机构:信达证券

Strong FY17 results as expected

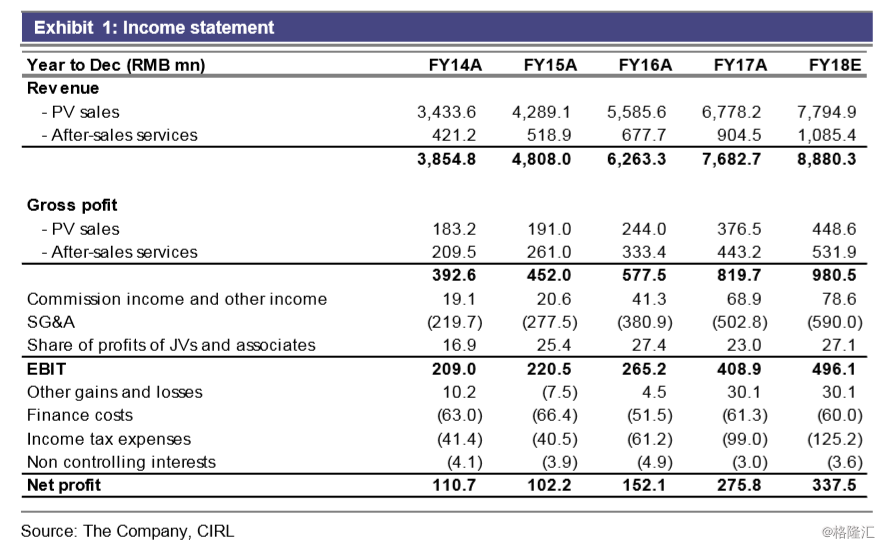

Meidong reported operating EBIT/net profit of RMB409mn and RMB276mn in FY17, up by 54% and 81% respectively, largely in-line with our previous estimates of RMB420mn and RMB261mn. Such growth was driven by i) 21%/33% yoy increase in new car sales and after sales services and ii) 1.2ppt GPM improvement in new car sales.

Remained upbeat for FY18E

Management stay positive towards 2018, and shared that inventory level remained relatively low YTD, particularly for Porsche. Management continue to expect Meidong to benefit from the new model cycle of BMW and Porsche, and the performance of Lexus and Toyota would be rather stable, while the worst is over for Hyundai

Continue to focus in luxury brands and “Single City Single Store” strategy

Meidong opened 5 new stores in 2017 (3 BMW and 2 Lexus), and have obtained the authorizations to open 11 new stores (3 Porsche, 4 BMW, 3 Lexus and 1 Toyota), a large proportion of them are expected to open in 2018 (2 are already opened in early 2018). We share the same view with management that luxury auto brands are well-positioned to enjoy China’s consumption upgrade trend.

Regarding the Company’s “Single City Single Store” strategy, Meidong would also attempt to introduce other brands into those “Single City”. For instance, in two cities of which Meidong operated the only BMW store, Meidong has introduced Lexus into them in recent years, which achieved decent performance with short ramp up period. Management would consider adopting similar strategy for other brands.

Moderate earnings growth in FY18E with decent dividend yield

After a strong rally since 2H16, share price of auto dealers generally underperformed in recent months. Some investors are concerned that the upcycle will be peaked due to intensified competition between auto brands, which could lead to inventory build-up for dealers. We agree that room for further GPM expansion is limited, hence profit growth of dealers, in general, would be less dramatic in FY18E. However, with a more consolidated dealership market nowadays, we view that dealers have stronger bargaining power to ask for a healthy GPM. Besides, Meidong’s low gearing ratio (negligible net debt as of end FY17) and absence of self-operated auto finance division make the Company less vulnerable amid credit tightening. Undemanding valuation at 8.4X FY18E PER with 5.8% expected dividend yield also help to protect downside.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员