机构:招商证券

评级:买入

目标价:28.1 港元

■ SH Pharma acquired 26.3% stake in Techpool from Takeda (ticker: 4502 JP) and now owns 67.1% of the target; Techpool is a leading urine protein pharma with strong specialty drugs research and A&E drugs marketing capabilities; the deal valued the target at 19/16x 2018/19E PER in our estimates.

■ We think that the stronger control of Techpool would help SH Pharma build out its specialty drug marketing capabilities; this in turn should underpin SH Pharma’s investment case as one of the leading marketers of MNC’s new drugs in China; Company is valued at 15/12x 18/19 PER, with good risk/reward.

Techpool has an interesting specialty drugs portfolio and strong A&E marketing capabilities Techpool mainly markets two products: 1) ulinastatin, a drug to treat acute and chronic pancreatitis and acute circulatory failure, and 2) urinary kallidinogenase, a drug to treat moderate and acute thrombotic cerebral infarction. Both are clinically necessary drugs used mainly in A&E or ICU. Noteworthy is Techpool’s specialty drug marketing capabilities – its sales team generated RMB2.6mn per head sales which is ahead of domestic peers’ and on par with MNC’s peers (RMB2.5-3mn per head).

The deal is with good strategic merits Techpool delivered RMB1.1bn revenue and RMB80mn NP in 2017, both down from the previous year due to the two-invoice reform, the government price negotiation and its distributors’ inventory adjustment. We expect that the sales and NP to recover gradually from 2018, thanks to the stronger support from SH Pharma’s distribution network. Financially we calculate that the deal would only add 0.2%/0.5% to FY18/19E EPS - consequently we leave our estimates unchanged for now. Strategically, we think that SH Pharma can better tap into Techpool’s valuable A&E/ICU marketing capabilities with greater stake in the group. Such capabilities will be crucial to underpin SH Pharma’s MNC drugs’ leading marketer story over long run, in our view.

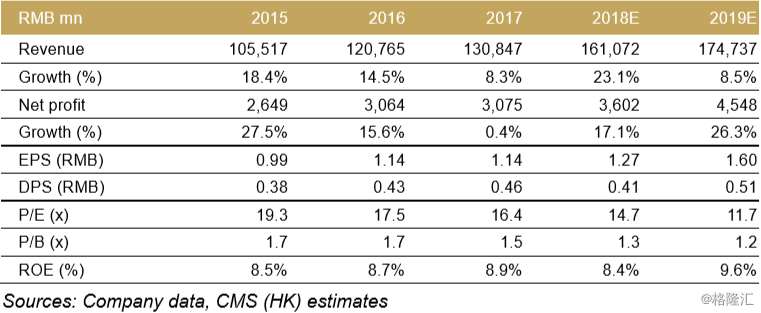

Financials

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员