Company:中国银河国际

Rating:BUY

Target Price : HK11.10 (+13.8%)

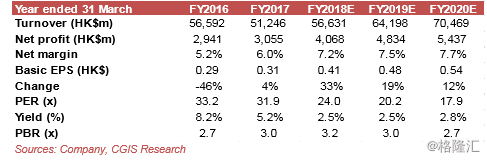

Chow Tai Fook Jewellery (CTF) reported encouraging Q4 FY2018 operating figures (covering Jan-Mar 2018) after market close on 16 Apr 2018. The Company had good retail sales performance in both mainland China, and HK/Macau (RSV up 13% & 11% YoY, respectively). The figures were better than Q3 FY2018, suggesting CTF has resumed its growth momentum in the HK/Macau segment. We expect the positive momentum to continue, especially for HK/ Macau. We lift our earnings forecast for FY19E/20E by 5%/9%, respectively. Our new earnings forecast implies an EPS CAGR of 25.7% in FY2017-FY2019E. We also raise our TP from HK$9.20 to HK$11.10, as our target FY2019E PER is raised from 20x to 23x after considering the macro-environment, peer performance and stronger EPS growth outlook. We believe CTF, as the leader in the Chinese jewellery segment, with a much bigger scale than its listed peers, now deserves a higher premium. We upgrade our rating from HOLD to BUY, as we expect there to still be trading opportunities within a 12-month horizon.

Growth Momentum Resumed in Hong Kong & Macau. CTF reported 11% YoY growth in Retail Sales Value (RSV) for the region in Q4 FY2018, which was notably better than Q3 2018 (+0% YoY). We believe the reasons behind the increase are that (1) CTF stopped conducting big sales during Jan-Mar 2018; (2) there was a strong contribution from mainland Chinese visitors, as the percentage of retail sales transacted in UnionPay/ RMB jumped from 42% in Q3 FY18 to 51% in Q4 FY18; and (3) local consumer purchases increased during the CNY period. The region also reported strong same store sales growth (SSSG) of 17% during the quarter, which we believe shows good progress in store network optimization.

Mainland China: So Far So Good. The Mainland China segment, which has been the largest segment for CTF, continued to report double-digit RSV growth for five consecutive quarters, driven by both new store additions (+17 during the quarter) and improved performance for existing stores (SSSG: +7% in Q4 FY18). Notably, the RSV YoY growth for the e-commerce segment moderated to 38% during the quarter, but we do not believe this is a major setback for the Company, due to CTF’s premium position.

We Expect Gold Product Sales to Improve. Gold products did better than gem-set jewellery during the period, as mainland China and HK/Macau recorded 14%/18% SSSG, respectively, for gold products. We expect this momentum to continue at least for a while, as we expect the increasing inflation risk in both markets to prompt more investors to buy more gold products.

We Now Believe CTF Deserves a Higher Valuation. Upgrade to BUY. We lift our earnings forecast for FY19E/20E by 5%/9%, to HK$0.48/HK$0.54, respectively. Our new earnings forecast implies an EPS CAGR of 25.7% in FY2017-FY2019E. We also raise our TP from HK$9.20 to HK$11.10, as our target FY2019E PER is raised from 20x to 23x. Our argument for a higher multiple is as follows: (1) we expect the gold price, which is likely to ignited by inflation risk, to support segment performance; (2) unlike the previous boom, which was hit by the anti-corruption campaign, we believe this growth is more healthy and sustainable, driven mainly by consumption upgrades; and (3) the 23x FY19E PER implies a <1x PEG ratio, assuming a FY2017-FY2019E EPS CAGR of 25.7%.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员