机构:交通银行

评级:买入

目标价:13港元

Earnings bottoming out: SMIC’s 1Q18 operational revenue (excluding one-time licensing) came in 3% ahead of our estimates on pick-up in customer demand. Due to higher-than-expected capacity utilization, GPM came in better than our expectation. For 2Q18, SMIC guides for wafer revenue to rise 15-18% QoQ, but this is partly caused by the timing of 28nm wafer shipment being pushed from 1Q18 to 2Q18 due to inventory correction. Without this, we estimate revenue would rise 8% QoQ. The company also raised capex from US$1.9bn to US$2.3bn on more R&D equipment spending and capacity expansion (mostly 8” capacity).

Upside to guidance: Given better-than-expected 2Q18 guidance, management’s positive commentary on the demand outlook and the increase in capex this year, we believe the company may revise up its revenue/GPM guidance later this year. This could be a repeat of 2H16 when the market was overly pessimistic on the earnings outlook, followed by guidance revision by the company which led to a share rally. The overall foundry sector outlook seems to be improving as other foundries such as Vanguard and UMC also guided positively.

Better positioned for sustainable growth with improving technology: Technology roadmap remains on track with production of 28nm HKC+ starting in 2H18 and 14nm risk production starting in 1H19. With improving R&D capabilities, capacity expansion and strategic alliance with key China customers, we believe the company remains a major beneficiary of China fabless growth. We remain cautious on 14nm outlook (a sentiment shared by the market), but is encouraged by the company’s prudent ramp-up approach. We also expect SMIC South JV partners to bear some of the losses at the initial stages, similar to the SMIC North (Beijing) JV.

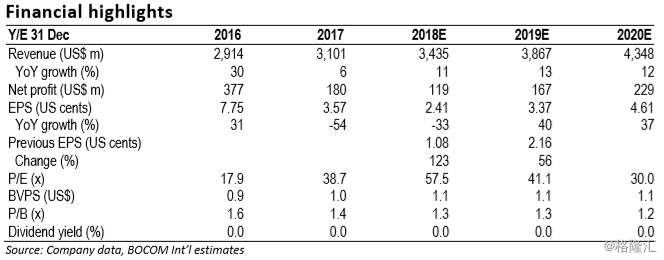

Raising estimates/TP; upgrade to Buy: We raise 2018/19E net profit from US$56m /112m to US$119m/167m, on better-than-expected wafer shipments and GPM outlook, offsetting the possibility of higher tax ahead. Shares trade at 1.3x 2018E P/B (vs 5-year average of 1.2x). We expect sequential improvement in earnings, possible revision of guidance and 14nm ramp-up to be catalysts. Our new TP of HK$13.00 is based on 1.5x 2019E P/B (previously HK$9.00 on 1.1x 2018E P/B).

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员