机构:交通银行

评级:BUY

目标价:15.50港元

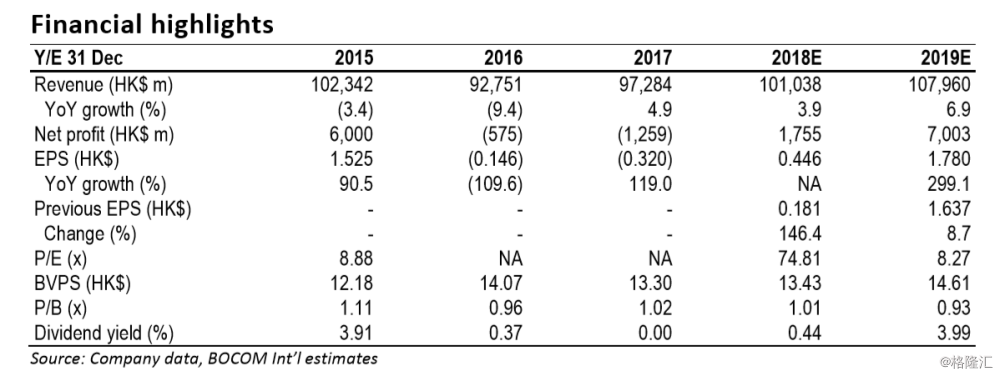

A profitable 2H17: Cathay Pacific Airways (CPA) reported a net loss of HK$1,259m, widening from -HK$575m in FY16 but better than our forecast of HK$3.0bn loss or Bloomberg consensus of HK$2.26bn loss. The reported net loss included one-off expenses of HK$841m and exceptional gain of HK$830m. Fuel hedging loss of HK$6.4bn (1H17: HK$3.2bn) was marginally lower than our forecast of HK$6.6bn. Management explained that it declared a dividend of HK$0.05 per share with the result because of the profitable performance in 2H17 (HK$792m).

Cargo operation fueled the turnaround: Cargo yield rose 11.3% YoY in FY17 (our forecast: 6.5% YoY), with much of the growth in 2H17 (up 16.3% YoY or 12.0% HoH). Cargo revenue grew 19.1% YoY to HK$23.9bn, better than our forecast of HK$19.8bn, which is the main reason for the results beat, in our view. Passenger yield declined 3.3% YoY in FY17, but rebounded in 2H17 (down only 1.5% YoY). On a HoH basis, passenger yield rose 3.1%. Cost per ATK, according to management, was essentially flat if the exceptional items and fuel expenses were excluded.

Management confident in FY18 outlook: The yield recovery trend will continue in FY18, according to management, for both passenger and cargo operations. CPA will introduce six new destinations this year, a record for the company, with less incumbent competition. Management projects ATK growth of 4.2-4.3% YoY this year. In terms of cargo operation, management said cargo mix shift to high value cargoes such as pharmaceuticals could continue to support volume growth as well as yield recovery. More importantly, management believes that most of the benefits from its transformation efforts will kick in over the next two years after the foundation for transformation was laid in FY17.

We maintain our Buy rating: We revise our FY18-19 earnings forecasts, and raise our target price from HK$14.50 to HK$15.50, which is based on 5-year average P/B and equivalent to 1.1x P/B on our forecast FY18 BVPS. We see the potential trade war between the US and China as the only concern over CPA’s cargo operation recovery.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员