机构:交通银河

评级:BUY

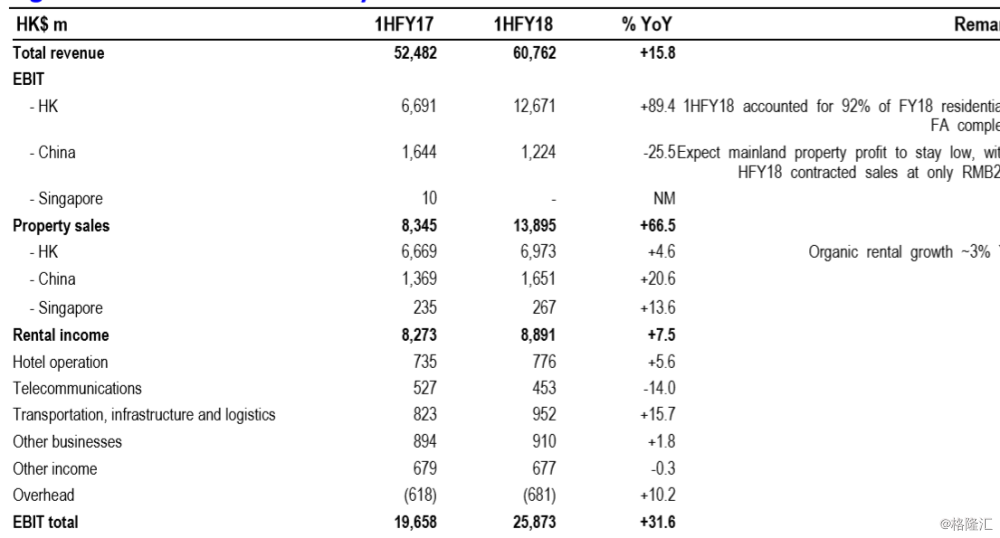

Strong headline growth led by Cullinan West. 1HFY18 core profit rose 37% YoY to HK$20.0bn, 19% ahead of consensus. The positive surprise came from the early booking of Cullinan West. Mainland net rental income also rose 21% YoY, helped by contribution from new malls and RMB appreciation. On the other hand, HK net rental income only posted a mild ~3% YoY organic growth, with rental reversion staying at low teens. Book value increased to HK$181.8/share as of December 2017 (June 2017: HK$172.0). Net gearing slightly improved to 8.5% (June 2017: 8.8%). 1HFY18 DPS rose 9% YoY to HK$1.2. Above all, we are upbeat on the company’s medium-term (MT) target of HK$40bn annual HK property sales.

Early recognition of HK property profit. Cullinan West and Victoria Harbour are two high-margin projects in SHKP’s landbank. Therefore, the early booking of Cullinan West helped to boost property profit by 89% YoY, with EBIT margin expanded to 40%. However, other projects’ margins are still capped at ~30%, dragged by higher land costs and selling expenses, in our estimate. In addition, 1HFY18 has already accounted for 92% of FY18E completion in residential GFA, and the company might restate the FY18E booking after adopting HKFRS15. Therefore, we see the heavily front-loaded earnings as only an accounting entry.

Good track record to override market uncertainty. Nevertheless, we believe the MT sales target would help mitigate the uncertainty in property profit outlook, especially when SHKP has a good track record in delivering promise regardless of market condition. Its current HK residential landbank of 18m sq ft GFA could support such target, at least for the next six years, in our view. We believe this can safeguard SHKP against potential property market weakness from US rate hike, as we expect it to speed up asset turnover to deliver the sales target, even in a property market slowdown. This will also help maintain ROE in the event of margin compression, in our view. Therefore, we lift our MT forecast of HK property profit to HK$10bn (in case of property price correction), which could rise to HK$12bn-14bn (if market stays buoyant). We revise up our FY18-20E core profit forecasts by 8-27% accordingly.

Continuous rental income growth despite high base. Rental income outlook remains positive, as management guided to a steady 3-5% organic rental growth in both HK and mainland. In addition, the company still has 1.3m sq ft GFA and 4.0m sq ft GFA completing in the next three years in HK and mainland, representing 6% and 33% of existing portfolio, respectively. Major upcoming openings include Two Harbour Square in Hong Kong and ITC (Xujiahui project) in Shanghai. Together with contribution from new malls, we maintain our forecast of 5% 18-20E CAGR in net rental income.

Upgrade to Buy. Management intends to maintain a progressive DPS in absolute terms, supported by continuous rental income growth. Moreover, we believe the MT sales target should help to mitigate market concern about HK property market and restore investor confidence on the sustainability of SHKP’s property profit, hence narrowing the NAV discount. We revise up our NAV estimate to HK$180.7 (from HK$171.0), to reflect the higher rents in HK CBD offices and prime shopping malls, as well as higher ASP at recent new launches. We lift our target price from HK$120.00 to HK$145.00, based on a 20% target NAV discount (from 30%), to reflect the faster asset turnover. We upgrade the counter from Neutral to Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员