机构:交银国际

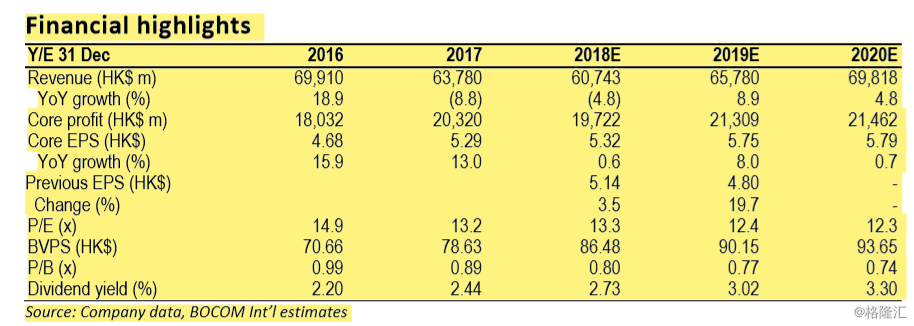

FY17 results in line: FY17 reported core profit rose 13% YoY to HK$20.3bn. Core profit would be HK$19.2bn if excluding fair value gain, in line with our forecast. Rental income, hotels and non-property formed a solid recurring income base, accounting for 42% of EBIT (2016: 33%). FY17 DPS rose 11.1% YoY to HK$1.70.

Non-property earnings to double in 2018E: Aircraft leasing and utility contributed HK$2.95bn EBIT in 2017. As of December 2017, the company had a fleet of 86 aircraft, and has committed another 56 aircraft, representing a CAGR of 14% if spread across a 4-year pipeline. On the other hand, the three newly acquired utility businesses (Duet, Reliance and ista) had only 2-7 months’ contribution in 2017. We estimate their full 12-month contribution to add another HK$2.8bn to 2018E EBIT. Therefore, we expect earnings momentum from non-property businesses to remain strong and double in 2018E.

Property profit to rebound in 18E/19E: HK property profit dropped 31% YoY in 2017, with the absence of major projects. Nevertheless, contracted sales were up to HK$50bn, led by the buoyant sales at Ocean Pride I&II. We estimate over 40% EBIT margin at this project. Therefore, we expect HK property profit to rebound by 9%/36% YoY in 18E/19E, respectively. In addition, 2018 is a harvest year, when the company will book as much as HK$18bn gain from the disposal of The Center and Shanghai Century Link by our estimate. Including the two disposals, we estimate 2018E core profit would jump to HK$35.8bn, or +76% YoY.

Huge war chest to build recurring income: We expect the growth in non-property earnings will help to fill the gap, when property profit slows down after 2020E, as landbanks in HK and mainland of the company are running down. More importantly, we estimate the company will return to net cash following the disposal of the two investment properties. This could potentially lift core profit by another HK$3bn, assuming reinvesting at a net yield of 5% and leveraging up to 20% net gearing. Therefore, we remain positive on the company’s growth prospects. We raise our NAV to HK$104.30 (from HK$98.50), mainly to reflect the higher-than-expected return from infrastructure projects. We raise our target price to HK$78.20 (from HK$73.90), based on 25% target NAV discount. Maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员