机构:银河证券

评级:BUY

目标价:12.52港币

Investment Highlights

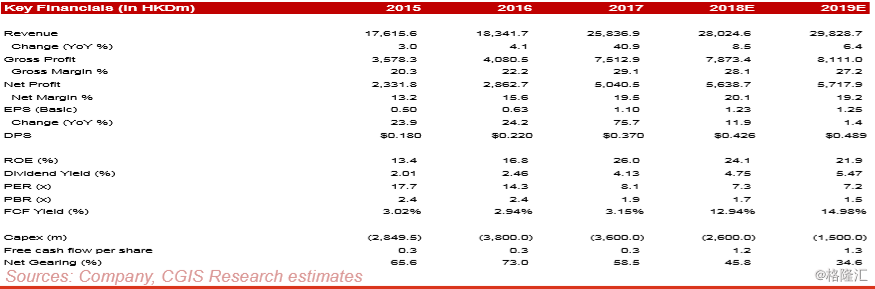

2017 net profit jumped 76%. LMP’s turnover was HK$25,836.9m in 2017, up 40.8% YoY, from HK$18,347.1m in 2016. The turnover growth was driven mainly by a 44% YoY increase in the average selling price to about HK$4,678 per tonne, as sales volume was down 1.9% YoY to 5.5m tonnes in 2017. LMP’s gross profit margin was 29.1% in 2017, up from 22.2% in 2016. LMP’s SG&A rose 35.2% YoY, because of higher selling expenses due to an increase in logistics costs. Interest expenses were up 11% YoY, from HK$167.2m in 2016 to HK$185.3m in 2017. Net profit was up 76% YoY, from HK$2,862.7m in 2016 to HK$5,040.3m in 2017. Net profit per tonne for containerboard was HK$910 and that for tissue paper was HK$953 per tonne. LMP declared a final dividend of HK$0.20 for 2017, up from HK$0.11 for 2016, implying a payout ratio of 34% in 2017. The Company’s tissue paper business reported an operating profit margin of 18.9% in 2017, up from 8.6% in 2016. Tissue business accounted for 10.5% of LMP’s total turnover in 2017. LMP had total annual tissue paper capacity of 685,000 tonnes at the end of 2017.

Tissue paper remains a growth driver. LMP’s tissue paper capacity will increase to 795,000 tonnes per year by mid-2018. Despite high pulp costs, the profitability of LMP’s tissue paper business remains stable, given its economies of scale. LMP will continue to adopt effective marketing strategies to grow its tissue paper business: a) selling its own-brand products, and b) promotion via online channels. LMP has three years’ operating history in tissue paper manufacturing, which in our view, offers the Company the option of spinning off its tissue paper business. We still maintain the view that the tissue paper business is a medium- to long-term growth driver for LMP.

Concerns about the containerboard paper segment overdone. Despite concerns about an increase in new capacity in the industry, LMP management believes that the increase will be lower than what some investors expect. We believe that containerboard prices will be supported by ongoing pollution controls in China and the paper mills’ strategy of maintaining prices by selling less volume. LMP management said that paper prices are unlikely to see a major correction. We still maintain the view that market concerns about the supply/demand situation seem overdone. The import quotas for waste paper released by Chinese government will also help constrain an increase in new capacity.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员