机构:交银国际

评级:Buy

目标价:7.00港元

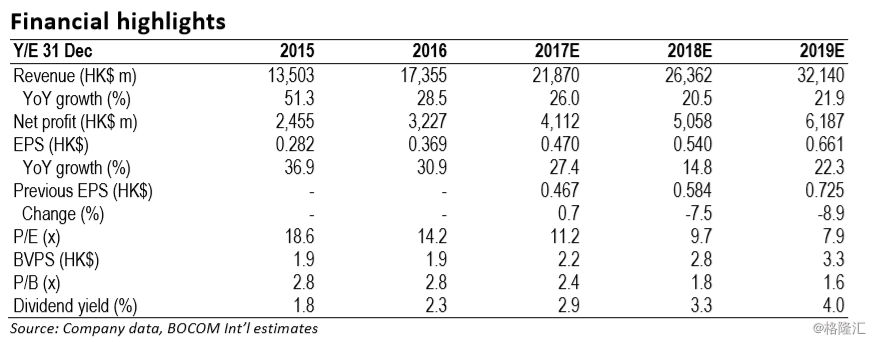

High profit growth to continue in FY17: BEWG will report FY17 results on 28 Mar. Our net profit forecast is HK$4.1bn (+27% YoY), in line with consensus. We forecast HK$8.8bn EPC revenue from water renovation (+90% YoY); and operation revenue from water supply and wastewater treatment to grow 24% YoY to HK$6.2bn, based on ~3.4m tons of new capacity commenced in 2017. Regarding PPP investment funds, we expect HK$620m contribution in 2017, to be booked at JV level.

Earnings visibility and cashflow improvement as key focus: We believe earnings visibility and quality, rather than growth, should be the key focus in the results. One key aspect is the split of PPP project profit between investment fund (JV) and subsidiary (consolidated) levels. We believe recognition of profit at JV level would lower earnings quality and visibility due to limited disclosure. Meanwhile, we forecast increasing contribution of EPC revenue from water renovation projects at subsidiary level should help improve operation cashflow, given the receivable turnover days of EPC revenue should be lower than that of concession-related receivables. Such improvement, in our view, will remain a key element of BEWG’s re-rating. We look forward to management’s view on this in investor presentation.

Share placement to lower net gearing to <100%: In Jan, BEWG announced a topup placement to investors, plus new shares subscription from parentco Beijing Enterprises Holdings (BEH, 392 HK; NR) to raise a total of HK$3.6bn. Assuming the BEH subscription is approved by minority shareholders, we estimate BEWG’s 2018 net gearing to drop from 101% in 2017 to 88%, which should ease investor concern on its interest expense and liquidity amid rising borrowing cost in domestic market.

TP reset to HK$7.00; retain Buy: We trim 2018/19E EPS by 7.5%/8.9% to factor in the dilution from recent equity financing and slight changes in our forecast on PPP project contribution and interest expense. Pegging 13x 2018E P/E (unchanged), we reset TP to HK$7.00 (from HK$7.65). Retain Buy. Yet, conservative investors could stay on the sideline before results for better view on earnings quality and visibility.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员