机构:高盛

目标价:11.75港币

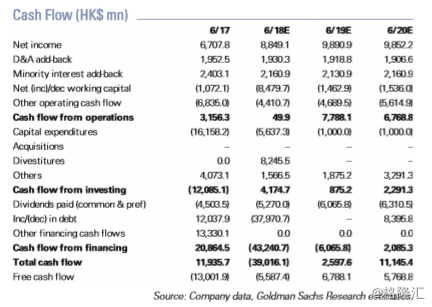

NWD reported better-than-expected underlying profit on accelerated China sales bookings. The 8% increase in interim DPS surprised to the upside, and management expects a further uptick upon full contributions from Victoria Dockside. China land banking was also a focus. After securing a new deal in Shenzhen, management expects to continue a relatively fast pace, with a c.HK$20 bn capex budgeted. Raising 12-month PT to HK$11 .75 (from HK$11 .40). Maintain Neutral.

Results highlights

1H FY18 underlying profit was HK$4.2 bn, vs. our HK$3.7 bn inn 1HFY17 (excluding one-offs), largely due to stronger-than-expected China development property (DP) sales, partly driven by faster-than-expected property sales bookings in China amid higher gross profit margins of 46%, up 10pp yoy. The higher sales resulted in China DP segment profit of HK$4.0 bn, or 49% of the group’s total. BVPS was up 7% hoh to HK$20.33, partly helped by an HK$7 bnn positive revaluation in the HK office segment. Interim DPS surprised, rising 8% yoy to HK¢14. Managementn explained the increase was due to its plan to ramp up cash returns amid the phased completions of Victoria Dockside (only a partial contribution from the office segment during the period).

Hong Kong

NWD achieved HK$7 .1 bn of contracted sales for the fiscal yearn to February, or 71% of the HK$10 bn full-year target. The company’s early adoption of HKFRS 15 did not lead to an significant difference in booked profit as guided by

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员