机构:信达证券

Transforming from product-based to services-based model We have discussed with the management on Sinosoft recent business development. Management shared with us that Sinosoft has upgraded and increased its product offerings to include more data analytics in each business segments, which we believe they would like to transform from a product-based business model to a platform/services-based model. By leveraging through its leading position in the exports tax, carbon management and government sectors, particularly in the judiciary, Sinosoft will be putting more focuses on expanding its cloud and big data services to current and potential clients .

For instance, on the tax software and related services, Sinosoft offer comprehensive export tax rebate risks control solutions for large foreign trade integrated service providers. In addition, they also teamed up with several financial institutions (such as banks) in Jiangsu, and launched financing services based on analysis in export tax rebate data and other trade related services in 2017, which helped small export companies shorten the time to secure banking facilities.

Partners with Huawei Cloud and Alibaba Cloud to promote low carbon & ecology product ; Sinosoft not only launched provincial low carbon ecology cloud platform which serves the government and enterprises etc, but also launched products such as environmental rights trading platform and low carbon transportation software. Products are currently sold in Jiangsu, Inner Mongolia Autonomous Region, Jilin and Heilongjiang Province. Sinosoft announced on Apr 6 that they recently co-operate with Huawei Cloud to promote low carbon & ecology products. Sinosoft is currently the only partner of Huawei Cloud, which reflects Sinosoft’s leadership in this segment.

Government Big Data segment to outperform industry Sinosoft has been engaging in the development and the sale of previously called e-Government solutions since 2002. These products are used by government agencies at various administrative levels, including the ministerial, provincial, municipal and district levels, in Jiangsu and other provinces of China. We believe Sinosoft’s segment revenue growth would continue to outperform overall industry growth (2016-2018 to grow at ~17% CAGR to RMB340bn in 2018), driven by i) service cloud platform expansion from provincial government to municipal government, ii) selling to other cities outside Jiangsu province and iii) leading player in the industry especially in judiciary (won 4 related tenders since Sept 2017)

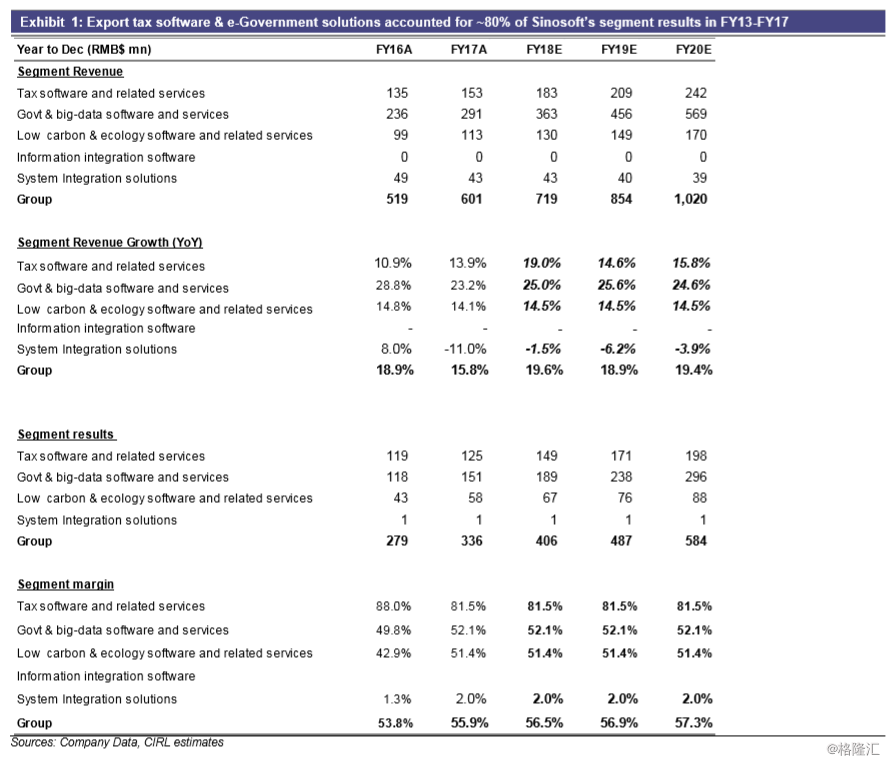

Undemanding FY18E 12.4x PE, deserve a re-rating story Though Sinosoft share price rocketed ~40% in the past month, it is trading at 12.4x FY18E PE, 60% discount to Hong Kong, A-share and US listed software peers. Sinosoft has been delivering decent/solid track record since listing (~23% EPS CAGR in FY13-FY17), we expect both revenue and EPS to grow at 23%/24% CAGR in FY17-FY20E, together with upside catalysts ahead which include i) More in depth co-operation with Huawei Cloud and Alibaba Cloud ;ii) Successful expansion of new businesses outside Jiangsu and iii) Solid 1H18 result regaining investors’ confidence, we believe Sinosoft deserve a re-rating opportunity. We value Sinosoft at HK$3.93, which implies FY18E 17.1x PE (55% discount to peers)

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员