机构:高盛

评级:买入

目标价:66港元

Sustainability of retail sales growth: We recognize that while most investors aren already expecting an ongoing recovery in HK retail market, their expectation on the sustainability of double-digit-growth trajectory into 2H18E and beyond is relatively low. We forecast the volume growth story from visitor arrivals to remain solid, amid upcoming infrastructure additions (e.g. high speed rail and HK-Zhuhai-Macau bridge). However, we do agree that on per capita spending front, currency is likely to remain a swing factor.

Occupancy-cost-ratio (OCR) started at relatively high levels: While wen acknowledge that Wharf REIC’s OCR for CY2017 looked relatively high at c.20% and 23% for Harbour City and Times Square, if we were to look at only 4Q17 , the ratios have already improved substantially to 17% and 19%, respectively. We see this as positive set-up for OCR to revert back to a relatively comfortable range, amid further improvement in retail sales 2018 YTD versus the historical range around mid-teens’ levels, for company to raise retail rentals going forward.

Turnover rentals as a blackbox: Our view is that we are likely to see likely an positive uptick from turnover rentals (was at c.8% of retail revenue back in 2017 per management) amid broader market retail sales growth 2018 YTD (we expect Wharf REIC’s portfolio to outperform this given their exposure to luxury tourist spending)

although the exact amount is difficult to quantify.

However, we think the correct angle to look at on this subject is from the occupancy-cost-ratio (OCR) perspective in which retail landlords will continue to move up their base rents when the tenants are paying more and more turnover rents, in order to raise the floor of income. In the longer term, if the malls can keep their OCR in a relatively tight range, it would mean that their operators are more or less raising the base rentals alongside with tenant sales growth.

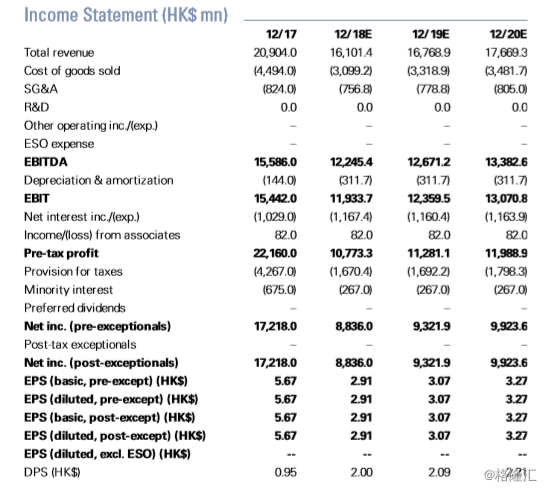

Raising EPS and TP; Reiterate Buy on Wharf REIC

We raise our NAV/EPS by up to 2% to factor in the current robust run-rate, withn retail spot rental growth assumptions up to 8% p.a. between 2018E/19E (from 7% p.a.), with a new 12-month NAV-based target price of HK$66 (from HK$65), set at 20% target discount (unchanged) to FY19E NAV. Key risks: Interest rates, new supply, policy changes and evolution of tourist spending behavior.

We like Wharf REIC for its direct access to giant and quality retail assets in Hongn Kong. It is the third-largest listed retail-focused landlord globally, is an owner and operator of key mixed-use investment properties in Hong Kong, with aggregate GAV of c.HK$283bn and c.12mn sq ft GFA of properties. The flagship retail malls in Hong Kong (Harbour City, Times Square and Hollywood Plaza) account for 59% of GAV and contributed c.70% to total HK IP revenue in 2017 . Their retail tenant sales together account for c.9.2% of total HK retail market sales in 2017 .

Compared to key listed HK retailers, we believe that the share price performance ofn HK retail landlords (Wharf REIC and Hysan Development) has been relatively benign. In addition to Wharf REIC, there are other Buy rated names with sizable HK retail property exposure, including Sino Land and SHKP . There are also Neutral rated names with substantial exposure to HK retail property: Mapletree North Asia Commercial Trust, Fortune REIT , Link REIT , Hysan Development and Hang Lung Proprties.

Rating and pricing information: Fortune REIT (Hong Kong) (N/N, HK$9.48), Hang Lung Properties (N/N, HK$17 .80), Hysan Development (N/N, HK$45.35), Link REIT (N/N, HK$69.40), Mapletree Commercial Trust (N/N, S$1 .57), Sino Land (B/N, HK$13.58) and Sun Hung Kai Properties (B/N, HK$126.60)

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员