机构:高盛

评级:中性

目标价:1.6港元

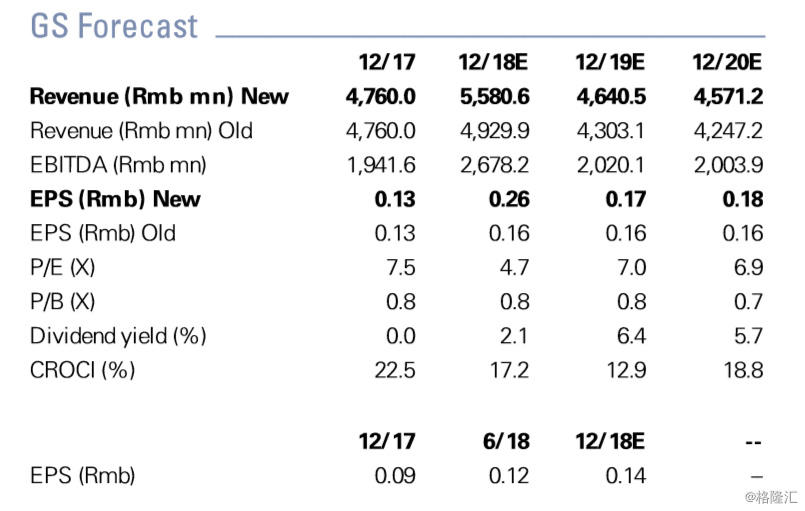

Estimates revised upwards and target unchanged: We revise up net profit estimates by 58% for 2018E, and 8% for 2019E (and core earnings up by 51% for 2018E but down 5% for 2019E), to reflect higher unit gross profit in 2018E and 2019E than prior assumptions, the higher VAT rebate and interest income, and partly offset by lower aggregate profit. We expect the unit gross profit of WCC to reach Rmb75/t in 2019E, nearly 30% lower YoY versus an average Rmb107/t for 2018E.

Our 12-month target price remains unchanged at HK$1 .60, based on a weighted average target price calculation which includes 1) an 85% weighting to a fundamental value of HK$1 .6, derived from 2019E P/B of 0.90x with a unit GP assumption of Rmb75/t; 2) a 15% weighting to an M&A value of HK$1 .7 , based on a 2019E P/B of 0.96x and unit GP assumption of Rmb80/t. The higher unit GP under the M&A scenario is in line with the high end of the range for cement in a good cycle and also reflects the potential for higher pricing power. Our target price implies 8.0x PE for 2019E.

Key risks: 1) better-/worse-than-expected cement prices driven by industry supply-demand balance that could swing on demand uncertainty, government supply policies;

2) greater-/weaker-than-expected cost pressure from coal, power and other raw materials; an

3) slower-/faster-than-expected execution on PC32.5 elimination.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员