机构:招商证券

Inline FY17 results

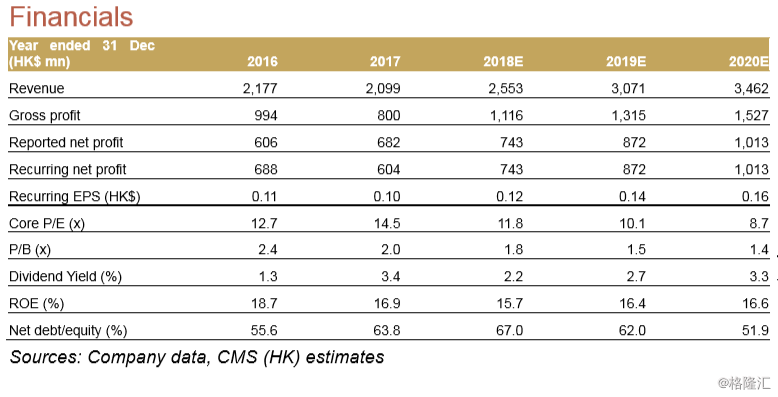

CTEG’s FY17 core profit dropped 12% YoY to HK$604mn, largely in line with our estimates, but 6% below consensus. The profit was mainly dragged by: 1) the loss status of its newly commenced Fumian project given the slow ramp-up; and 2) lower-than-expected utilisation of sludge and general solid waste treatment (4% YoY revenue growth) and hazardous waste treatment business (revenue dropped 8% YoY) due to the facilities upgrades and maintenance.

Guiding a positive 2018

CTEG is speeding up the development of Fumian Project Phase I & II and Bobai Project Phase I & II. With the commencement of these projects in 2018-19, together with more tenders received for sludge and general solid waste treatment and hazardous waste treatment business starting from Dec 17, mgmt. guides a 30% YoY growth in NP in 2018.

Maintain NEUTRAL and slightly adjust our TP to HK$1.52

We basically maintained our forecasts with only very minor adjustment due to the announced results. Accordingly, we lower our DCF-based TP by a slight 2% to HK$1.52. While we see limited downside risk for CTEG at the current valuation level (2018E P/E of 11.8 with 20% recurring EPS CAGR in 2017-19E), the auditor’s qualified opinion on HK$62mn of sludge and solid waste treatment service revenue might affect investors’ confidence on the co.’s execution abilities. Despite the affected amount only accounted for less than 3% of the total turnover in 2017 and the co. promised to have a better book keeping for new customers going forward, we believe it takes some time for the co. to regain investors’ confidence. We maintain NEUTRAL.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员