATION SCENARIOS

资产公允价值

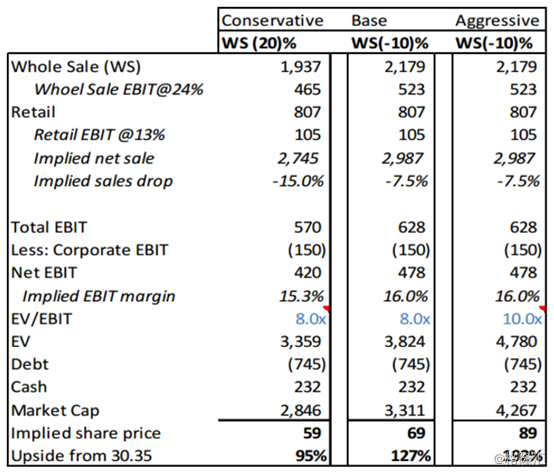

Assume the wholesale revenue drops by 20% (conservative &Base) 10% drop for aggressive case, for the sake of conservative valuation. Wholesale is the higher margin business. Retail sales Flat. It is reasonable to assume Wholesale EBIT margin is 24%; Retail margin is 13% based on historical data; EV/EBIT: 8x based on peer valuation; EV/EBIT:10x based on historical trend (aggressive case).

保守一点的话可以假设批发业务的收入下降20%,乐观一点的话可以假设其下跌10%。因为批发业务的利润率会比零售高,那么根据历史数据,我们就可以假设批发业务的EBIT利润率为24%;零售的利润率为13%。EV/EBIT的值如果根据同业水平的话则为8x,根据历史数据的话则为10x。

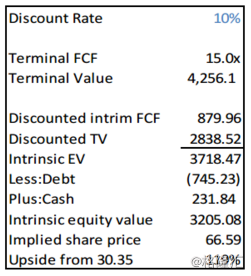

DCF

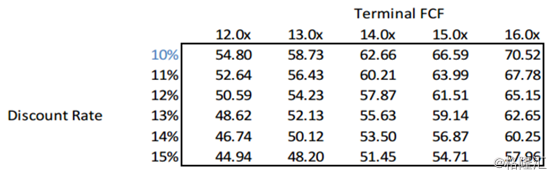

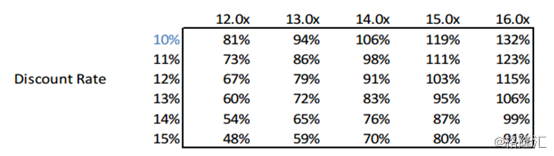

Implied Share price sensitivity Table:

基于敏感性分析推测出的股价

Implied upside from $30.35 sensitivityTable:

基于敏感性分析得出股价最高可达30.35美元。

Conclusion:

Behind all the pessimism that arose from the margincompression and the new smart watch introduction from other companies, FOSL istrading at a very good valuation. Analysts are more obsessed with the margincompression and fail to look the possibilities that lie ahead in the future. Ibelieve patient investors will eventually reap the benefits.

总结

利润的压缩,智能手表的冲击带来的市场悲观情绪使得福斯尔现在的买入价非常划算。华尔街上的分析师们只看到了集团现阶段利润的减少,却不去看它未来的增长可能。但我坚信的是,只有耐心的投资者才会笑到最后。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员