机构:交通银行

评级:买入

目标价:34港元

1Q18 results in line: Total revenue was RMB1.26bn, up 4% YoY/down 8% QoQ, and 3% higher than our estimate of RMB1.23bn. Non-GAAP net profit was RMB157m, down 51%/59% QoQ/YoY, and 2% above our estimate.

WPS beat on VAS business: WPS revenue beat our estimate on solid growth of VAS revenue, which jumped by nearly triple-digit rate YoY. Leveraging on the 100m MAU of WPS personal edition, WPS provides users with resource-sharing services which drove the rapid growth of content value-added services. Gaming business was soft as expected, because (1) JX III PC revamped version still needs time to recover, in our view; (2) old mobile games declined, where monthly average paying accounts declined by 17%/22% QoQ/YoY during 1Q18. Cloud revenue increased by 56% YoY to RMB419m, driven by increasing usage of cloud services in mobile video and internet sectors. Xiaomi contributed less than 25% of total cloud revenue.

2Q18 and 2018 outlook: Gaming business remains under pressure in 2Q18 in our view, as no new game will be launched in the quarter. We expect gaming business to recover from 2H18, driven by (1) the launch of new mobile games, such as Yunshangyuyi (云裳羽衣), JX Online II mobile and JX Online III mobile, around Aug/Sep; (2) JX III content update in 2H18 to drive user engagement and revenue growth. We expect 21% YoY revenue growth for the gaming business in 2018, mainly driven by mobile games. We expect WPS/cloud to maintain momentum and post 38%/59% YoY revenue growth in 2018.

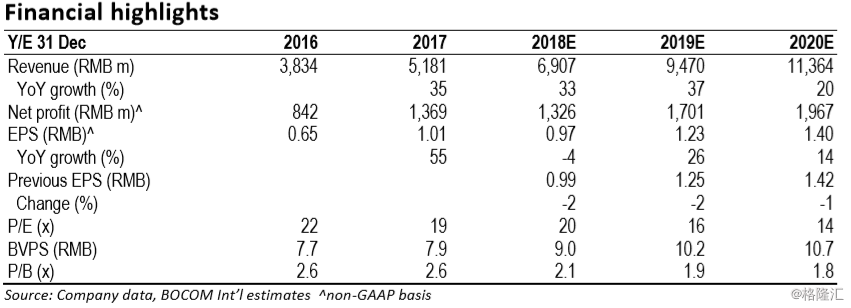

Valuation: Given the latest game launch plan, we lower our 2018E revenue/profit estimates by 2%. We nudge down our SOTP TP from HK$35.00 to HK$34.00, implying 29x/23x 2018E/19E P/E. Despite temporary headwinds for the gaming business which bring margin pressure, we are confident about its growth in 2H18 driven by the launch of new mobile games. Catalyst: (1) new mobile games launch and better-than-expected growth of JX III; (2) A-share IPO of WPS by the end of this year. Maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员