来源:广发香港

德国Q3 GDP增速下滑拖累欧洲经济,预期继续维持美元强欧元弱的格局

受消费和出口增速下滑的影响,德国三季度GDP增速不及预期。三季度经济增速的走弱主要来自于汽车行业需求不振以及外需走弱;10、11月经济景气指标显示,四季度经济仍有较大下行压力;同时,英国脱欧、意大利财政矛盾、土耳其货币危机也可能构成四季度经济增速下行的潜在风险。德国是欧元区的重要组成部分,三季度GDP增速下行也拖累了欧元区的整体经济表现。目前美欧10年期国债利差处于历史高位,欧洲经济偏弱使得欧美央行政策的分化持续,美欧利差或进一步扩大,美元指数年内仍有向上突破的空间。

德国三季度GDP增速不及预期,分项目中消费和出口下滑明显

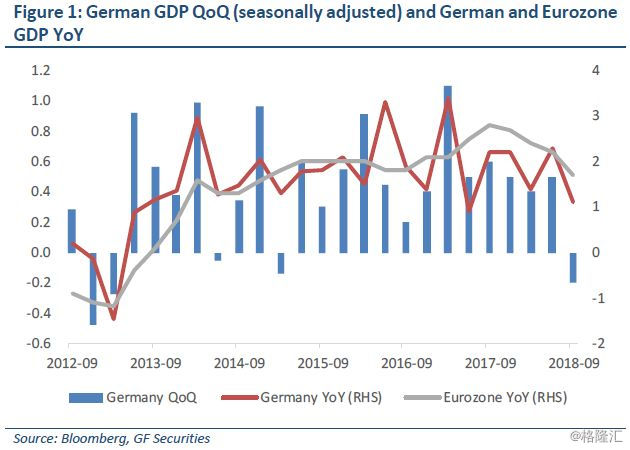

11月14日德国公布三季度GDP季调后环比初值为-0.2%,低于预期-0.1%和二季度环比0.5%,是2015年一季度以来首次季环比下降;GDP同比初值为1.1%,相比预期低0.1个百分点,二季度同比为2.3%。分项目来看,家庭最终消费环比下降,政府最终消费支出环比略有增加。相比二季度,机械设备固定资本形成和建筑固定资本形成都在增长,出口增速下降的同时进口有所增加。德国就业保持相对稳定,二季度就业总人口达到4500万人,同比增长1.3%。

汽车行业需求不振和外需走弱推动GDP增速下降,四季度经济压力仍存

德国三季度经济增速下降主要来自于汽车行业的总体低迷和外需走弱。9月开始,欧盟的汽车必须遵守新的排放标准,限制了欧洲市场的销售,并且中国乘用车销量7月份以来连续4个月下跌,9月跌幅超过两位数达12%。同时外需走弱下,德国三季度3个月出口环比增速分别为-0.6%、0.1%和-0.8%。10月制造业PMI和IFO企业景气指数,以及11月ZEW预期指标都显示德国四季度经济仍有较大下行压力,同时英国脱欧、意大利财政矛盾、土耳其货币危机也可能构成四季度GDP下行的潜在风险。

美欧货币政策分化将持续,支持强美元

德国是欧元区的重要组成部分,也一直为欧元区复苏的主要推动力量,三季度GDP增速下行拖累了欧元区的整体经济表现。10月30日公布的欧元区GDP季调后环比先值为0.2%,同比先值为1.7%,均低于预期和前值。欧央行10月25日利率决议称2018年底前退出QE,关键利率维持在目前水平至少至2019年中,如有必要会将当前利率维持更长时间。三季度德国GDP增速的下降可能会推迟欧央行货币收紧的进度,而美国良好的非农和PCE物价数据指示美联储12月份大概率再加息一次,美欧、美德利差在年内大概率会进一步扩大,美元指数在年内有可能进一步走高。

Germany impeding Eurozone economy, DXY may rise further

German GDP growth fell in 3Q18, impeding the Eurozone economy and resulting in a strong USD and weak EUR

Germany’s 3Q18 GDP growth missed expectations due to a sharp fall in consumption and exports. A sluggish auto industry and weaker external demand led to the economic slump. Economic sentiment indicators for Oct and Nov suggest significant downward pressure on the country’s economy in 4Q18. Meanwhile, Brexit, the fiscal budget conflict in Italy, and the Turkish currency crisis are all potential risks. As a major driver of the Eurozone’s economy, slower growth in Germany during 3Q18 hampered economic growth in the region. The 10Y Treasure spread between the US and EU remains high, and the weak Eurozone economy will mean central bank policy divergence continues. The interest spread may therefore widen further, and we could see further upside for the DXY this year.

Significant decrease in consumption and exports

On Nov 14, Germany announced seasonally adjusted GDP growth for 3Q18 of -0.2%, lower than expectation of -0.1% and the 0.5% seen in 2Q18. This is the first QoQ decline since 1Q15. Preliminary YoY GDP growth was 1.1%, 0.1pp lower than expected, and below 2Q18’s 2.3%. As for components, gross fixed capital formation both in machinery & equipment and in construction was higher than the previous quarter, while final household consumption expenditure declined. Final government consumption expenditure was slightly higher than in 2Q18. Exports growth slowed while imports rose in 3Q18 compared with the previous quarter. Employment in Germany was relatively stable, with total employment increasing to 45m during the quarter, up 1.3% YoY.

Sluggish auto industry and external demand depressed GDP, pressure remains

The slump in 3Q18 was mainly driven by a sluggish auto industry and weaker external demand. Since Sept, new emissions standards in the EU have limited sales in the European market, while in China passenger vehicle sales have decreased for four straight months since July, falling as much as 12% in Sept. Meanwhile, weak external demand led to slower export growth, while MoM growth of exports was -0.6%, 0.1% and -0.8% in the three months of 3Q18. Sentiment indicators such as manufacturing PMI and the IFO Business Climate Index in Oct, and ZEW expectation in Nov all indicate significant downward pressure on the German economy in 4Q18. External events such as Brexit, the Italian fiscal budget conflict, and the Turkish currency crisis may also cause an economic downturn in 4Q18.

Monetary policy divergence to continue, DXY could rise further this year

As the biggest economy in the region and driving force of the Eurozone recovery, downward pressure on the German economy in 3Q18 hampered the wider region’s economy. Data released on Oct 30 showed preliminary GDP growth for the Eurozone of 0.2% QoQ and 1.7% YoY, both slower and below expectations. The ECB’s interest rate decision on Oct 25 was accompanied by a claim that the EU will exit QE during 2018, and that the key interest rate will remain at the current level until mid-2019, or even longer if necessary. The downturn in German GDP may set back the ECB’s monetary contraction, while in the US, benign non-farm data and the PCE price index indicate another rate hike is likely in Dec. The interest spread between the US and EU and between the US and Germany may widen further this year, and there may be further upside for the DXY between now and the year-end.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员