机构:中金公司

评级:卖出

目标价:2.60港元

Lenovo 3QFY18 in line with expectations

Lenovo Group announced its 3QFY18 results: revenue +6.3% YoY toUS$12.9bn, in line with both our and consensus estimates; pre-taxincome was US$150mn (+48.3% YoY), basically in line; while netlosses were US$289mn, mainly due to a US$400mn one-timenon-cash write-off of deferred income tax assets due to US TaxReform.

Trends to watch

Traditional business still struggles: 1) PC market expected to recoverslightly. PC revenue +9.2% YoY, given its shipments were flat it wasmainly driven by rising ASP. 4QFY18 likely to continue with single-digitgrowth, and to maintain solid upwards momentum in FY19. PCsegment’s margins will stabilize as impact of component prices fade.2) DCG still transforming. DCG reported strong growth in both revenue (+17% YoY & +26% QoQ) & shipments, as it saw accelerating growth of high performance computing (HPC) business, while traditional products are still in trouble. And, 3) mobile continues to disappoint. Lenovo’s mobile business saw its revenue/shipments fallby 5%/18% YoY in 3QFY18, due to the weak performance of high-end models and fiercer competition. We believe Lenovo will face heavier headwinds if domestic mobile vendors expand their overseas landscapes; hence, we remain cautious about its mobile business and its related huge losses.

Financial risks see striking rise. As of 3QFY18, Lenovo had total debts of US$2.7bn, bringing heavy financial costs; its perpetual notes will further impact margins and its leverage ratio has risen to 5.7. High leverage and huge intangible assets have seen Lenovo incur significant financial risks, harming its financial stability.

Earnings forecast

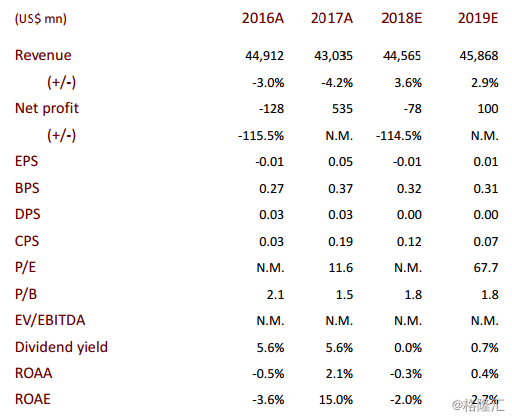

We raise our FY18/19 earnings forecasts by 0.6%/5.0% toUS$44.6bn/45.9bn and trim adjusted net profit by 55%/2.3% toUS$202mn/400mn, implying EPS of HK$0.14/0.26.

Valuation and recommendation

We reaffirm our SELL rating and cut our target price by 19% fromHK$3.20 to HK$2.60, based on 10x FY19 P/E.

Risks

Financial risks related to M&A.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员