机构:德意志银行

评级:Sell

目标价:14.2港币

Remain positive on copper; upgrade to Buy on undemanding valuation

Results likely missed consensus on bad debts but copper outlook is positive and valuation is undemanding; upgrading to Buy

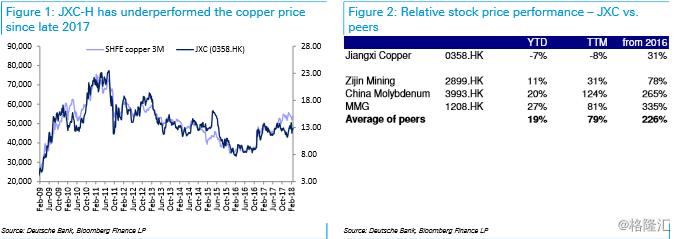

Jiangxi Copper has historically offered the most direct exposure to the copper price, both in terms of operations and share price correlation but the latter relationship has faded in the past seven months. Our review highlights weaker disclosure and the incidence of bad debts as probable factors and we look for greater clarity with the full results release in late March. We have revised our projections to reflect latest price moves, the inclusion of preferential tax treatment and our bullish copper outlook and see 20% upside to our fair value and upgrade the shares to BUY. We retain retain our copper sector preference for China Moly and Zijin and our Sell rating on JXC-A on valuation grounds.

Outlook for copper still positive; earnings growth despite potential bad debts

From an industry perspective, we remain positive on copper and expected growing deficits towards 2020, supported by slow supply growth globally, potential disruptions, and higher-than-consensus expectations for Chinese copper demand (~4% pa) over the next several years. Based on our latest copper price forecast of $7,175/t and $7,500/t in 2018 and 2019, we raise 2018/2019 earnings to RMB3.2b and RMB4.4b, suggesting 76%yoy growth in 2018 and 37%yoy in 2019, respectively.

DCF mine of life; risks

Our target price of HKD14.2 is based on a life-of-mine DCF methodology, 8.4% WACC (3.9% Rf, 5.6% MRP and Beta of 1.1). With 20% potential upside, we upgrade JXC-H to Buy. The stock is trading at 10.5x/7.7x 2018/2019 DBe EPS, 20% and 30%+ lower than its global peers. We however maintain a Sell rating on JXC-A on demanding valuation. Risks for JXC- H shares include a weaker copper price, higher unit cost of production and potential bad debts. For JXC-A risks: higher copper price due to copper mine disruptions, lower production cost if the company takes further initiatives on cost cut and lower bad debt.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员