机构:银河证券

评级:买入

目标价:11港元

Investment Highlights

2018E is the First Year of Full Recovery. LNC has been a turnaround story since its eponymous founder Mr. Li Ning returned as Chairman in 2014. We expect the recovery story to continue in the years ahead, as most of the indicators are encouraging. We believe the Company structure is now stable, providing a foundation for continued recovery. We believe 2018 will be the first year of a full recovery for two reasons: stabilized corporate structure and normalized advertising and promotional spend (A&P).

Sales Continue to Show Resiliency. Despite facing struggles in its inventory and channels, LNC has still managed to increase overall sales since 2014. Various indicators show that LNC’s sales have become healthier, and almost all of the legacy problems of the Company have been dealt with (e.g. new products in the sell-through mix accounted for 78% in 2017 compared to 57% in 2013). We expect overall sales to continue to grow moderately. Same store sales growth (SSSG) has remained in positive territory (2017: mid single-digit growth at the group level).

Still Huge Room to Raise EBIT Margin. LNC’s efforts are reflected in various major key performance indicators, which should help the Company return to normal margins. Going forward, because of the improving operating performance, we expect the EBIT margin to continue to improve. The EBIT margin in FY2018E should see a sharper improvement to 8.3%, thanks to better operating leverage. (2017: 5.0%) There is still a lot of room for improvement compared with Anta’s 23.77%.

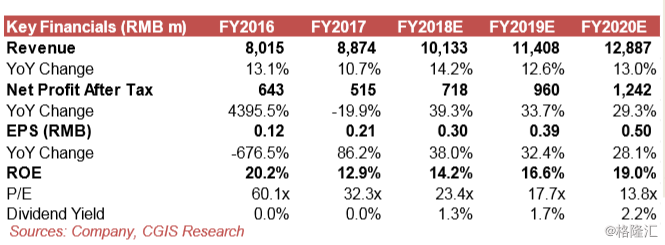

Initiate with BUY. Currently, we forecast that LNC’s EPS for 2018E/2019E/2020E will be RMB0.30/0.39/0.50, suggesting 39.3%/33.7%/29.3% YoY growth. This implies earnings growth acceleration over previous years. Our target price of HK$11.00 is based on 23.0x 2019E PER. We think 23.0x PER is reasonable when PEG is considered. Our EPS estimate suggests that LNC’s EPS will grow at a CAGR of 32.8% between FY2017FY2020E, so a 23.0x target multiple still suggests a PEG <0.8x. We also expect LNC to resume distributing dividends in the near term, which should be another milestone in its business recovery.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员