机构:招商证券

评级:买入

目标价:6.8港元

■ Ali Health has evolved into a healthcare informatics propelled, integrated healthcare e-commerce and service platform in China to ride the “Internet + Healthcare” policy tailwind

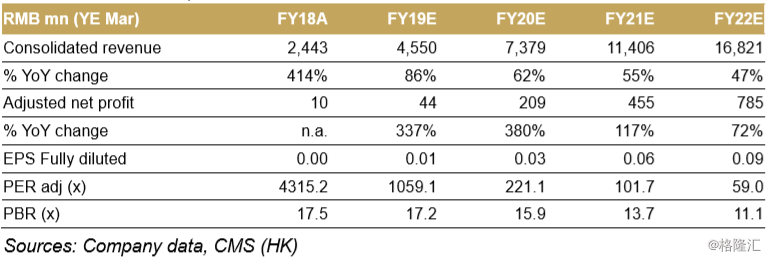

■ We expect Co. to have 62% CAGR in revenue over FY19-22E (Mar YE), and to continue to have positive adj. NP, reflecting its leading and growing market share in ecommerce, rising contribution from innovative revenue, synergy with online healthcare, protected by continuously strong investment in HCIT

■ Company currently trades at FY21 EV/Sales 3.9x vs listed peer’s 5.2x; initiate with BUY and SOTP-based TP of HK$6.8

China’s healthcare e-commerce champion

From a data tracking service company, Ali Health evolved into a healthcare e-commerce champion. Though China’s health product ecommerce GMV reached c.RMB100bn in 2017, its penetration rate (3%) remains low vs the overall e-commerce (20%). Co.’s own B2C unit (65% of FY18 GP) has solid No.1 position in online pharmacies. Its parent’s Tmall Medicine Hall (from which Co. derives 19% of its GP) was also the leader in online marketplace. As such, Co. should benefit significantly from the rising e-commerce penetration and upcoming RX pharma deregulation.

Riding the wave of “Internet + Healthcare”

We estimate a new RMB13bn “Internet healthcare” market is in the making by 2020E, thanks to China’s “Internet+” initiatives and advancing technologies. Different from peers who primarily focus on online consultation, Co. is exploring various online/offline scenarios to help hospitals in areas from early diagnosis to clinical supports, leveraging its strength in healthcare informatics (Big Data/Cloud/AI). Given time, we think it can replicate its success with pharmacies and build out a “Tmall for hospitals”.

We arrived at SOTP valuation of HK$6.8

Our SOTP TP applies FY22 EV/EBITDA for e-commerce and FY22 EV/Sale for advertising & marketing and discounted them back to end FY19. We refrained from directly valuing its internet healthcare business as the monetisation remains remote and peers’ metrics are not comparable. Instead we capitalised 2/3 of the R&D spend (i.e. that of HCIT) over FY19-22E and applied a P/B valuation for such assets, as we view them as necessary investment for Ali Health’s future as a “New Healthcare” champion.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员