机构:银河证券

评级:买入

目标价:59.50港元

Investment Highlights

1H18 net profit expected to grow 80%-100%. Based on Conch Cement’s positive profit alert, the Company is going to report a net profit of RMB12bn-13.4bn for 1H18. This implies that net profit in Q2 2018 should be not less than RMB7.2bn, a hefty jump from RMB4.78bn in Q1 2018. The positive surprise should come mainly from strongerthan-expected gross profit per tonne, in our view.

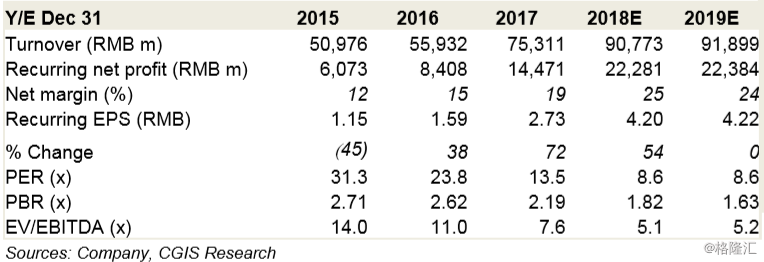

Likely to see another round of earnings upgrades once the financial details are disclosed. The low end of the guidance (RMB12bn) is equivalent to 54.5% of our fullyear forecast and market consensus. Since the sales volume is usually higher in 2H due to seasonality, net profit in 2H should be higher than that in 1H unless we see a sharp decline in cement prices. If there is no major one-off item in the actual results, we and the Street are likely to raise our full-year earnings forecasts again.

Cement price weakness during the rainy season has been relatively moderate so far. It should not be a surprise to see cement price weakness in July and August because of the rainy season. However, the price decline has been relatively mild so far, as shown in Figures 2 and 3. Cement prices in east China and south central China, the two major operating regions for Conch Cement, were still high on a YoY basis, thanks to effective coordination among the major players and a production suspension caused by environmental protection inspections, which prevented a sharp increase in inventory levels. Therefore, we should continue to see strong earnings growth in Q3 2018.

Attractive valuation after the correction. The share price of Conch Cement has dropped about 15% in the past few weeks due to the poor sentiment in the overall market. We believe this offers a good entry point, as the Company’s business should not be affected by the trade war, and its net cash balance sheet should enable the Company to weather the storm caused by tight liquidity in mainland China. Conch Cement is trading at 1.82x 2018E PBR, slightly below the average of 1.86x since 2009.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员