机构:交银国际

评级:Buy

目标价:5.12港元

Operating volume growth remained solid in 1Q18: Sinotrans reported across-theboard volume growth in freight forwarding business in 1Q18, thanks to steady growth of trade performance in China. Sea freight forwarding and shipping agency volumes trended up by 13.6% YoY and 12.5% YoY, respectively. On the other hand, logistics volume increased by 22.3% YoY, mainly due to its continuous expansion in the Belt and Road region, in our view. The new business segment from China Merchants Logistics, namely logistics equipment leasing, also witnessed operating volume growth in pallet leasing and container leasing, up 15.2% YoY and 6.5% YoY, respectively. Express service volume maintained its uptrend, surging by 220.7% YoY in 1Q18. However, warehouse operating volume and terminal throughput declined during the period.

Net profit growth of SinoAir slowed to 6.5% YoY in 1Q18: SinoAir, an A-share listed subsidiary of Sinotrans, announced its 1Q18 net profit at RMB203.1m, representing a slow growth of 6.5% YoY (vs 30.7% YoY and 36.0% YoY in 1Q17 and FY17, respectively). Revenue of SinoAir rose 21.6% YoY, compared with an increase of 28.5% YoY in 1Q17. Operating margin fell to 13.7% in 1Q18 from 15.7% in 1Q17, mainly due to soaring asset impairment loss. Investment income growth moderated to 9.6% YoY in 1Q18 as a result of slow growth of earnings contribution from DHLSinotrans JV, partly due to high base in our view.

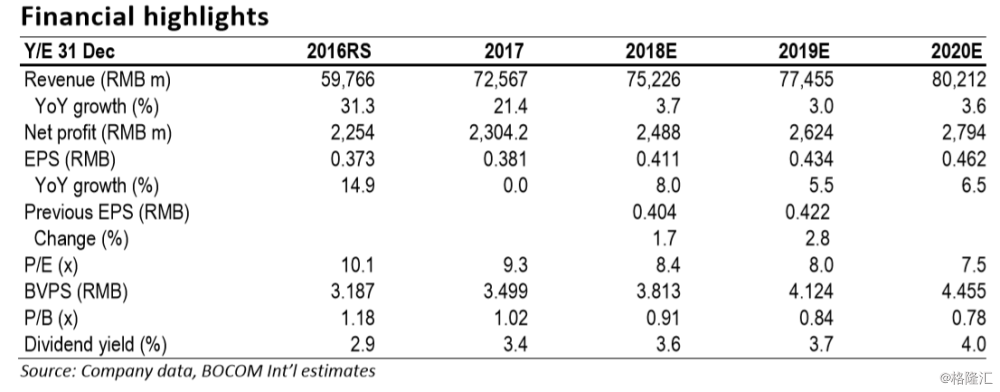

We maintain our Buy recommendation: We expect steady volume growth from freight forwarding and logistics segments to buttress overall revenue growth in 1H18. We fine-tune our FY18-19E earnings forecasts and introduce FY20 forecast. We maintain Buy recommendation and TP of HK$5.12 at the moment.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员