作者:市川新田三丁目

The U.S. Dollar’s Global Roles: Where Do Things Stand?

![]() Linda S. Goldberg and Robert Lerman

Linda S. Goldberg and Robert Lerman

Previous Liberty Street Economics analysis and New York Fed research addressed the potential implications for the United States if the dollar’s global role changed, noting that the currency might not retain its dominance forever. This post checks the status of the dollar, considering whether any erosion in the dollar’s international standing has occurred. The evidence to date is that the dollar remains the world’s dominant currency by broad margins. Alternatives have not gained extensive traction, albeit this does not rule out potential future pressures.

纽约联邦储备银行在以前的Liberty Street Economics研究专栏中曾经探讨过这样一个问题:如果美元作为全球货币的角色发生改变,也就是说如果美元的主导地位不再,会给美国带来何种影响?今天这篇文章的目的是来回顾一下美元的地位问题,搞清楚美元在国际上的声望是否遭到削弱。迄今为止看到的证据显示美元仍以很大的优势确保了其在全球货币体系中的主导地位。其竞争对手的地位并没有获得明显的提升,但不排除美元将在未来遇到更多的挑战。

We consider a currency to be international based on its use in foreign countries as: a primary currency in official foreign exchange reserves; an anchor currency in exchange-rate regimes; a store of value and medium of exchange; and a unit of account, whether for transactions in foreign exchange and international capital markets, or for invoicing and settling in international trade. An assessment can also go beyond the traditional unit-of-account definitions and encompass the currency’s use in international clearing and settlements systems, financial markets infrastructure, and in reference rates in important financial contracts.

评判一种货币的国际地位的标准是看该货币在外国的使用情况,包括该货币是否为国际上主要的官方储备货币,是否为各国在汇率管理方面的锚定货币,是否扮演了储藏手段和价值尺度等作用,是否为记账货币,不管是在外汇交易和国际资本市场的应用方面还是在国际贸易的结算和清算方面。衡量标准也可以超越传统的记账货币定义,标准可以扩大到该货币在国际清算和结算系统中,在金融市场基础设施,以及在重要的金融交易中作为参考汇率等方面是否得到广泛应用。

A Changing Environment

国际金融体现的变化 Major developments pertinent for the current international financial architecture include the introduction of the euro in 2000, China’s rising status in the global economy, and post financial crisis changes in the U.S. policy and financial environment. Various additional policy and operational developments have had and will have the potential to alter the desirability of using U.S. dollars.

当今的国际金融体系经历了一些重大变化,包括欧元在2000年的推出,中国在国际经济舞台上的地位崛起以及2008年金融危机后美国在政策和金融环境等方面的变化。政策的各种后续变化以及实务运行操作方面的趋势演变已经并有可能继续改变各国使用美元的意愿。

After its introduction in 2000, the euro saw its status as an international currency deepen, peak around 2003, and decline in the aftermath of the global financial and euro-area crises amid slower growth in the euro area and uneven progress toward reaching a fuller financial and economic union. The euro’s international role remains close to historical lows, but it remains the second most important currency in the international monetary system. Its status could be enhanced with stronger economic growth, capital markets union, and a deeper and more liquid euro-area bond market. The euro-area economy is roughly comparable in size to that of the United States.

自2000年诞生后,欧元作为国际性货币的地位日益深化,其声望在2003年达到顶峰,但2008年金融危机以及欧债危机的发生,并伴随着欧元区经济增速放缓以及欧元区在实现财政和经济完全一体化的道路上波折不断等情况出现后,欧元的地位遭到削弱。当前欧元在国际上的地位已接近历史最低点,但在全球货币体系中的重要性仍仅次于美元。欧元的地位有可能随着经济增长态势走强,资本市场一体化形成,欧元区债券市场流动性增强和市场容量增长而得到强化。欧元区的经济规模几乎与美国不相上下。

The international use of China’s currency has risen with the importance of China in global output, official investments to improve China’s institutions and governance, and deliberate promotional steps by the Chinese government. Such steps include establishing extensive networks of swap lines with foreign central banks, designating overseas renminbi (RMB) clearing banks, including in the United States, and rolling out a payments infrastructure for cross-border RMB payments. The “Belt and Road Initiative” along the Silk Road corridor dispersed large amounts of infrastructure investment funds globally, also paving the way for RMB expansion.

随着中国在全球GDP总量中的占比增加,中国政府下大力气完善体制机制和治理水平并周密部署推进人民币的国际化进程,人民币在国际上的应用变得更加广泛。中国采取的步骤包括与更多的各家外国央行签署人民币与当地国家货币的互换协议,指定在海外各国包括在美国的人民币清算行,延展跨境人民币支付体系建设。在全球范围内以沿丝绸之路经济走廊地带延展的“一带一路战略”为依托大规模投入基础设施建设资金,也为人民币的国际化铺平了道路。

Developments in U.S. policy over the past decade supported the international role of the dollar. Crisis containment efforts during the global financial crisis—including enhancing the Federal Reserve’s lender-of-last-resort role around dollar funding (for example, through central bank swap lines) and shoring up bank resiliency under the Dodd Frank Act—supported the international use of dollars and the so-called safe-haven status of U.S. Treasuries. Countries outside of the U.S. central bank swap network have bolstered their dollar reserves to buffer against future dollar funding risks.

在过去十年里美国推行的各项政策对美元在全球的应用起到促进作用。2008年全球金融危机期间为遏制危机蔓延而采取了一些举措,包括强化美联储的最终贷款人角色,如在联储与其他国家央行之间设立外汇互换额度;以及按照《多德-弗兰克法案》的监管要求增强商业银行抵抗危机的能力,这些举措对于拓展美元在全球的应用以及增强美国国债的所谓避难资产的角色起到了支持作用。未与美联储签署外汇互换协议的外国央行则在不断增加美元外汇储备以应对未来有可能发生的美元融资危机。

《多德-弗兰克法案》全称《多德-弗兰克华尔街改革和消费者保护法》(Dodd-Frank Wall Street Reform and Consumer Protection Act),于2010年7月21日生效。该法案是自20世纪30年代以来美国最全面的金融监管改革法案,明确旨在限制系统性风险,为大型金融机构可能遭遇的极端风险提供安全解决方案,将存在风险的非银行机构置于更加严格的审查监管范围下,同时针对衍生产品交易进行改革。

多德-弗兰克法案包涵三大核心内容:

一、扩大监管机构权力,破解金融机构“大而不能倒”的困局,允许分拆陷入困境的所谓“大到不能倒”(Too big to fail)的金融机构和禁止使用纳税人资金救市;可限制金融高管的薪酬。

二、设立新的消费者金融保护局,赋予其超越监管机构的权力,全面保护消费者合法权益;

三、采纳所谓的“沃克尔规则”,即限制大金融机构的投机性交易,尤其是加强对金融衍生品的监管,以防范金融风险。

Potentially working against the international use of dollars are: a decline in correspondent banking, where banks seek out other banks to provide services on their behalf (occurring as banks de-risk); higher fiscal imbalances in the United States, to the extent that concerns rise about fiscal deficits and debt burden sustainability; and policy actions that could weaken international trade and financial ties.

有可能对美元在国际上的应用产生不利影响的因素包括:代理行业务往来减少,即商业银行寻求用其他类型的银行为其提供服务,体现为银行去交易对手风险;美国在国际收支方面的失衡进一步加剧,导致市场对美国财政赤字和债台高筑的局面是否能够持续下去的担忧加剧;以及各国政府在政策方面的变化有可能削弱各国之间在国际贸易和金融方面的合作关系。FinTech developments can also have implications. Cryptocurrencies, set up to challenge the conventional structure of payments in official currencies, thus far are unlikely to meet criteria for international roles in the near to medium term. Widespread use of online retail platforms has not yet challenged dollar roles.

金融科技领域的进展也有一些影响。虚拟货币旨在挑战以官方货币为基础的传统支付体系,但到目前为止还不具备能在中短期内替代传统支付体系的能力,在线零售电商平台的广泛应用尚未对美元在支付领域的主导地位构成挑战。

Status Check

美元的地位到底如何

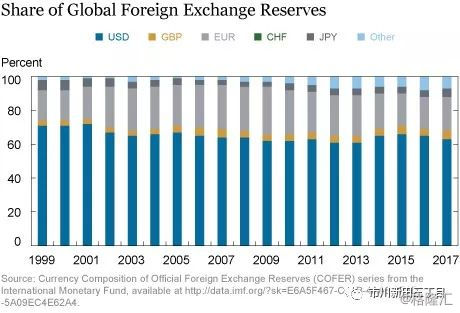

By many measures, the dollar remains the dominant medium. Consider, for example, its status as a “reserve currency.” Global foreign exchange reserves

totaled roughly $11 trillion at the end of 2017, with the dollar’s

share at 63 percent, followed by a sizable portion in euros, then by

significantly lower shares in yen, pounds, RMB, and other currencies

(see the chart below).

如果用多个标准来衡量,美元仍具有主导地位。比如,美元作为全球“储备货币”的角色。截止到2017年末,全球外汇储备的总量约为11万亿美元,其中美元的份额为63%,紧随其后占比较高的是欧元,其他货币如英镑、日元、人民币等的占比明显低于美元和欧元,见下图。 Since the global financial crisis, central banks have accumulated

official reserves more extensively to self-insure against dollar-funding

market disruptions. Indeed, many foreign investors and central banks

are major holders of U.S. Treasuries, as these represent deep and liquid

dollar investments. (See the next chart.) The dollar is the principal

anchor currency for about 65 percent of countries with fixed or managed

exchange rate arrangements. These countries account for approximately 75

percent of world output.

Since the global financial crisis, central banks have accumulated

official reserves more extensively to self-insure against dollar-funding

market disruptions. Indeed, many foreign investors and central banks

are major holders of U.S. Treasuries, as these represent deep and liquid

dollar investments. (See the next chart.) The dollar is the principal

anchor currency for about 65 percent of countries with fixed or managed

exchange rate arrangements. These countries account for approximately 75

percent of world output.

自从2008年全球金融危机以来,各国央行大力增加外汇储备以确保自身不会因市场动荡而在美元融资方面陷入困境。确实,有很多外国投资者和各国央行大量持有美国国债这种流动性更好、最根本的美元资产,见下图所示。在实行固定汇率或管理浮动汇率制度的各个国家中有约65%的国家将美元作为最主要的确定本币汇率水平的锚定货币,这些国家在全球GDP总量中的占比约为75%。

The dominant role of the dollar as a unit of exchange and as a

transactions and settlement currency is illustrated by its continued

broad use in 88 percent of foreign exchange transaction volumes and at

least 40 percent of the invoicing of imports of countries other than the

United States. Sixty-two percent of international debt securities

issuance, 49 percent of all debt securities issuance, and 48 percent of

all cross-border bank claims are dollar-based (see charts below).

Roughly half of the $1.6 trillion of dollar banknotes in circulation are

held overseas, fluctuating with economic and political uncertainty in

foreign countries. In payments systems, roughly half of the $5 trillion

of transactions settled daily through the CLS system are denominated in dollars, according to 2018:H1 data.

美元在全球外汇交易总量中长期占有88%的市场份额,除美国之外的各个国家有至少40%的进口结算是通过美元进行的,这两个数字凸显了美元在货币兑换以及在国际贸易结算及清算领域所扮演的主导角色。在美国之外发行的债券总量中有62%,全球债券发行总量中的49%,全部跨境银行债权中的48%是美元标价的,见下图。在1.6万亿美元的流通量中有差不多一半流通于美国之外,在政治经济局势不稳定的国家之间流转。在支付体系方面,2018年上半年的统计数据显示CLS系统每天清算的总量大约相当于5万亿美元,其中有约一半是美元清算量。

The dominant role of the dollar as a unit of exchange and as a

transactions and settlement currency is illustrated by its continued

broad use in 88 percent of foreign exchange transaction volumes and at

least 40 percent of the invoicing of imports of countries other than the

United States. Sixty-two percent of international debt securities

issuance, 49 percent of all debt securities issuance, and 48 percent of

all cross-border bank claims are dollar-based (see charts below).

Roughly half of the $1.6 trillion of dollar banknotes in circulation are

held overseas, fluctuating with economic and political uncertainty in

foreign countries. In payments systems, roughly half of the $5 trillion

of transactions settled daily through the CLS system are denominated in dollars, according to 2018:H1 data.

美元在全球外汇交易总量中长期占有88%的市场份额,除美国之外的各个国家有至少40%的进口结算是通过美元进行的,这两个数字凸显了美元在货币兑换以及在国际贸易结算及清算领域所扮演的主导角色。在美国之外发行的债券总量中有62%,全球债券发行总量中的49%,全部跨境银行债权中的48%是美元标价的,见下图。在1.6万亿美元的流通量中有差不多一半流通于美国之外,在政治经济局势不稳定的国家之间流转。在支付体系方面,2018年上半年的统计数据显示CLS系统每天清算的总量大约相当于5万亿美元,其中有约一半是美元清算量。

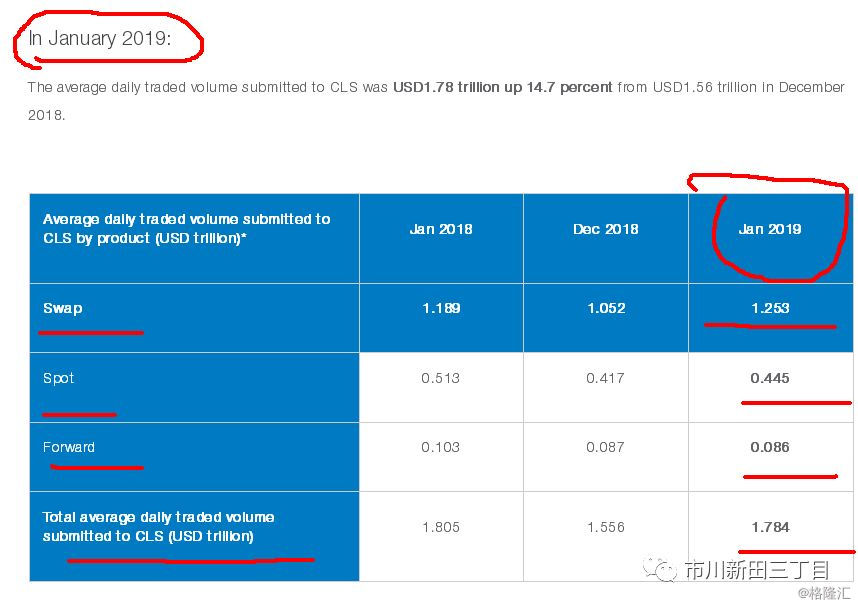

CLS是一家专业从事外汇清算服务的美国公司,外汇市场上对外汇交易本身并没有集中清算系统,如果选择CLS的系统进行清算可以消除清算过程中可能遇到的交易对手风险。到2017年3月,CLS所清算的外汇交易量在全球外汇交易总量中的份额已超50%。

根据CLS网站最新公布的数据,在刚刚过去的2019年1月份,CLS清算的日均外汇交易量达到1.78万亿美元,比2018年12月份的1.56万亿美元的日均交易量高了14.7%。

在1.78万亿美元的日均清算业务量中,互换类交易总量为1.25万亿美元,即期外汇买卖总量为4450亿美元,远期外汇交易的清算量为860亿美元,互换类外汇交易在CLS的清算业务总量中占比最高。

下图为在债券发行总量中美元表价债券的占比情况,图中红线为全球所有债券发行总量,蓝线为在美国境外发行的债券总量 Developments have led to some changes to the dollar’s status, both positive and negative. For example:

Developments have led to some changes to the dollar’s status, both positive and negative. For example:

随着局势的变化,美元的地位也有一些好的或不好的变化。例如:

The dollar share in official global reserves has gradually declined, falling from as high as 70 percent in 1999 to about 63 percent at the end of 2017, with early gains for the euro and later gains for a broader group of currencies. The accumulation of dollar reserves accelerated and then stabilized at higher levels after the global financial crisis as countries sought to amass cushions against U.S. dollar liquidity shocks. Some accumulation of other currencies in portfolios occurred in recent years as countries looked to improve portfolio returns in the low interest rate environment.

在官方外汇储备中美元的份额在逐步降低,从1999年的高达70%降至2017年末的约63%,先是欧元的份额出现上升,后来其他所有货币的占比均出现了上升。2008年全球性金融危机后,美元储备总量增加的速度出现加速然后稳定在较的水平上,因为各国均在寻求增加美元储备以对抗美元流动性不足带来的冲击。

The RMB’s status as a reserve currency has risen, but remains low. The RMB was added to the International Monetary Fund’s special drawing rights basket in 2015 and the volume of transactions through the wire transfer and settlement systems has continued to rise. The RMB comprises roughly 25 percent of China’s trade turnover and has become the second most used trade finance currency and fifth most popular world payments currency (behind the dollar, the euro, the pound, and the yen), according to SWIFT.

人民币作为全球储备货币的地位出现了上升,但占比仍很低。2015年国际货币基金组织将人民币纳入构成特别提款权的一篮子货币,之后人民币的汇款量和清算交易量在持续攀升。人民币在中国与外贸有关的货币清算总量中占比约为25%,已成为中国第二大贸易融资货币,根据SWIFT的统计,人民币已成为继美元、欧元、英镑和日元之后全球第五大最常用的贸易结算货币。

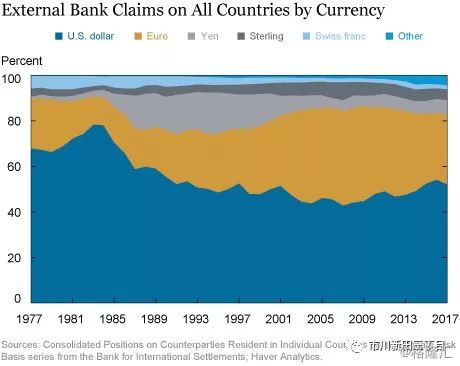

The dollar’s share in bank external claims has risen, largely at the expense of the euro, in the aftermath of the global financial crisis and the euro-area crisis. Its share at the end of 2016 stood at 54 percent, the highest level since 1990, while the euro’s share was 29 percent, down to what it was when the currency was initially introduced in 1999, as we see in the Bank for International Settlements data charted below.

美元在商业银行对外债权中所占的比重越来越高,很大程度上是抢了欧元的份额,主要是受到2008年全球金融危机以及欧元区债务危机的影响。2016年末美元在商业银行对外债权中所占的比重为54%,创下自1990年以来的最高位;欧元的占比为29%,降至欧元诞生之初1999年的水平,下面这张来自国际清算银行的图清楚地显示出这一点。

商业银行对外债权中各货币的占比图,其中蓝色面积为美元,黄色为欧元。

Volumes through U.S.-based dollar wire transfer and settlement systems have continued to rise. Daily settlement of foreign exchange through the CLS system has increased from about $1 trillion in the mid-2000s to over $5 trillion today, with just under half of that activity in dollars. Additionally, daily clearing and settling of domestic and international payments in dollars through CHIPS are $1.5 trillion and global wire transfers in dollars through Fedwire are $3 trillion.

美元汇款和清算总量还在持续增长。通过CLS系统清算的外汇交易量从2000年代中期的每日约相当于1万亿美元增至当前相当于5万亿美元以上,其中美元交易量的占比略低于一半。此外,每天通过CHIPS系统清算的美国国内和国外的美元支付金额为1.5万亿美元,通过Fedwire系统清算的美元全球支付金额为3万亿美元.

In sum, the period since the global financial crisis has not seen a widespread change in the international monetary architecture. While the dollar’s international status may have declined in some pockets, overall it remains dominant. Nevertheless, recent trends bear watching as history suggests that a currency’s dominant status is not immutable.

总而言之,2008年全球金融危机以来国际货币体系没有发生大的变动。虽然美元的国际地位在某些方面有所下降,但总体上仍维持了主导地位。尽管如此,近年来的变动趋势仍值得关注,因为历史经验证明一种货币的主导地位并不是一成不变的。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员