机构:交通银行

评级:卖出

目标价:3.90港元

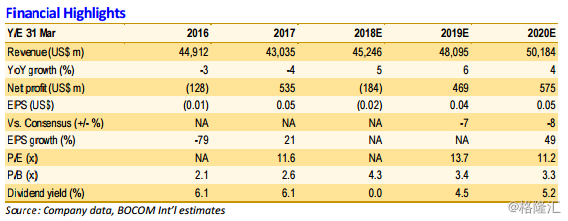

3QFY18 largely in line operationally; healthier PC market and DCG growth are bright spots. Helped by growth in PC and narrowed losses in DCG, pre-tax profit returned toYoY growth for the first time in five quarters. PTI came in at US$150m vs. our/Street estimates of US$146m/US$151m. PC revenue grew 8% YoY helped by a stable market and 9% ASP increase. PC PTI margin remained stable at 4.5% despite component pricehike, while DCG PTI margin was better than our expectation. However, we believe thesmartphone business came in softer than expected as shipments fell 20% QoQ despitepeak seasonality.

Smartphone competition remains intense; looking for sustained data center recovery.We expect the PC business to remain healthy with growth driven by (1) the Fujitsuacquisition to be closed by March (to add about 800k units of shipment per quarter), (2)growth in gaming and enterprise PC which should drive ASP, and (3) continued industry consolidation. Smartphone competition, especially in the Asia-Pacific and other developing markets, continued to intensify. We expect smartphone profitability to worsen again inthe near term due to product down-cycle and slower seasonality. We expect losses insmartphone to continue for at least the next few quarters. For DCG, while we wereencouraged by the healthy YoY revenue growth (first growth quarter since 1QFY17), weremain cautious and continue to watch for sustainable growth. For 4QFY18, we expect company revenue to decline 19% QoQ with pre-tax profit of US$42m.

Stay cautious on lack of further earnings recovery near-term. We believe the company’soverall profitability is stabilizing, but further improvement in the near term may be limited due to challenges in smartphones and slower seasonality. Shares trade at 14x FY19E P/E,largely in line with its closest peers HP/Asus’ 13x/13x CY18 P/E. We lower our FY18/19 PTIestimates by 30%/4% on weaker-than-expected margin outlook for smartphones. Our newTP of HK$3.9 (previously HK$4.1) is based on 12x FY19E P/E. Maintain Sell.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员