机构:德意志银行

评级:买入

目标价:42.3港元

moved up 10% on the first day the share resume trading. We believe Mr. Tainwala’s decision allows the company to draw a line and eliminate the connected party transactions. We believe investors view this positively.

As mentioned in our quick comment released on 25 May regarding the allegations, we believe 1) the accounting treatments are common for acquisitions, provided they fall within a reasonable range accepted by the auditors; and 2) the connected transactions and JVs have been disclosed since the IPO .

In our view, since the IPO, management has been disclosing far more financial information than required by HKEX and IFRS, as it understands investors’ need to distinguish its organic growth trends from acquisitive growth.

We view Samsonite as the leader in the luggage segment, with a portfolio of brands covering different segments and price points. The segment benefits from more business travellers with economic growth and more leisure travellers with consumption upgrades and consumers’ focus on lifestyle experiences. Samsonite/Tumi’s premium price proposition relies on its focus as a luggage brand, with investment in product development like design, new materials and durability. Customers are willing to pay a premium because it is a trusted brand. Other brands in its portfolio cater to consumers’ various preferences. We thus believe the group's sales performance and brand equity are more stable than those of fashion brands, especially brands focused on ready-to-wear.

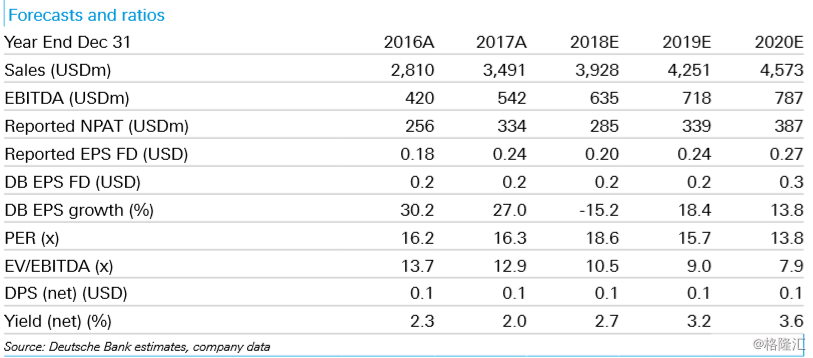

We maintain our Buy recommendation with a TP of HK$42.3. As Samsonite is an international company, we use the blended weighted-average COE of its top seven sales markets − the US, the PRC, South Korea, India, Japan, the UK, and Europe − to derive its COE. This generates a COE assumption of 7.1%, with a risk-free rate of 2.2% and an ERP of 5.2%. We use a beta of 0.94 and a long-term growth rate of 1%. This is within the range of rates that we use for Hong Kong/China consumer companies (0-2.5%) listed in Hong Kong (assuming an ex-growth rate closer to the CPI). Our TP implies a FY18/19 PE of 27/23x or EV/EBITDA of 14x/12x. Risks: 1) failure of newly acquired brands to perform, 2) failure to smoothly integrate Tumi, and 3) USD strength.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员