机构:德意志银河

评级:买入

目标价:31.22港元

Core environmental business to grow 10x by 2023?

Conch Venture's five-year strategy will focus on two businesses: 1) solid waste solutions (hazardous and sludge waste incineration); and 2) waste incineration of municipal garbage via grate furnace. Combined, Conch Venture's vision is that its core environmental earnings could reach RMB7bn (RMB5bn from hazardous waste and RMB2bn from grate furnace) or 10x by 2023. Without question, the potential for the incineration market is huge, and among the few projects rolled out by CV, the economics would seem so positive as to defy credibility. However, projecting this far has its risks, whether that be in execution or policy. DB currently expects core earnings for CV to reach c.RMB1.6bn by 2020 from c.RMB700m in 2018, representing a c.50% earnings CAGR.

CB issuance solidifies growth prospects for next five years On 5 Sep, CV issued a USD500m zero coupon CB with a strike of HKD40 maturing in five years. The bond provides cheap financing for the company as they charge ahead into the grate furnace segment. The capex for a 100kt project is c.RMB150m and assuming 70% debt per project, the bond proceeds are enough to fund capacity growth up to 7.6mt versus its capacity of 610kt currently. The longer-term growth is to reach c.15mtpa by 2023 with many mega-sized projects planned overseas. Thus far, CV is able to deliver 15% IRR using all cash and can achieve up to 20% IRR if using 70% debt.

A win-win partnership with Conch Cement

Conch Venture has attached its solid wastes co-processing capacity to the cement kilns under Conch, with average co-processing fees at c.RMB40/t charged by Conch as cement kiln rental fees to cover costs. That is a risk for Conch Venture should the fee be raised but Conch Cement is not in the environmental business, therefore they will not be inclined to charge CV excessive rates. Conch plants fitted with waste co-processing can benefit from not being subject to peak shifting production halts and energy savings. The co-processing of hazardous wastes provides heat to the kilns and it can save 3-4 kg of coal consumed for each tonne of clinker produced. A similar arrangement is also being finalized with CNBM, with c.2mt to be fitted on CNBM plants by 2020.

Valuation and risks

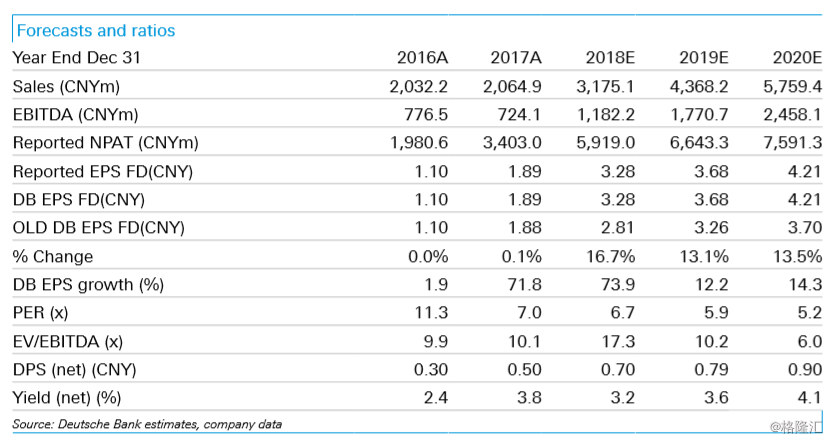

We have rolled forward our model from FY18 to FY19. We value Conch Venture using SOTP with 30% conglomerate discount, applying 2019E 20x P/E to solid waste solutions, 14x to the port business, 12x to waste incineration, 9.4x P/E to cement, and 8x to energy saving equipment (see Figure 1 and Figure 2 ). Risks include the heavy reliance on Conch Cement and a lack of government support for the solid/hazardous waste disposal business.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员