机构:中信建投

评级:BUY

目标价:2.6港币

According to the announcement on 11 Feb 2018, CGN has proposed to issue no more than 5,049.86mn A shares, with the proceeds to be used to finance the construction of nuclear power units Yangjiang No.5 & 6, and Fangchenggang No. 3 & 4.

In our view, the A share offering will lead to a re-rating and increase the liquidity of CGN’s H shares, given the large valuation gap between its A shares and H shares, and subsequently raise the PBR of its H shares going forward.

We reiterate our BUY rating on CGN and price target of HKD2.60. Our PT implies 1.5x/1.4x FY17/FY18E PBR (before A share IPO), which we think is undemanding given an estimated FY17E/FY18E ROE of 16.0%/15.6% respectively.

A-share listing a sensible move for CGN in capital intensive industry. Nuclear power stations require billions of RMB in upfront capital investment for construction. CGN currently has eight nuclear power units under construction. In addition, the company has 12 nuclear power units commencing operation during 2014-2016. The substantial capital investment has subsequently hiked the company’s debt to equity ratio from +200% in 2014 to +350% as of 30 June 2017.

Rising deleverage pressure amid deepening SOE reform. At the National Financial Work Conference held in July 2017, it has been stressed that China should treat the deleveraging of SOEs as “the priority of priorities”. Against this backdrop, CGN plans to offer A shares in order to reduce the company’s debt. After the offering, the ratio is likely to drop to around 250%, based on our calculation.

A-share listing to improve liquidity and valuation. Currently, CGN’s H shares trade at 1.2/1.1x FY17E/FY18E PBR, and in contrast, China Nuclear (601985.CH), the only A-share nuclear power play, trades at 2.5/2.3x FY17E/FY18E PBR. However, both China Nuclear’s installed capacity and profitability still lag behind that of CGN. As of 31 Dec 2017, CGN had owned 20 nuclear power units that are in commercial operation with a total installed capacity of 21.5GW, versus 16 units with 14.3GW total installed capacity for China Nuclear. In terms of profitability, based on our estimate, CGN’s FY17E ROE will come in at ~18% versus ~11% for China Nuclear. Thus, we estimate CGN’s A share IPO will be priced in-line or even at a premium to China Nuclear. In addition, we believe the A share IPO will increase the liquidity of CGN’s H shares, given the large valuation gap between its A shares and H shares.

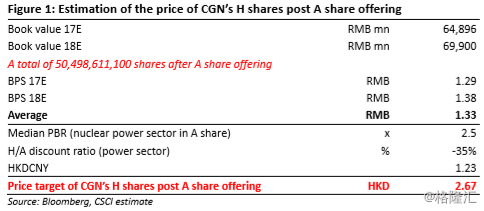

Attractive entry levels. We anticipate CGN’s A share offering will take place in the 2H18-1H19 timeframe, and thus it is difficult to estimate the IPO price range at present. However, based on the current median PBR (2.5x PBR FY17E/FY18E) of China Nuclear, as well as the A/H discount ratio (-35%) of the power sector in China, we estimate the price of its H shares will surge to HKD2.67 post the A share offering, implying FY17E/FY18E PBR of 1.7x/1.6x PBR (Please refer to the detailed calculation on page 2). As such, we reiterate our BUY rating and price target of HKD2.60.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员