机构:信达证券

Strategy investment from BMEDI, a SOE specialized in municipal construction design and research In Apr 17, Beijing General Municipal Engineering Design & Research Institute Co., Ltd. (BMEDI), a wholly-owned subsidiary of Beijing Enterprises Group, subscribed 27.6% stake of C Cheng at HK$1.99 per share. BMEDI is a leader in the municipal construction design and research in the PRC, involving in a wide range of projects such as urban roadwork, mass transit railway system, urban design and landscape.

Increasing revenue and new orders with BMEDI’s support With BMEDI’s partnership, C Cheng is now able to participate in large scale state-owned projects, which is hardly accessible before. C Cheng also became more competitive for private projects in the PRC with the endorsement from BMEDI. C Cheng achieved 47% yoy revenue growth in 2H17 versus 3% in 1H17, and the Company secured a record high of HK$658mn new contracts in FY17, up by 98% yoy. Management stated that the strong momentum continue YTD, the Company now has ~730 architects versus ~480/~670 as of end FY16/FY17 to support the robust demand.

Acquisition of Building Information Modeling (“BIM”) firm to enhance the Company’s technological capabilities C Cheng acquired 49% of ISBIM Limited at HK21mn in Nov 17. ISBIM primarily engaged in Building Information Modeling (“BIM”) related business, including software development, consultancy and training services. Management expressed that ISBIM is a leading BIM company in HK in terms of staff number, its client base includes the Hong Kong Housing Authority, the Architectural Services Department and reputable property developers. ISBIM contributed ~HK$3mn revenue in FY17 for ~1 month of consolidation.

BIM technology basically provide a digitalized perform for architecture, engineering, and construction professionals to plan, design, construct and manage buildings and infrastructures. With BIM technology, various parties in the value chain could communicate in a more accurate and efficient way, so that projects could be completed in shorter timeline with lower costs. According to “HK 2017 Policy Address”, government would adopt BIM technology for sizeable projects starting from 2018, management of ISBIM also stated that orders from the PRC increase dramatically YTD leverage on the network of C Cheng. Expecting a substantial growth in FY18E .

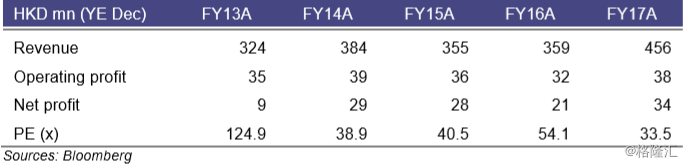

We view that C Cheng gradually establishes a strong position in the PRC market with SOE’s support and technological edge. While current valuation at 33.5X FY17 PER does not look particular attractive, we expect C Cheng to achieve substantial growth in FY18E and enjoy a bright outlook in coming years. We advise investors to keep an eye on the transformation of C Cheng.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员