机构:广发证券

评级:买入

目标价:5.90港元

2Q18 SSSG beats Xtep reported mid-teen SSSG for 2Q18, up from low-teen growth in 1Q18 and better than our expectation for low-teen growth, thanks to the completion of a three-year transformation. This is an impressive QoQ SSSG improvement for 2Q18. In contrast, we believe the company’s domestic peers may see retail sales growth soften slightly QoQ during the period due to high comparable bases. According to management, e-commerce sales growth during June 1-18 was better than industry growth of around 50%. Retail discount levels improved to 20-25%, from 30% in 2Q17. Retail inventory was kept at a healthy level of around four months.

1Q19 trade fair The trade fair is now over, and management thinks the response from distributors has been positive, underpinned by encouraging SSSG in 2Q18.

Stable GPM outlook Management expects a relatively stable GPM in FY18 despite increases in raw materials prices. Xtep has adopted a cost-plus model meaning it locks up raw material prices when the trade fair is completed. The company procures raw materials for both its own and manufacturing contractors’ production needs to gain better bargaining power over suppliers. Replenishment orders would be affected by GPM uncertainty if the company did not lock in the prices of the raw materials it uses for replenishment orders.

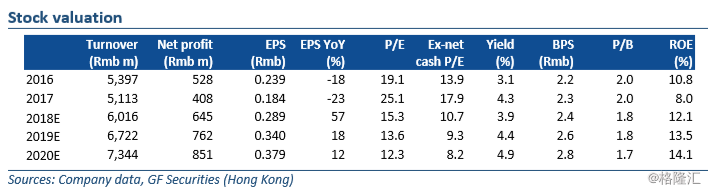

Raise TP to HK$5.90 We raise our FY18/19/20 net profit estimates by 3-4%, mainly to factor in higher SSSG assumptions (from 10%/6%/4% to 12%/7%/5%) and e-commerce sales growth assumptions (from 20%/13%/10% to 30%/18%/13%). We now estimate 18%/12% revenue growth and 58%/18% net profit growth in FY18/19. We lift our TP from HK$5.20 to HK$5.90, based on 17x FY18E P/E (vs 15x previously), at its historical average plus two standard deviations. We believe this valuation is justified as the company is experiencing its best fundamentals since its listing, following the completion of a three-year transformation of its brand (from being fashion-focused to functionalityfocused), its improved product offerings and flattened distribution network (>60% of stores operated directly by distributors). Sales of more than 1m pairs of professional running shoes (Figure 3, 第五代减震旋, retail price Rmb399) within 1.5 months of their launch in 2Q18 is a good reflection of these improved fundamentals. We maintain our Buy rating.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员