机构:招商证券

评级:买入

■ Evergrande’s core profit (ex MI) rose 50% YoY to RMB323bn, likely to be the most profitable developer in 1H18 ;

■ The scalable and cheap land bank ensures both scale and profitability amid the tightening period ;

■ Re-rating on Evergrande’s anti-cyclical strategy is still in the midway; Raise TP to HK$36 on 15% disc to NAV; Reiterate Buy .

The most profitable developer in 1H18

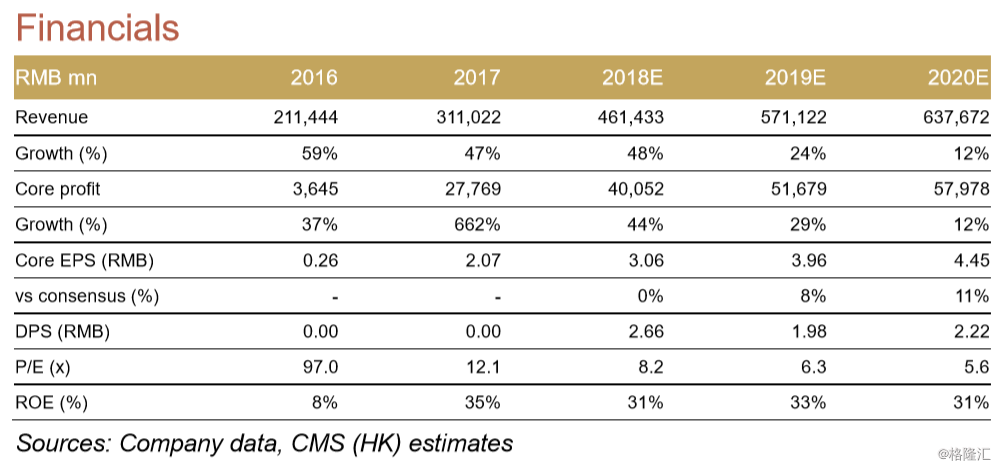

Evergrande’s 1H18 core profit rose 102% YoY to RMB55bn, in-line with the profit alert +100%. Core profit (excluding MI) rose 50% YoY to RMB323bn, also in-line with market expectation. Net gearing improved substantially by 56ppts to 127% in 1H18, faster than management’s previous guidance. Management expect the net gearing to improve to 100% by end 2018 and to stay at above 70% from 2019.

Time to monetize the appreciated land value

We believe Evergrande has adopted a correct strategy to gear up at the relaxation period and de-leverage amid tightening. It currently has land bank of 305mn sqm (sales value RMB5tn), enough for 6-8 year sales. In big contrast to its peers, Evergrande can now monetize the appreciated land value from its cheap land bank, with high flexibility on both scale (contracted sales >RMB600bn) and profitability (gross/core margin of 30%/15% despite price cap).

Re-rating on anti-cyclical strategy

Share price has recovered 75% of its correction since Oct 17. Although the A-share listing lacks progress, Evergrande has delivered substantial improvement in its financials and is at preferential position amid the tightening thanks to its anti-cyclical strategy, in our view. We expect the re-rating is still in the mid-way. We raise our TP from HK$29 to HK$36 on higher earnings forecast (2-8% in 2018-20E) and narrower disc to NAV (from 20% to 15% on easing of debt concerns). Current valuation of 31% disc to NAV, 6x P/E, 8-10% dividend yield is attractive. Reiterate BUY.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员