机构:银河证券

评级:买入

目标价:49.16港元

Investment Highlights

ANTA – The King of Domestic Sportswear. We believe Anta Sports will be a multi-year growth story. One of the early entrants in the industry, Anta Sports has been a leading domestic sportswear company for years. The core ANTA brand, which we estimate accounted for ~75% of revenue in 2017, has maintained steady growth amid intensified competition. We believe ANTA is likely to maintain its growth momentum. The Company is the largest domestic sportswear company in terms of revenue, and therefore, its spending on advertising and marketing is also the largest. We believe this will create a virtuous cycle for ANTA, allowing it to capture more market share from smaller players.

FILA & Foreign Brands – Engine of High Growth. Another growth engine for Anta Sports is the significant contribution from the FILA brand, which we estimate accounted for ~25% of revenue in 2017. As a high-end sports fashion brand, it complements the ANTA brand, and has helped the Company increase its share of the overall sportswear market. We expect the FILA brand to continue to be a key driver for the Company. It is likely to maintain strong growth (top line: >30% YoY) in the future. The GPM of FILA, which we estimate to be 60%-70%, is also notably higher than that of ANTA so it raises the overall GPM.

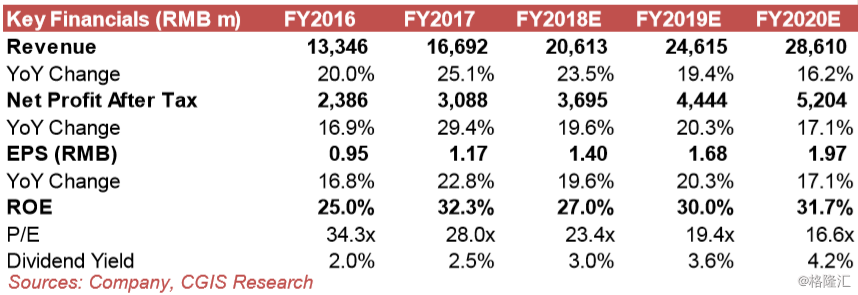

Consistent Track Record. Thanks to steady growth from the ANTA and FILA brands, as well as well-controlled operating costs, we expect in annual net profit in 2018E and 2019E to achieve ~20% YoY growth. We acknowledge that Anta Sports has been a uniquely successful sporting goods company in China and has delivered superior returns compared to its peers. However, its EBIT margin is still lower than that of the China operations of Nike and Adidas, so the criticism of abnormally high margins is unfounded, in our view.

Initiate with BUY. Our EPS forecast for 2018E/2019E is RMB1.40/1.68 respectively, implying 19.6%/20.2% growth. This earnings growth is in line with the previous growth rate. The Company is the industry leader and is likely to enjoy a virtuous cycle in terms of earnings growth. Therefore, we believe a longer horizon should be considered. Initiate with BUY.

Our TP of HK$49.16 is based on 24x 2019E PER. Our target multiple of 24x takes into consideration earnings growth (19.1% CAGR for EPS between 2017 to 2020E) and a premium for its status as the industry leader. Also, the Company has a good track record of paying dividends at a 70% payout ratio, which warrants a premium.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员