机构:国信证券

评级:BUY

目标价:HKD36.20

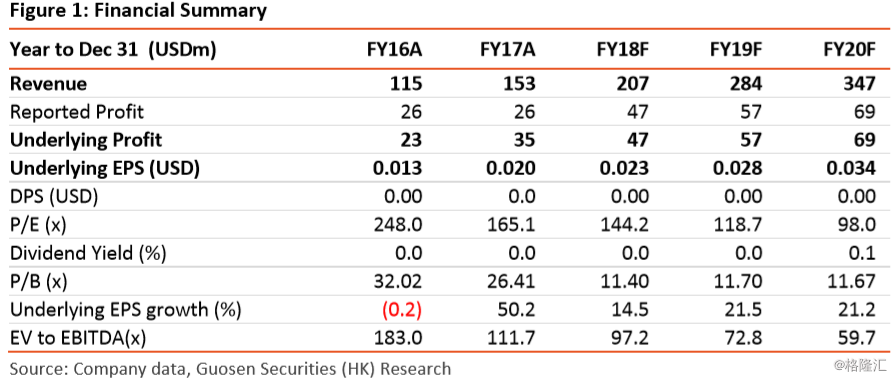

FY17 Result beat on smaller opex to sales. Genscript reported FY17 net profit at USD26m, flat growth y-o-y. Core profits after exchange gain/loss and other one-off items, came in USD35m, climbed 52% y-o-y and beat our estimate of USD29m. This was due to smaller operating expenses to sales after taking out R&D cost, having covered by the same extent from booking the new Cell Therapy sales. This sales was derived from Janssen’s USD350m contribution plus milestone payment agreed in Dec 2017. Post Management roadshow, we see this P&L booking will continue to cover its high R&D cost for CAR-T, similar to installments. On the good integration of its preclinical drug development services with the main business, we keep our biosciences services and products sales to grow at high-twenties of 25%/ 26% y-o-y in FY18F-19F (FY17:23%).

Edging up GPM on more Cell Therapy sales. In light of its (1) improving industrial enzyme sales with successful revamp and three to four times increase in production capacity in the next few years; (2) booking of new Cell Therapy sales for R&D, our revenue forecast is lifted by 23%/27% in FY18F-19F to USD207m and USD284m. Same for margin, post inserting 100% GPM for new Cell Therapy sales, our blended FY18F-19F GPMs are up 70/150bps to 71.0%/70.3% with FY17 at 68.5%.

Raising FY18F-19F net profit estimate by 13% and 2%. After our cut in the adjusted opex to sales ratio (without R&D cost) to 33.7% (from 60.5%) in FY18F and 38.3% in FY19F (from 59.5%) versus FY17 at 34.9%, we lift our earnings by 13% and 2% in FY18F-19F to USD47m(+34% Y-o-y) and USD57m (+22% y-o-y). We see its R&D cost to sales would be 17.0% (USD35m) and 15% (USD43m) of total revenue in FY18F-19F against 28.5% (USD48m) and 28.7% (USD64m) previously. Further, with its partnership with Janssen Biotech, Genscript will pack up its data in good shape for US’s IND approval by end-April 2018, likely to be approved by end-May but a delay from our expected end-1Q18.

SOTP-TP rises to HKD36.20 (from HKD34.50); Keep BUY. Our new SOTP-derived TP of HKD36.20 comprises (1) existing product sales at HKD11.04/s (from HKD8.66) whose implied FY18F core P/E stands at 61.3x (or 3.2x PEG) (from 54.1x); and (2) CAR-T R&D valuation at HKD25.16/s. Key risk: Slower or failure of CAR-T drug approval and clinical trials, impairing its stock price.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员