机构:交通银行

评级:中性

目标价:33.70港元

Key highlights:

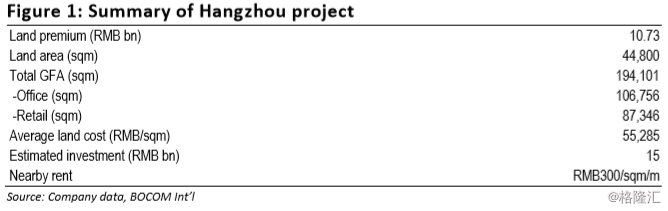

Hang Lung Properties (HLP) won a Hangzhou commercial project for RMB10.7bn, or an AV of RMB55.3k/sqm, a record high in the city.

The project is primely located in Wulin CBD in Hangzhou.

Management expects initial yield at 4-5%.

First acquisition in five years.

HLP outbid major HK and mainland developers including Wharf (4 HK/Neutral), CR Land (1109 HK/Buy), SHKP (16 HK/Buy), NWD (17 HK/Neutral) and China Yintai. Management is very positive on the Hangzhou market, which they see as very comparable to Shanghai in terms of rental level. Management also expects a rental premium over nearby projects, given its prime location and luxury positioning. Management targets the project to open in 2024E and expects an initial yield on cost at 4-5%, in line with HLP’s other non-Shanghai projects. The project will be funded by internal resources, and management is comfortable with a higher gearing.

Little NAV and earnings enhancement. We believe management’s target of 4-5% yield on cost is achievable if they can successfully position the project as the price leader in the city, where spot rents for office/retail are at ~RMB300/sqm. Yet, we believe such yield on cost is not very attractive as it is merely equal to current cap rate, and even lower than onshore funding costs (on a net basis). Therefore, we see insignificant NAV and earnings enhancement from the project, unless there is further rental upside. We estimate net gearing to increase to 14.3% following the acquisition (Dec 2017: 4.7%).

Maintain Neutral. HLP is trading at 46.7% NAV discount and 0.6x 18E P/B, roughly 13% discount to peers. We believe such valuation gap will remain, as we expect a similarly-low yield on cost for its upcoming projects. Earnings and dividend growth may also be curbed by the increased financial burden, especially when both onshore and offshore funding costs are trending up, in our view. We maintain Neutral on the counter with a target price of HK$20.20, based on 40% discount to its NAV of HK$33.70.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员