机构:交通银行

评级:买入

目标价:24.00港元

1Q18 results beat on strong sales and lower MI. Sino Biopharm (SBP) reported 1Q18 adjusted net profit of RMB798m (+40% YoY), beating our estimate of RMB691m by 13% mainly due to strong product sales and lower minority interests (MI). Total revenue of RMB4.65bn (+20% YoY) was higher than our estimate of RMB4.32bn (+12% YoY), but was more than offset by higher-than-expected operating expenses, leading to a lower-than-expected operating profit at RMB869m (vs. our estimated RMB951m). Nonetheless, MI of RMB156m was much lower than our estimated RMB345m, leading to a 1Q18 earnings beat.

Stellar performance of major products. In 1Q18, total revenue registered robust YoY growth of 20%, mainly driven by strong performance of major products in key therapeutic areas:

(1) Hepatitis medicines’ sales of RMB1.78bn (+3% YoY) came in slightly lower than our estimate of RMB1.82bn (+5% YoY). Runzhong recorded sales of RMB941m (+6% YoY), better than our estimate of RMB929m. We expect continued recovery of Runzhong in the following quarters, given the relieved pricing pressure.

(2) Oncology drug sales grew 6% to RMB444m, below our estimate of RMB472m, negatively impacted by severe decline of mature product Zhiruo. However, three products (Qingkewei, Genike and Yinishu) reported sales of RMB146m (+38% YoY), upon their new entry into the NRDL. The recent launch of Anlotinib should drive the strong growth for SBP’s oncology franchise in the year, in our view.

(3) New products accounted for 15% of total sales in 1Q18.

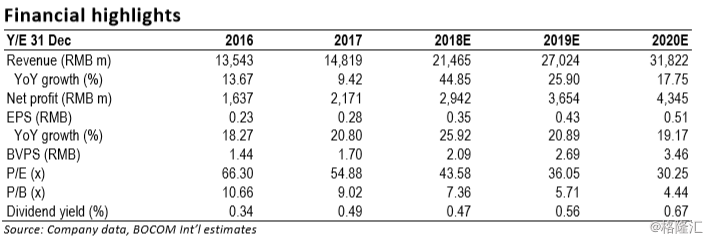

Maintain Buy and TP of HK$24.00. We reiterate our Buy rating and 12M TP of HK$24.00. We keep our 2018-20E EPS unchanged, but fined-tune 2Q-3Q18 results forecasts to reflect the quarterly fluctuations of MI. Key risks: prices cut of major products, fierce competition and R&D setbacks.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员