On December 29th, Pien Tze Huang, ranked No. 4 in A-share pharmaceutical market value, once again dropped its limit. This news was shocking.

The Chinese Medicine Index (Shenwan) fell 3.5%. Among them, Guang Yu Yuan plunged 6% and plunged more than 9% on the 2nd; Tongrentang C plunged 5% and plunged 8% on the 2nd; Jianmin plunged 5% and plunged 15% on the 2nd.

This crazy wave of Chinese medicine prices may have ended. Some people say that as soon as the brokerage came out and talked about the great opportunity of Chinese medicine, it peaked.

CITIC Securities: As a safe haven for low valuations, the Chinese medicine sector has highlighted its value

Guosheng Securities: Outstanding performance in traditional Chinese medicine sector.

Kaiyuansecurities: The traditional Chinese medicine industry is supported by policies and possesses definite performance growth and value-for-money valuation.

Tianfeng Securities: Some traditional Chinese medicine companies are expected to usher in a dual restoration of valuation and operation.

1、High valuation is the biggest risk variable for investing in Pien Tze Huang

Brokerages say that Chinese medicine is a good investment opportunity, the time is roughly after December 20, the main logic is low valuation, ushered in the allocation opportunity.

But what is the truth?

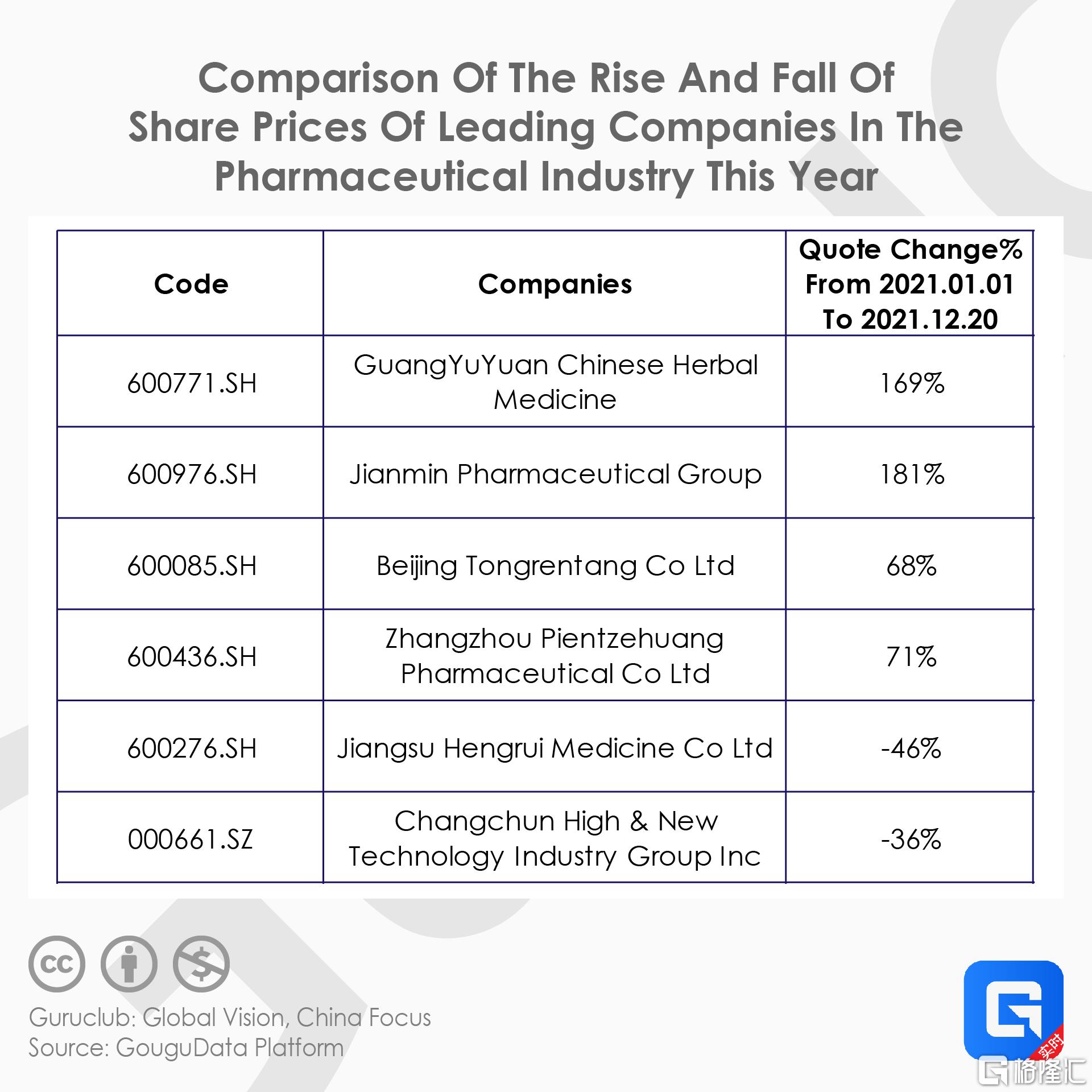

Chinese medicine rose all the way from the beginning of the year to the end of the year, the sector once rose 30%, before December 20, up 20%, significantly outperforming many segments of medicine. For example, innovation drugs, which used to be hot, saw their coincident index fall 3%. Breaking it down into Traditional Chinese medicine, it's even more dramatic, with Guang Yu Yuan up 170%, Pien Tze Huang up 72% and Tongrentang up 68% (year-to-Date through Dec. 20).

At the beginning of the year or march this year, when Chinese medicine stagflation, should be a good allocation of opportunities. Wait to rise fast 1 year, the organization is concentrated to shout to have the opportunity, is to have what intention! ? This is not a bit similar to the beginning of the white wine flicker dish xia! On February 10 this year, when Moutai hit 2600, CITIC Securities called for a target price of 3000 in the next one year. In the next six months, moutai plunged 40%.

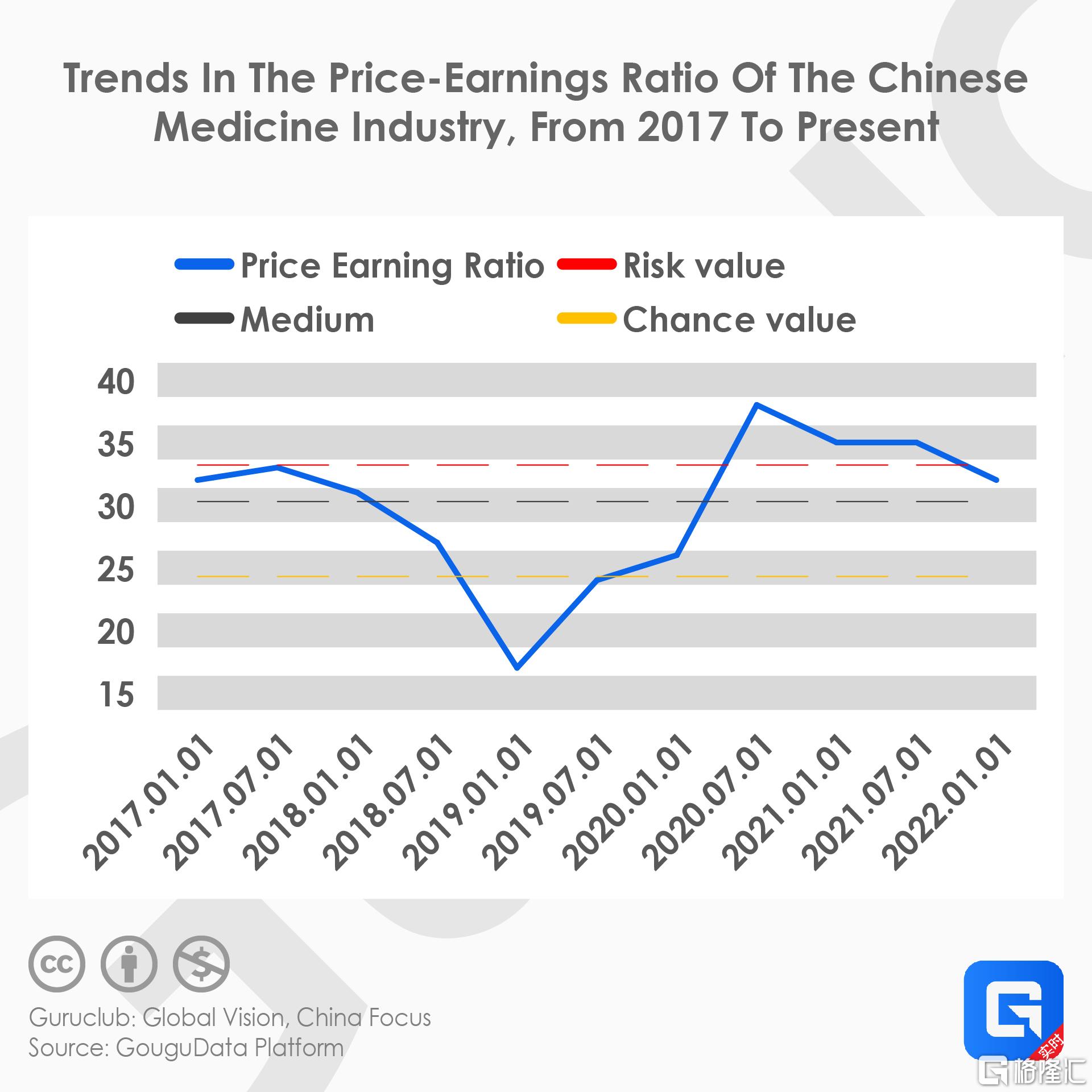

Even according to the valuation of the Chinese medicine sector, it is not cheap, and even can be said to have been very overvalued. PE of Traditional Chinese medicine is as high as 32 times (December 20), and now it reaches 35 times, which is the absolute high in the last 3 years and the upper limit of 5 years.

Specific to Pien Tze Huang is more exaggerated, the latest PE has been as high as 110 times, in the last 10 years of absolute high level, the valuation of the bubble is obvious.

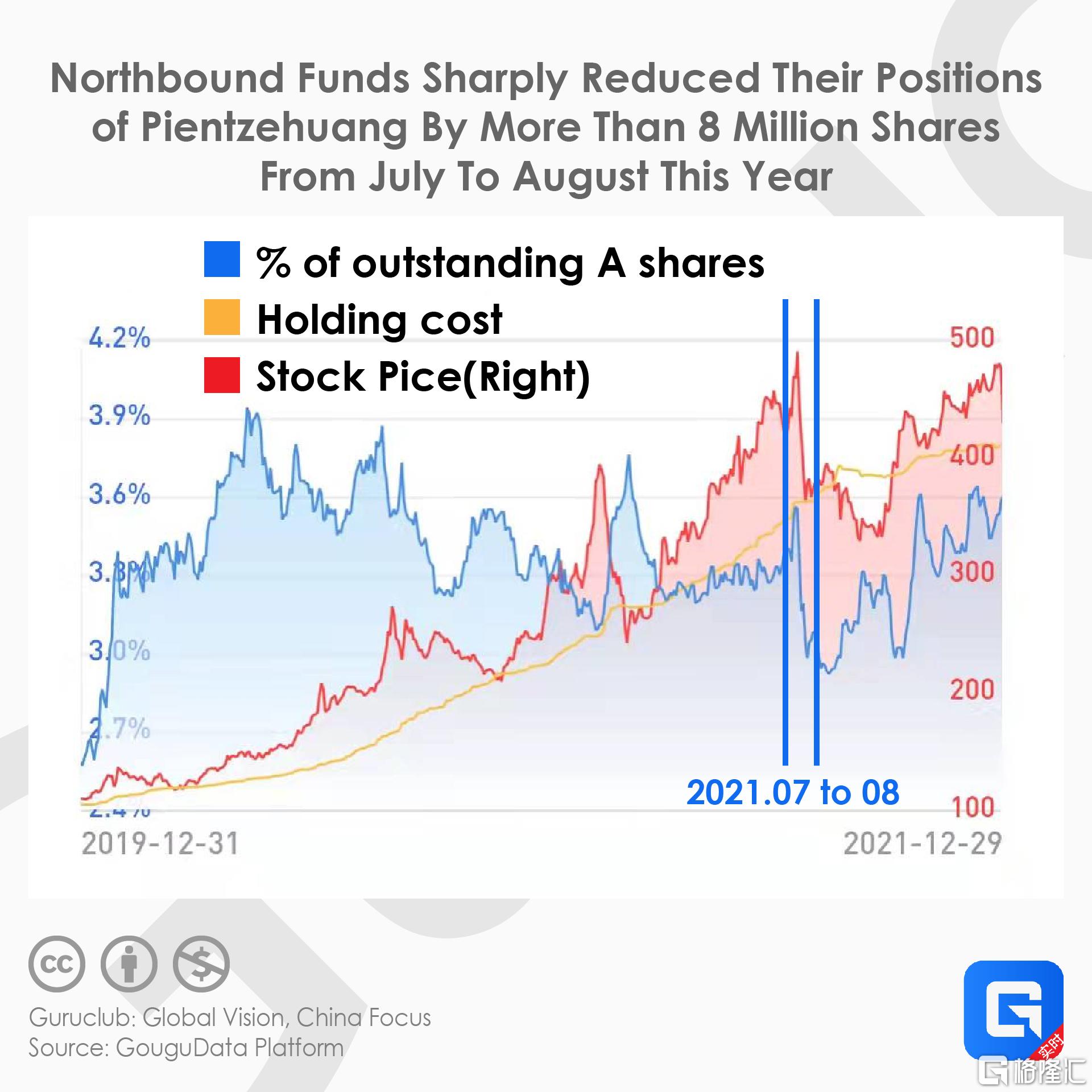

Today, Pien Tze Huang fell limit without obvious negative news, high valuation is the main core sin behind. Just like the crazy speculation of Pien Tze Huang in the first half of this year, the market rose 90% in four months and hit record highs for several days. On July 21, jiulongjiang Group, a major shareholder, announced a reduction of its holdings by %, and the company's stock price fell by a rare limit on July 22, dropping 26% in four trading days. Major shareholders to reduce holdings is only the trigger of the sharp fall in share prices, the most fundamental logic or valuation bubble is too high, Germany does not deserve it.

How do institutions view the current Pien Tze Huang?

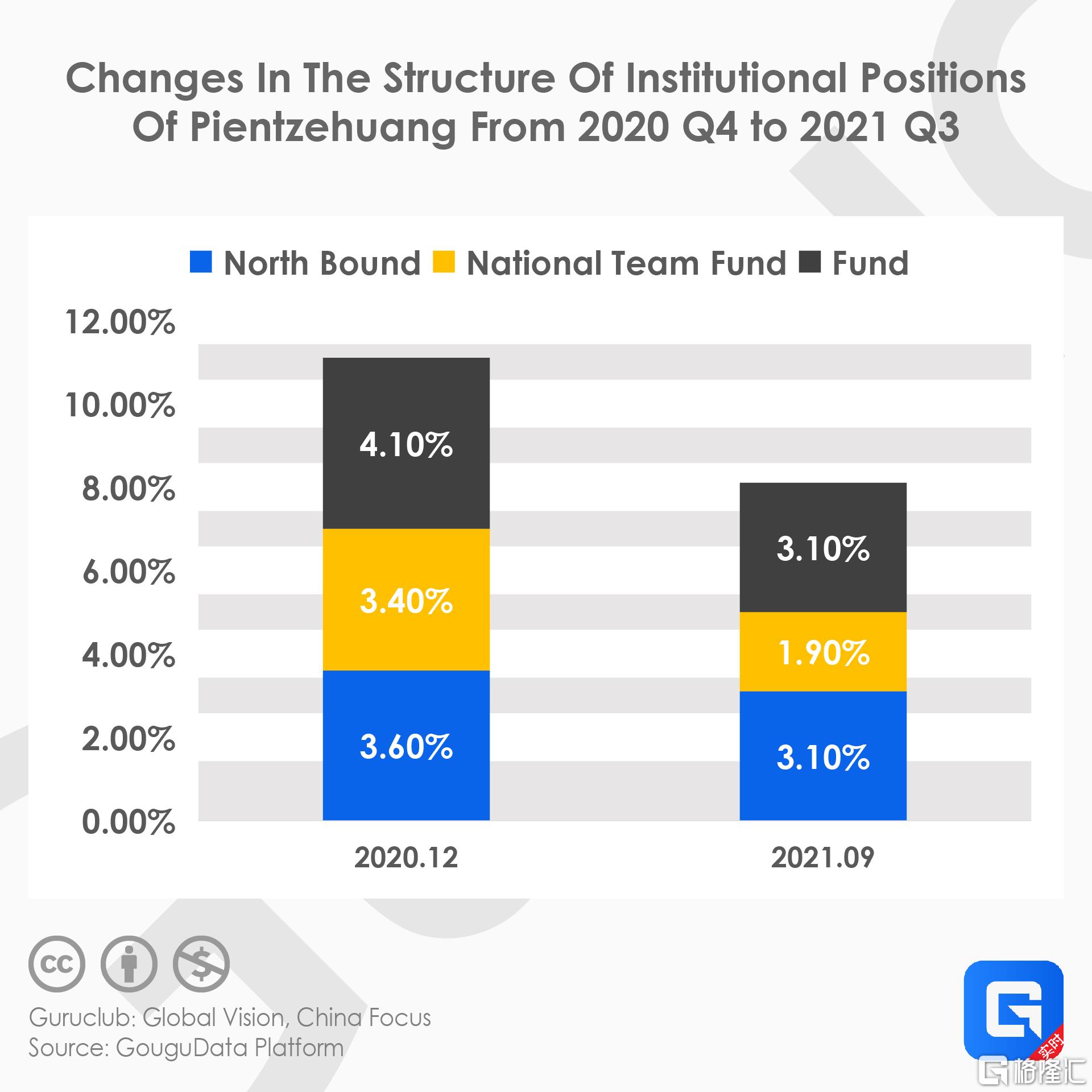

Northbound capital slashed its holdings by more than 8 million shares in July-August, cutting 8.5 percent of its total position at the beginning of July. From the highs at the beginning of the year, a total of 14 million shares were cut for the year.

As for domestic funds, domestic funds accounted for 4.5% at the end of 2020 and 3.1% in the third quarter of this year, showing a trend of reducing their positions as a whole.

On July 21, The closing price of Pien Tze Huang was 489.7 yuan. Yesterday, the stock price came to 476 yuan, approaching a record high. Jiulongjiang, the former major shareholder, announced a reduction of 1%, more obviously reminded the market "valuation is too high". Did not expect a few short months, the market again to challenge this valuation red line.

High valuations are the original sin. This is the biggest risk variable in investing in Pien Tze Huang.

2、Will the basic disk of Pien Tze Huang change?

Some people will say that the high valuation will cause the stock price to retrace without fear, but it will panic that Pien Tze Huang's logical base will change.

In terms of prices, the company raised prices 9 times in 2016, from 325 yuan to 590 yuan, an increase of 81%, and a compound annual price increase of 3.8%, which was only slightly higher than the inflation rate. In addition, Pien Tze Huang has always been more expensive than traditional Chinese medicines such as Angong Niuhuang Wan and Babao Dan in history, but the price of Angong Niuhuang Wan increased by 493% during the same period. Pien Tze Huang's price increase model can continue, and the ceiling is still relatively high.

In terms of quantity, it is severely constrained by the production capacity of forest musk deer. Pien Tze Huang may only grow by a few percent in the next few years. The rapid growth of performance depends more on "price increase."

Pien Tze Huang's business model is excellent, as evidenced by the rapid growth in performance over the past few years.

Looking to the future, if Pien Tze Huang still follows the passive price increase model in the past (not actively making a large price increase, it may be limited by the pressure of state-owned assets, morality and public opinion, which is similar to Moutai), and there is no imagination in terms of quantity. , Then performance growth will slow down, and the current valuation is too expensive. On the optimistic side, if you take the initiative to raise prices significantly in the future, your performance can still be stable, which depends on the management decision of the leadership. But what is strange is that this year, Pien Tze Huang has changed two chairmanships. In April this year, Pan Jie took office and left in December.

If we consider from the perspective of pessimistic assumptions, if the main business Pien Tze Huang is not strong, does the company have a second growth point to contribute a large increase? Can the Angong Niuhuang Wan or cosmetics business stand alone?

Angong Niuhuang Pills, as a traditional and precious Chinese medicine for the treatment of cardiovascular and cerebrovascular diseases, are popular in overseas markets and have a large market capacity. In the first three quarters of this year, China’s export volume of Angong Niuhuang Wan reached 85.71 million yuan, of which 72.98 million in Hong Kong, accounting for 85%. Followed by Vietnam, Indonesia, Malaysia, the United States, and Myanmar.

In Mainland China, sales of Angong Niuhuang Wan, an urban retail pharmacy, have been rising year by year, with a compound growth rate of 21.4% in 2016-19.

The market growth rate of Angong Niuhuang Pills is still very good, but the market structure is not favorable for Pien Tze Huang (in July 2020, it spent 44.48 million yuan to acquire 51% of Longhui Pharmaceuticals).

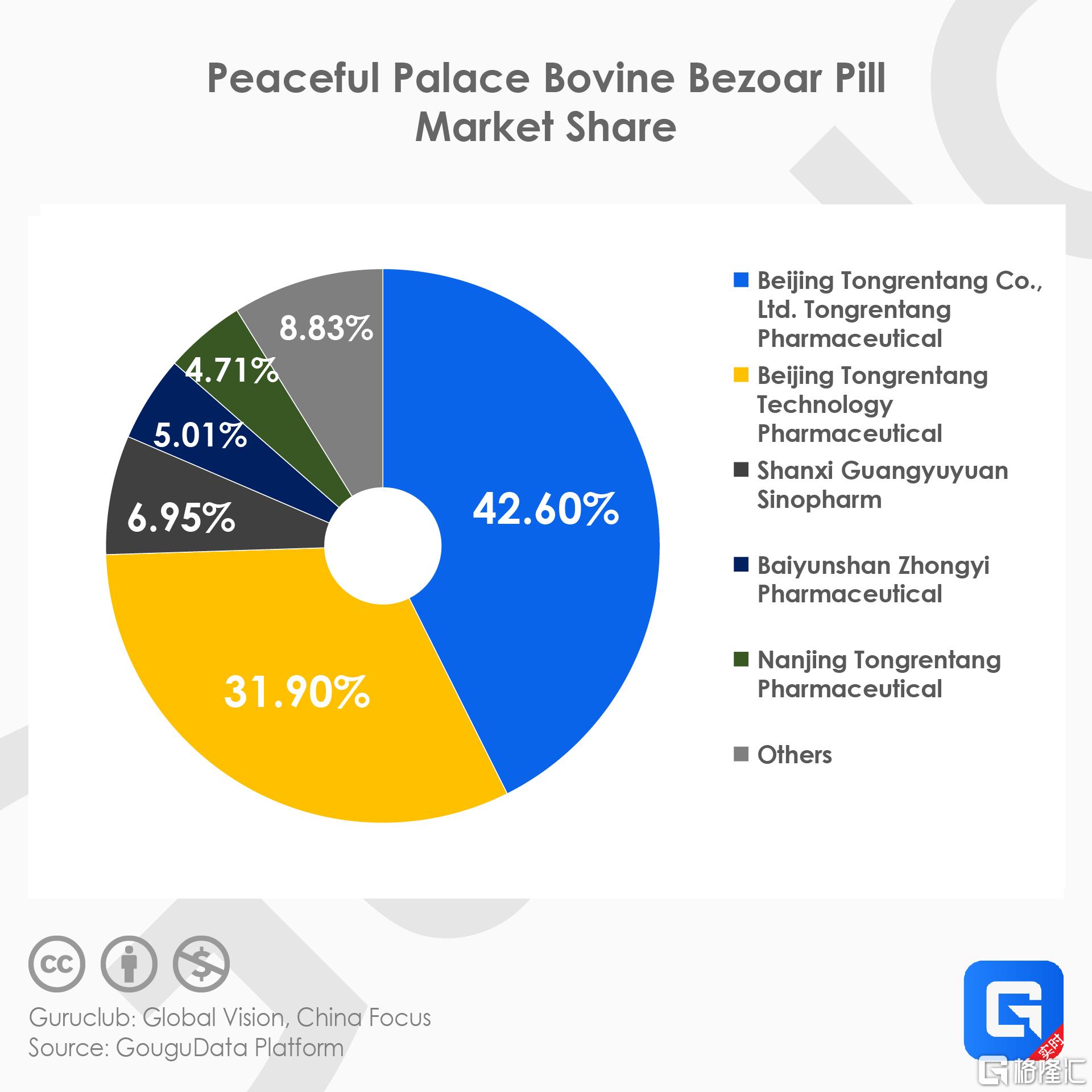

According to statistics, there are 121 manufacturers of Angong Niuhuang Pills, involving 125 approvals. Among them, the combined market share of Beijing Tongrentang Pharmaceutical and Beijing Tongrentang Technology Pharmaceutical is 74.5%, and Guang Yu Yuan is 7%. The sales of Longhui Pharmaceutical Angong Niuhuang Pills accounted for a very low proportion.

In fact, the owner of Longhui Medicine is from acetylsalicylic acid tablets, compound paracetamol diphenhydramine, anti-pain tablets and other popular general medicines. The products are homogenized and the competition is fierce. The main sales channels are in Heilongjiang Province. Even partly concentrated in Qiqihar. In 2019, revenue was 22.04 million yuan and net profit loss was 6.54 million yuan.

After being controlled by Pien Tze Huang, Longhui Pharmaceutical quickly increased its volume with the original channel network of the Pien Tze Huang series. In the first three quarters of this year, Pien Tze Huang's cardiovascular drug revenue was 84 million yuan, a year-on-year increase of 385%. There is no problem with this business becoming a single product with a value of 100 million yuan, but the contribution increment is relatively small.

Pien Tze Huang also has a business, cosmetics are placed high hopes, accounting for roughly 10% of total revenue. In 2020, the business revenue of this business is 610 million yuan, an increase of 42% year-on-year. From 210 million yuan in 2017 to 610 million yuan last year, the company's revenue has grown at a compound annual rate of 42.3% in the past three years. 2021 is expected to maintain double-digit growth throughout the year.

In October 2020, Pien Tze Huang announced that it intends to spin off the cosmetics company for listing, but the listing location has not been announced yet, and there is no relevant progress. In the cosmetics industry, there is a huge industry space and there is a logic of domestic substitution. At present, there is no domestic cosmetics brand that takes the lead. Pien Tze Huang also has a certain chance to compete with Proya, Betteni, Marumi and other companies. This business is still very interesting in the future. At present, its revenue is not large. It is possible to get out of the parent company's "second spring" of growth. However, the cosmetics industry is highly competitive and there are uncertainties.

In the past many years, Pien Tze Huang's performance has grown very fast-in the last five years (2014Q3-2021Q3), the annual compound growth rate of revenue and net profit attributable to the parent has reached 27.96% and 31.3%. In the next few years, if we want to maintain a high growth rate, we will still rely on the Pien Tze Huang business, which has the highest gross profit margin and high profit ratio.

3、Conclusion

This year, medical equipment, medical services, consumer medicine, vaccines, innovative drugs and many other sub-fields have seen tragic markets. The most important logic is that the concentration and breadth of procurement have deepened, and anti-monopoly supervision has also begun, destroying the growth prospects of a large number of pharmaceutical companies.

However, Chinese medicine has bucked the trend this year. The main logic is driven by policy and driven by superimposed price increases.

At the end of January this year, the General Office of the State Council issued the "Notice on Several Policies and Measures to Accelerate the Development of Traditional Chinese Medicine Characteristics". The notice has been improved and optimized from the evaluation system, the willingness of Chinese medicine companies to research and develop, and the registration and approval mechanism that hinder the development of the Chinese medicine industry. , To establish a friendly environment conducive to the development of the Chinese medicine industry.

From the perspective of application and registration, according to Yaozhi data, as of December 16, there are 58 new Chinese medicine applications and registrations in 2021, a significant increase of 115% compared to 2020; and from the perspective of approval, as of October this year, A total of 11 new drugs were approved by the State Food and Drug Administration, including Kangyuan Pharmaceutical’s Yinqiao Qingre Tablets and Yiling Pharmaceutical’s Jieyu Chufan Capsules, which became the year when the most new Chinese medicines were approved in the past five years.

In May of this year, senior leaders inspected Nanyang City, Henan Province and said: In the past, the Chinese nation used Chinese medicine to treat illnesses and save people for thousands of years. Especially after fighting against the new crown pneumonia epidemic, SARS and other major infectious diseases, we have a deeper understanding of the role of Chinese medicine. We must develop Chinese medicine, focus on interpreting the principles of Chinese medicine with modern science, and take the road of integrating Chinese and Western medicine.

According to official data, as of March 23, 2020, there were 74,187 confirmed cases of COVID-19 in the country that participated in the treatment of Chinese medicine, accounting for 91.5%. Among them, 61,449 people in Hubei Province used Chinese medicine, accounting for 90.6%. Chinese medicine The total effective rate is over 90%.

In June this year, the National Health Commission, the State Administration of Traditional Chinese Medicine and other institutions jointly issued the "Opinions on Further Strengthening the Work of Traditional Chinese Medicine in General Hospitals to Promote the Coordinated Development of Traditional Chinese and Western Medicine."

...

Traditional Chinese medicine also has the logic of price increase. The transmission from upstream raw materials to downstream end products is very smooth. The price of many varieties increased by more than 100%, and some even exceeded 300%. Then, the online price of Pien Tze Huang rose from 590 yuan to 1500 yuan, and the price of Tongrentang Angong Niuhuang Wan increased by 10%, from 780 yuan to 860 yuan. , The ex-factory price of China Resources Sanjiu Angong Niuhuang Wan also rose along the way. The ex-factory price of Huoxiang Zhengqi Liquid of Taiji Group increased by 12%.

This is called the exclusive right to increase prices of Chinese medicines.

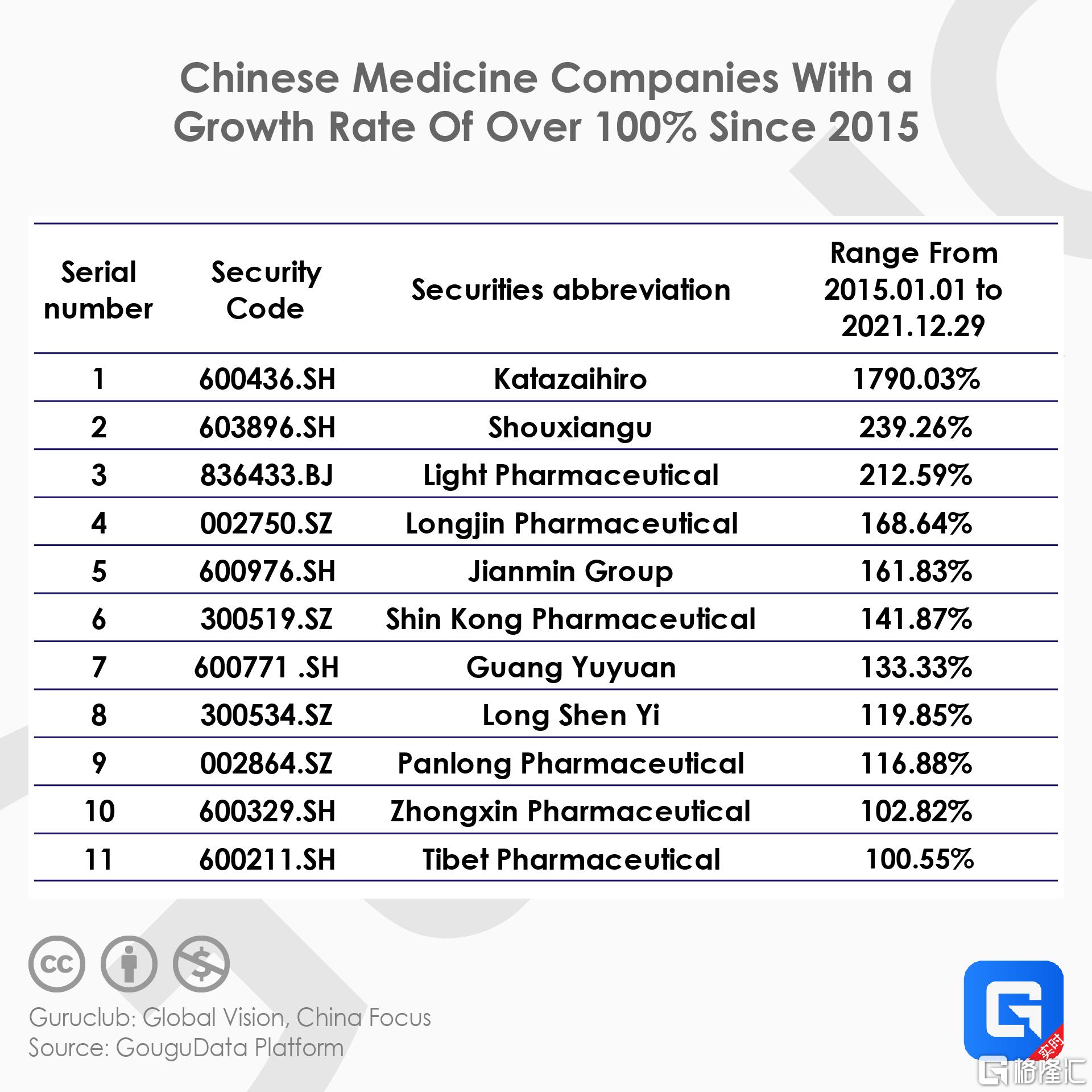

However, we still have to recognize the reality that the collective surge in Chinese medicine cannot be sustained. Since 2015, the Chinese Medicine Index has risen by only 38%, significantly underperforming other medical segments. Specific to individual stocks, of the 79 Chinese medicine companies, 33 fell, accounting for 42%. Among the 46 gainers, only Pien Tze Huang rose by 17.9 times. The rest of the players are far behind and the overall performance is not good.

Even with strong policy support, the Chinese medicine industry as a whole does not have big investment opportunities in the future. Only by choosing a subdivision leader, there will be some opportunities, and Pien Tze Huang may be one of them. However, Pien Tze Huang has passed the fastest growing stage in the company's life cycle. The marginal decline in future performance growth is inevitable, and the decline in return on investment will also be inevitable.

In the past, Yunnan Baiyao was a super big bull stock, but it has only risen 75% in the last 7 years, and the return rate is very unsatisfactory.

Will Pien Tze Huang become the next stock similar to Yunnan Baiyao?

let us wait and see.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员