机构:高盛

目标价:9.6港元

According to Hongqiao, the 1H18 captive power tariff was Rmb0.28/kWh; if we add Rmb0.05/kWh (or Rmb0.043 if excluding VAT) cross subsidy tariff in 2H18E and 2019E as required by the announcement, we estimate the captive power tariff would reach Rmb0.315/kWh in 2H18E and Rmb0.317/kWh in 2019E, versus our assumption of Rmb0.272/kWh in 2H18E and 2019E. If fully executed, the captive power tariff is close to Hongqiao’s external purchase power tariff of Rmb0.32/kWh (ex-VAT) in 1H18 and coal-fired power benchmark tariff in Shandong of Rmb0.317/kWh (excluding VAT and deNOX, deSOX under our estimates). We estimate the cross subsidy power tariff starting from 2H18 would lead to a potential 17%-32% negative impact on recurring profit in 2018E-2019E if fully executed. Meanwhile, we estimate Hongqiao’s unit production cost would increase to Rmb10,713/t in 2018E and Rmb11,008/t in 2019E versus our assumption of Rmb10,429/t in 2018E and Rmb10,416/t in 2019E. The cost advantage between Hongqiao and Chalco would be narrowed to 2% in 2019E from 8% in 2017 .

While the overhang of potential captive power tariff hike for Hongqiao has existed since late March 2018 when NDRC announced a coal-fired captive power plant management consultation plan, the cross subsidy power tariffs of Rmb0.05/kWh during transition period and Rmb0.1016/kWh post transition period are higher than our expectations. We estimate the current share price implies 7 .1x PE for 2019E under the scenario of the policy fully executed and no ASP pass through, compared to three year historical average PE of 6.4x.

Implications

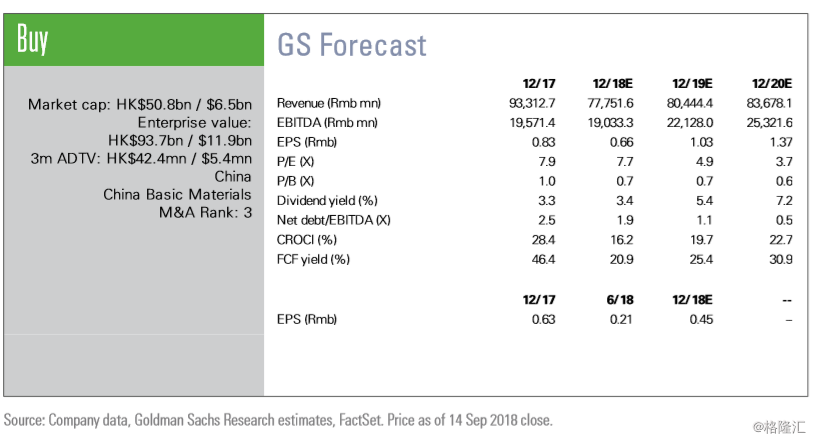

As the discussion between Hongqiao and local government is not yet finalised, we do not take a view on the final outcome and keep our earnings unchanged. Maintain Buy on the stock with unchanged 12-month target price of HK$9.6. Our valuation methodology remains based on historical P/B vs. ROE correlation - or 2019E P/B of 1 .1X and ROE of 14%. Key risks include: (1) aluminium and alumina pricing, which is driven by supply-demand; and (2) execution of supply-side reform on shutting down illegal capacity. (3) CNY/USD exchange rate movement. As SHFE aluminium price moves in line with LME Aluminium price, RMB appreciation would lead to lower realized Rmb denominated price. (4) Government policy change on captive power plants as Hongqiao’s main energy sources are from captive power.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员