机构:高盛

Henderson Land reported in-line results from operations plus a sizable disposal gain. On the asset monetization front, management maintained the active pace, having already secured two major disposals YTD, with more to come. On land banking, the company said progress on farm land conversion would likely take a pause and resources be diverted to other avenues of land banking. Keep Neutral.

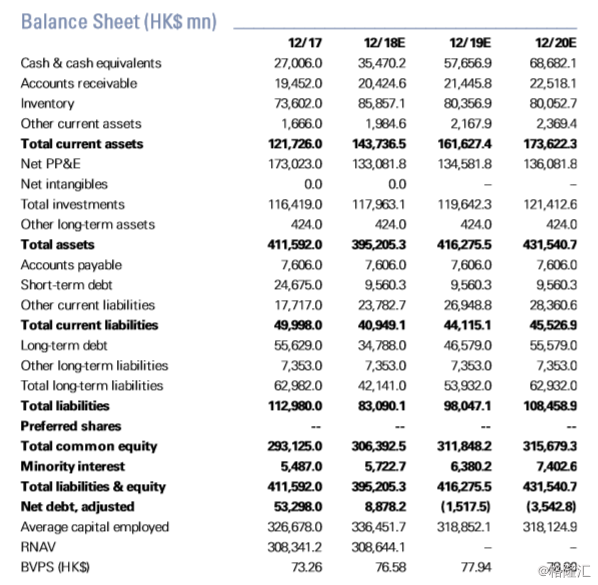

Henderson Land reported in-line results from operations Underlying profit for FY2017 at HK$19.6bn, up 38%. If wen exclude one-off disposal gains of HK$7 .5bn (versus HK$4.5bn in our model), recurring underlying profit would be up 18% at HK$12.1bn, in line with our forecast of HK$12.0bn. Full year DPS at HK$1 .71, up 10% yoy (excl. 1-for-10 bonusn issue). BVPS at HK$73.26, up 11% yoy.n

Key takeaway from analyst briefing

Fast pace of asset monetization to continue ahead:n 2017: HK$7 .5bn disposal gains represent contributionso from two hotels in HK, various shops/car parks/ industrial units in HK, and mixed-use project and land sites in China.

2018: The company said disposals of 18 King Wah Roado and Tuen Mun Town Land Lot No. 500 have already completed, and that it will recognize c.HK$9bn in disposal gains in upcoming results. Management see ongoing opportunities to dispose of non-core projects amid still-strong investment demand.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员