作者:Mikko编译

来源:智堡Wisburg

欧洲央行执委Benoît Cœuré的演讲稿件,译者Mikko

译者注:

如果你想了解美国货币市场与欧元区货币市场的差异性,以及近期货币市场利率跳升的原因,这篇译文不容错过。科雷用非常平实的语言解读了美国和欧洲各自的问题,简言之,美国的问题在于准备金集中度过高,都在大行手里,所以虽然准备金总量很多,但是分布非常不均匀,旱的旱死涝的涝死。欧洲的问题在于准备金市场过于割裂,一些钱多的国家只在本国做生意,不肯把钱借给其他国家的对手方,所以德拉吉(作为一个意大利人)离任前推出了双层利率体系,逼迫有钱的国家资金(德国)流向那些没钱的国家(意大利)。理解欧洲央行的双层体系或许有些困难,建议读者多读几遍。科雷最终的建议就是无论集中度高的问题还是过于分散割裂的问题都要央行出手直接解决掉,开放资产负债表给更多的对手方甚至直接给非银部门都是OK的。

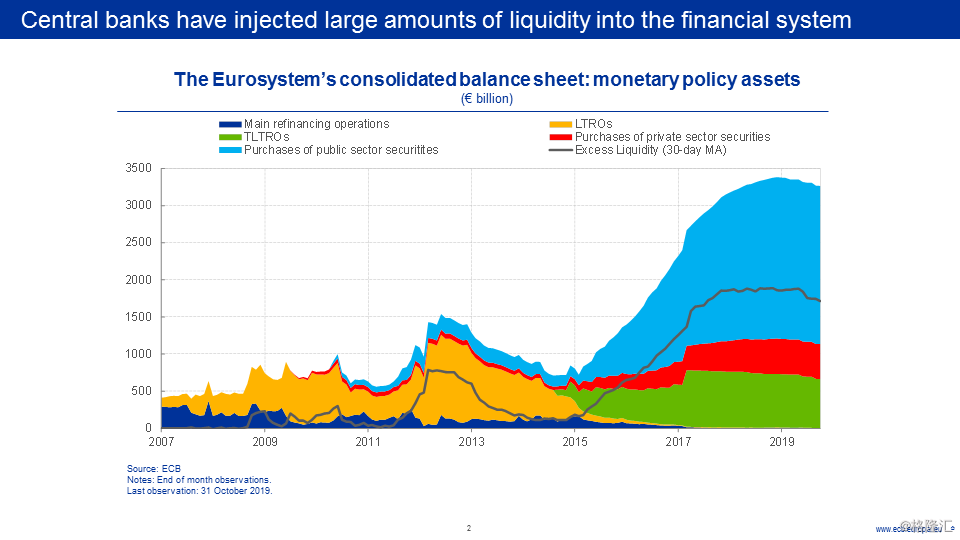

Since the outbreak of the global financial crisis, central banks have injected a huge amount of liquidity into the financial system. The monetary policy assets on the Eurosystem’s consolidated balance sheet, for example, have expanded from around €0.5 trillion on the eve of the crisis in July 2008 to nearly €3.3 trillion at the end of September this year.

自全球金融危机爆发以来,各国央行向金融体系注入了大量流动性。以我们自身为例,欧元体系综合资产负债表上的货币政策资产规模已经从2008年7月危机前夕的约0.5万亿欧元扩张至截止今年9月底的近3.3万亿欧元。

Not all of the expansion in central bank balance sheets reflects direct monetary policy actions, however. Part of it relates to regulatory factors, as I will explain shortly in more detail. And part of it relates to autonomous factors, such as the steady increase in the demand for banknotes.

然后,央行资产负债表的所有扩张并非反映的都是直接的货币政策行动。部分原因与监管因素有关,我将在稍后详细就此进行说明。其中另一部分则与自发的内生性因素有关,例如对欧元现钞需求的稳定增长。

Yet, changes in the way we operate and implement monetary policy – in our case, the fixed-rate full allotment at our main refinancing operations, (targeted) long-term refinancing operations and our asset purchase programme – have resulted in considerably more liquidity being injected into the financial system than is required by banks to meet their immediate liquidity needs.

确实,我们的货币政策操作和实施的方式发生了变化——例如,我们在主要再融资操作(MRO),定向长期再融资操作和资产购买计划中采用了固定利率全额分配,这导致被注入到金融体系中的流动性大大增加,这部分流动性的增长并非是为银行满足其即时的流动性需求所需要的。

These excess liquidity holdings were first a sign of uncertainty and mistrust, and then of a dysfunctional money market. As a result, central bank operations substituted for market-based intermediation in times of crisis.

这些富余的流动资金持有量首先是不确定性和不信任的标志,此外则是货币市场失调的标志。最终,在危机时期,中央银行的操作取代了基于市场的中介活动。

Today, large excess reserve holdings are, by and large, a reflection of the accommodative monetary policy that central banks have conducted in recent years, and that many, including the ECB, are still conducting today in view of stubbornly low inflation rates. You can see this on my first slide. Excess liquidity increased as we rolled out our unconventional policy measures.

如今,(银行)持有的大量超额准备金基本上反映了中央银行近年来所采取的宽松的货币政策,且鉴于通货膨胀率的持续低迷,包括欧洲央行在内的许多央行今天仍保持着宽松姿态。您可以在我的第一张幻灯片中看到,随着我们推出非常规货币政策,富余流动性水平相应地增加。

In this environment, an important – albeit by no means the only – role of excess liquidity is to firmly anchor short-term interest rates at the levels judged appropriate by policymakers. In the case of the euro area, this is currently the level of our deposit facility rate.

在这种环境中,富余流动性的重要作用(尽管绝非唯一作用)是将短期利率牢牢地锚定在决策者认为合适的水平上。就欧元区而言,目前是我们的存款便利工具利率(DFR)。

And yet, recent events in the euro area and the United States have highlighted that the current ample excess liquidity levels may not guarantee that short-term interest rates will reflect policymakers’ desired levels at all times.

然而,最近欧元区和美国所发生的事件表明警示了我们,当前充足的富余流动性水平可能无法保证短期利率始终反映决策者所期望的水平。

In the United States, short-term funding rates experienced severe upward pressure towards the end of September, which required the Federal Reserve to conduct additional liquidity-providing operations. In the euro area, the introduction of a two-tiered reserve remuneration system triggered expectations among market participants of some, albeit limited, upward pressure on overnight rates.

在美国,短期融资利率在9月底遭受了严重的上行压力,这迫使美联储进行更多的流动性供应操作。在欧元区,引入两级准备金利率的政策点燃了市场参与者的预期,也导致了一定的隔夜利率上升压力。

In my remarks this morning I would like to use these two episodes as examples for explaining why managing liquidity conditions in the post-crisis environment has become more complex. In the United States, a prime reason behind the increased complexity relates to the highly uneven distribution of excess liquidity across individual banks. In the euro area, it relates to an uneven distribution across jurisdictions. And in both cases, it also relates to the growing role of intermediaries without access to central bank balance sheets.

在我今天的演讲中,我想以这两个事件为例来说明为什么在危机后的环境中管理流动性状况变得更加复杂。在美国,复杂性有所增加的背后主因与各个银行之间的过度流动性分配高度不均衡有关。而在欧元区,这与各个司法管辖区的流动性分配不均衡有关。而在这两种情况下,这都与(流动性的)中介机构的货币市场地位有所上升却无法触达中央银行资产负债表的原因有关。

I will argue that this concentration of excess liquidity may ultimately require policymakers to tolerate central bank balance sheets that are larger than would be required to control short-term interest rates if liquidity was more evenly distributed. And I will argue that if there would be a need for policymakers to increase their control of short-term rates in an environment of excess liquidity, providing non-banks with access to central bank balance sheets is a powerful option

我将就此问题进行说明,富余流动性的高度集中最终可能会迫使决策者忍受中央银行的资产负债表的规模不得不要大于分配流动性更为均衡的控制短期利率所需的水平。如果决策者有必要在流动性富余的环境中加强对短期利率的控制,那么为非银部门提供央行资产负债表的触达权限是一个强有力的选择。

银行间富余流动性的分配

Demand for central bank liquidity has increased considerably since the financial crisis. A number of liquidity regulations affecting banks, such as the net stable funding ratio and the liquidity coverage ratio (LCR), require banks to hold a sufficient quantity of high-quality liquid assets. Central bank reserves count as such high-quality liquid assets.

自金融危机以来,对中央银行流动性(准备金)的需求已大大增加。许多影响银行的流动性监管指标,例如净稳定融资比率(NSFR)和流动性覆盖率(LCR),都要求银行持有足够数量的高质量流动性资产(HQLA)。在中央银行持有的准备金就是这种高质量的流动资产(之一)。

Naturally, the role of central bank reserves in meeting regulatory requirements depends on the availability of other high-quality liquid assets, such as government bills and bonds. In the euro area, the supply of such alternatives has declined notably over recent years, reflecting both crisis-related downgrades of sovereign issuer credit ratings and fiscal surpluses in some jurisdictions, including Germany.

当然,中央银行准备金在满足监管要求方面的作用取决于其他高质量流动性资产的可获得性,例如国债(短期和长期)。在欧元区,近年来,此类替代品(高质量流动性资产)的供应显着下降,这反映了与危机相关的主权部分债券发行者信用评级下降以及包括德国在内的某些司法管辖区的财政盈余。

As a result, ECB staff estimate that the introduction of the LCR increased demand for reserves in the euro area by up to €200 billion in a sample of systemically important euro area banks from mid-2015 to the end of 2016. On my next slide you can see that banks, especially those with low LCRs, are estimated to have significantly increased their demand for central bank reserves.

欧洲央行的工作人员估计,自2015年中期到2016年底,对具有系统重要性的欧元区银行进行抽样调查,引入LCR使欧元区的准备金需求最多增加2000亿欧元。请看下一张幻灯片,据估算,对于那些LCR较低的银行,他们对中央银行准备金的需求大大增加。

It is certainly not the responsibility of central banks to help commercial banks meet their regulatory requirements. Banks should stand on their own feet when it comes to capital and liquidity. But the hoarding of central bank reserves for regulatory reasons becomes a matter of attention for policymakers insofar as it has the potential to adversely affect the transmission of monetary policy.

中央银行当然无需对商业银行达到监管要求负责。在资本和流动性这一问题上,银行应该自力更生。但是,出于监管原因而贮藏起来的中央银行准备金,已成为决策者应当注意的问题,因为它有可能对货币政策的传导产生不利影响。

This provides the background to understand the recent events in the US money market.

这对我们了解美国货币市场近期所发生的事件提供了一个背景。

As you can see on my next slide, excess reserves – the grey shaded area – currently stand well above $1 trillion – an extraordinary amount from a historical perspective and a level that, according to survey evidence, market participants had expected to be sufficient to keep market rates tied to policy rates, even when accounting for regulatory demand.

正如您将在我的下一张幻灯片中所看到的那样,银行在美联储持有的超额准备金(灰色阴影区)目前远高于1万亿美元,从历史的角度来看,这么大的规模实属非同寻常,根据调查的结果显示,市场参与者预计这么大规模的准备金水平足以维持住市场利率与政策利率的挂钩关系,即使考虑到监管需求也应是如此。

Nevertheless, and you can see this on the right-hand side more clearly, the secured overnight financing rate surged markedly towards the end of September, well above the Federal Reserve’s policy rates. Even the effective federal funds rate briefly exceeded its target range.

然而事与愿违,有担保的隔夜融资利率(SOFR)在9月底显着飙升,远高于美联储所设定的政策利率区间。您可以在右图更清楚地看到这一点,甚至有效的联邦基金利率(EFFR)也短暂超过了美联储的政策利率目标区间。

Such volatility is clearly undesirable from a monetary policy perspective. Short-term rates – and the relevant swap curves that are linked to them – are the key benchmark rates for the pricing of credit.

从货币政策的角度来看,这种波动显然是不可取的。短期利率以及与之相关的掉期曲线是信用定价的关键基准利率。

The Federal Reserve therefore added more than $200 billion in additional overnight and 14-day repo operations and announced additional purchases of US Treasury bills at a pace of approximately $60 billion per month at least into the second quarter of 2020.

作为对此的回应,美联储增加了超过2000亿美元的隔夜和14天期的回购操作,并宣布至少在2020年第二季度之前以每月约600亿美元的速度购买美国短期国债。

These operations became necessary for a simple reason: because holdings of excess reserves in the US financial system are highly concentrated. You can see this on my next slide. According to data from the US Federal Deposit Insurance Corporation (FDIC), 86% of excess reserves are held by just 1% of US banks. Four banks alone account for 40% of aggregate excess reserve holdings in the United States.

这些货币政策操作必要性的原因很简单:因为美国金融系统中超额准备金的持有是高度集中的。您可以在我的下一张幻灯片中看到。根据美国联邦存款保险公司(FDIC)的数据,86%的超额准备金仅由1%的美国银行持有。仅四家银行就占美国超额准备金总额的40%。

Whenever these intermediaries are reluctant, for regulatory or other reasons, to react to a shortage of liquidity elsewhere in the system – even in response to short-term shocks to the supply of and demand for liquidity – upward pressure on short-term rates becomes unavoidable.

但凡这些(货币市场的)中介机构(银行)出于监管或其他原因不愿对(金融)系统中其他地方出现的流动性短缺做出反应时,甚至哪怕只是为了应对流动性供求的短期冲击,短期利率的上行压力也不可避免。

In addition, liquidity may be increasingly supplied by intermediaries which do not have access to central bank refinancing – a point to which I will return to later in my remarks. All in all, it is fair to say that the supply of liquidity has become less elastic in recent years.

此外,无法获得中央银行再融资的中介机构可能提供了更多的流动性,我将在稍后的讲话中再次回到这一点上。总而言之,可以说,近年来流动性供应的弹性减弱了。

Excess reserves are, however, much more concentrated in the United States compared with the euro area, despite the fact that there are almost twice as many banks in the United States than monetary financial institutions in the euro area. On this side of the Atlantic, the top 1% of banks hold less than 50% of excess liquidity.

但是,尽管美国的银行数量几乎是欧元区的货币金融机构(MFIs)的两倍,但与欧元区相比,美国的过剩准备金集中度更高。在欧洲,前1%的银行持有的过剩流动资金不到50%。

And on the right-hand side you can see that the ten largest banks in the euro area hold just a little more than a quarter of excess liquidity, compared with almost 70% in the United States.

在上图的右侧,您可以看到欧元区前十大银行持有的超额流动性仅略高于25%,而在美国,这一比例接近70%。

At face value, the euro area’s more even distribution of liquidity suggests that it may be less likely to experience an episode of high interest rate volatility.

从表面上看,欧元区流动性的分布更为均匀,这表明我们不太可能经历高利率波动。

但是有两个特征(其中一个特定于欧元区)值得我们保持谨慎。

富余流动性的分配与两级体系

The first feature relates to the distribution of excess liquidity within and across euro area jurisdictions.

第一个特征涉及欧元区辖区内和跨欧元区辖区之间富余流动性的分配。

On the left-hand side of my next slide you can see that banks’ excess liquidity is often much less evenly distributed than at the country level. In Italy, for example, the top ten banks together hold 80% of excess reserves – a concentration level that is, in fact, higher than in the United States. In France, the top 10 banks hold 70%.

在我的下一张幻灯片的左侧,您可以看到,从各国的情况来看,银行的富余流动性分布情况要不平衡得多。例如,在意大利,排名前十位的银行合计拥有超额准备金的80%——实际上,这一集中度高于美国。在法国,排名前十位的银行则占70%。

On the right-hand side you can see that excess liquidity holdings in the euro area are also highly concentrated in just a few countries.

在右侧,您可以看到欧元区富余的流动性资产也高度集中在少数几个国家。

Such concentration levels are, in principle, of little concern to policymakers in the presence of a deep and active money market across the euro area – that is, as long as banks with excess liquidity holdings are willing and able to smooth liquidity shortages elsewhere in the system.

原则上,在整个欧元区存在活跃的货币市场的情况下,政策制定者几乎无需担心这种情况——也就是说,只要持有过多流动性的银行愿意并且能够缓解欧元体系内其他地方的流动性短缺问题。

If there is fragmentation, however, then temporary spikes in interest rates are also possible in the euro area, despite the remarkable excess liquidity levels we are currently seeing.

但是,如果出现市场割裂的情况,尽管我们目前看到的富余流动性水平很高,欧元区的利率也可能会短暂上冲。

In other words, in the euro area, compared to the United States, it is fragmentation rather than concentration that may make liquidity supply less elastic.

换句话说,与美国相比,在欧元区,货币市场的割裂而不是集中可能使流动性供给的弹性降低。

The recent introduction of a two-tier reserve remuneration scheme for the excess reserves of euro area banks provides an interesting showcase for just how fragmented our money markets remain today. The scheme allows banks to deposit a pre-determined quantity of excess liquidity – their exemption allowances – at a rate higher than the deposit facility rate.

最近,欧洲央行针对欧元区银行的超额准备金推出了两级准备金利率的方案,这为我们当下的货币市场仍然处于割裂的情况提供了一个有趣的示例。该计划允许银行以高于存款便利工具利率的水平来存入预定数量的过剩流动资金(给银行准备金提供的免于征缴负利率的额度)。

To see the effect of the scheme on money markets, it is important to recall that exemption allowances are allocated as a multiple of banks’ reserve requirements.[5] This allocation scheme has led to some banks receiving allowances that are higher than their excess liquidity holdings.

为了了解该计划对货币市场的影响,重要的是要记住,豁免额是银行法定准备金的倍数。这种分配方案导致一些银行的豁免额高于其超额流动资金的持有量。

Specifically, ECB staff calculations suggest that around one-third of exempt excess liquidity would need to be traded across banks for the system as a whole to benefit fully from the two-tier scheme. Most of this trading can take place within euro area jurisdictions, and often even within banking groups.

具体来说,欧洲央行工作人员的计算表明,整个系统需要从银行之间交易约三分之一的豁免过剩流动性,才能从两级计划中充分受益。这种交易大部分可以在欧元区管辖范围内进行,甚至经常在银行集团内部进行。

But because of the uneven distribution of excess liquidity, ECB staff estimates that around 4% of exemption allowances, or around €30 billion, could only be filled if banks trade across borders.

但是由于富余流动性的分配不均,欧洲央行工作人员估计,只有大约4%的豁免额(约300亿欧元),可供银行跨境间进行同业交易。

Such volumes are potentially large. For example, they are about the same size as the volumes currently underpinning the daily computation of the €STR, and they amount to about 30% of the size of the current daily turnover in the secured money market.

这样的交易量可能很大。例如,这与当前支撑€STR(欧元短期利率)的日常计算的交易量大致相同,并且占有担保货币市场当前每日交易量的大约30%。

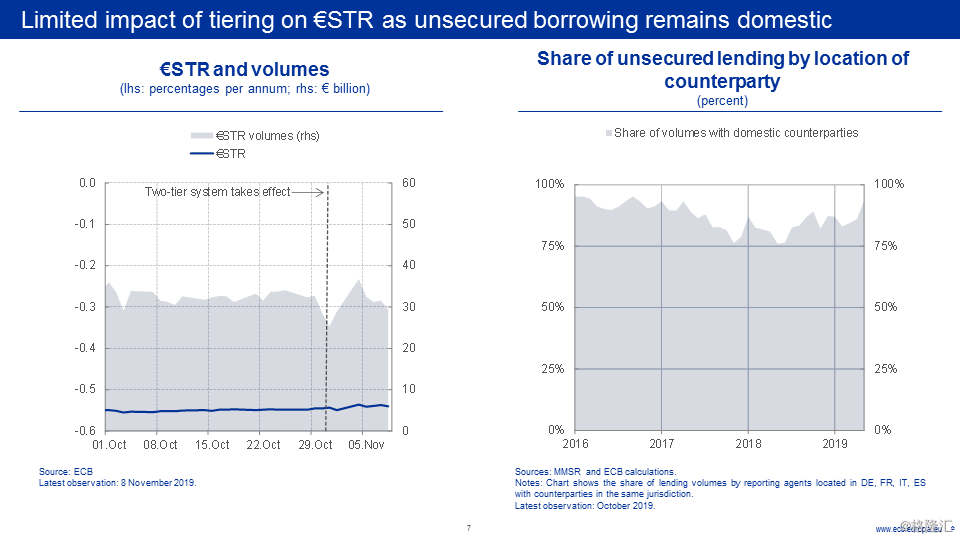

Yet, the impact on the €STR, as you know, has been very limited. You can see this on the left-hand side of my next slide. Our analysis shows that this stability is not primarily the result of the statistical trimming procedure that is applied to the €STR and that could potentially treat transactions at higher rates as outliers.

但正如您所知道的那样,这对€STR的影响非常有限。您可以在我的下一张幻灯片的左侧看到这一点。我们的分析表明,这种稳定性主要不是应用于€STR的统计调整程序的结果,并且可能会将较高利率的交易视为异常值。

It is rather a reflection of the remaining impediments to cross-border trading in the unsecured segment. You can see from the chart that trading volumes for the €STR have hardly changed in response to the introduction of the two-tier system.

这恰恰反映了无抵押货币市场中跨境资金交易的剩余障碍。从图表中可以看出,引入了两层系统以后,€STR的交易量几乎没有变化。

Unsecured cross-border trading appears to remain limited to core countries even a decade after the outbreak of the global financial crisis. Indeed, on the right-hand side you can see that unsecured borrowing remains, by and large, domestic, particularly in countries where excess liquidity is high.

即使在全球金融危机爆发后的十年,无担保的跨境流动性交易似乎仍然局限于核心国家。在上图的右侧您可以看到,无抵押借款总体上还是国内的机构之间主导,特别是在富余流动性水平很高的国家。

Of course, current elevated excess liquidity levels remove incentives to money market trading more generally. But the muted response of unsecured market trading volumes to the introduction of the two-tier system suggests that we may still be facing a situation in which banks in some parts of the euro area may hold on to excess liquidity while those in other parts of the currency union may face a liquidity shortage.

当然,当前较高的富余流动性水平抹除了货币市场交易的诱因。但是,无担保资金市场的交易量对引入两层体系的反应冷淡,这表明我们可能仍面临着这样一种情况,即欧元区某些地区的银行可能会保持富余的流动性,而欧元区其他地区的银行则可能面临流动性短缺。

Where we have initially seen a more pronounced reaction of rates to the introduction of the two-tier system, however, is in the secured market, in which the use of collateral and central clearing can mitigate counterparty risks. You can see this on the left-hand side of my next slide, which shows repo rates for banks located in different countries.

在引入两级体系以后,我们反而在有担保市场中看到了更为显著的利率反应,在有担保交易中,可以使用抵押品进行担保,中央清算方则可以缓解对手方风险。您可以在我的下一张幻灯片的左侧看到,图中显示了位于不同国家的银行的回购利率。

The chart suggests, for example, that Italian banks with unused allowances increased their demand for cash in the Italian repo market, which has led to a notable – albeit temporary – increase in repo rates. Arbitrage opportunities caused other banks to increase their lending, however, which gradually mitigated this upward pressure.

例如,该图表表明,手中有未使用准备金免征额的意大利银行增加了其在意大利回购市场中对现金的需求,这导致回购利率显着(尽管是暂时的)上升。套利机会导致其他银行增加了资金融出,这逐渐缓解了这种利率上升的压力。

The observed movements in rates are broadly consistent with recent changes in cross-border flows in excess liquidity. You can see this on the right-hand side. On the first day of operation of the two-tier system we observed a considerable redistribution of excess liquidity, often away from liquidity-flush countries such as Belgium, Germany and the Netherlands and towards countries with unused allowances, such as Italy.

观察到的利率变动与富余流动性的跨境流动最新变化所表现出来的大致一致。您可以在右图看到。在两层体系运作的第一天,我们观察到大量富余流动性的重新分配,通常是从流动性充裕的国家(例如比利时,德国和荷兰)转移到未使用豁免额的国家(例如意大利)。

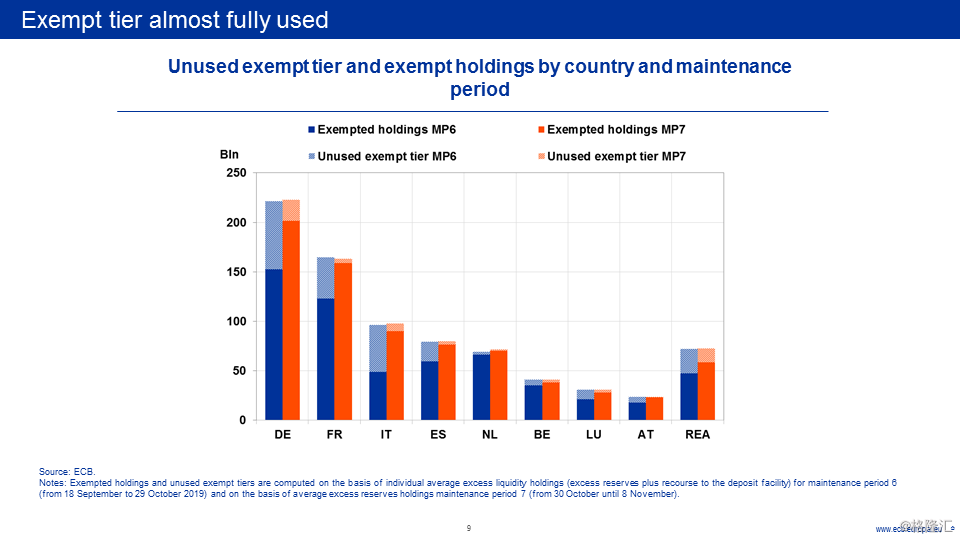

On my next slide you can see banks’ progress in making full use of the exempt tier. For comparison, the blue bars show the theoretical allocation of allowances before the start of the scheme. The chart shows that the Italian banking system as a whole is almost fully benefiting from the allocated allowances, also in response to the re-distribution of excess liquidity towards the Italian banking system.

在我的下一张幻灯片中,您可以看到银行在充分利用豁免层方面的进展。为了进行比较,蓝色条显示了方案开始之前的豁免额水平的理论分配。该图显示,意大利的整个银行系统几乎都从分配的豁免额中充分受益,这也是对富余的流动性向意大利的银行系统进行重新分配的反应。

But in some countries, particularly in smaller peripheral jurisdictions, which I have grouped together here, but also in Germany, there still seem to be some remaining impediments that stop banks from making full use of the scheme.

但是在一些国家,特别是在我在该图中综合在一起的较小的外围国家中,以及在德国,似乎仍然存在一些障碍,阻碍了银行充分利用该计划。

跨部门富余流动性的分布

So, provided banks have sufficient collateral, secured interbank lending has been able to at least partly offset the remaining constraints in unsecured cross-border lending. This was the first feature I alluded to.

因此,只要银行有足够的抵押品,有担保的银行间同业拆借就能至少部分抵消无担保跨境流动性借贷中的剩余限制。这是我提到的第一个特征。

The second feature that warrants caution relates to the distribution of liquidity across sectors, including holdings outside the euro area.

需要保持谨慎的第二个特征涉及部门之间的流动性分配,包括欧元区以外的持有量。

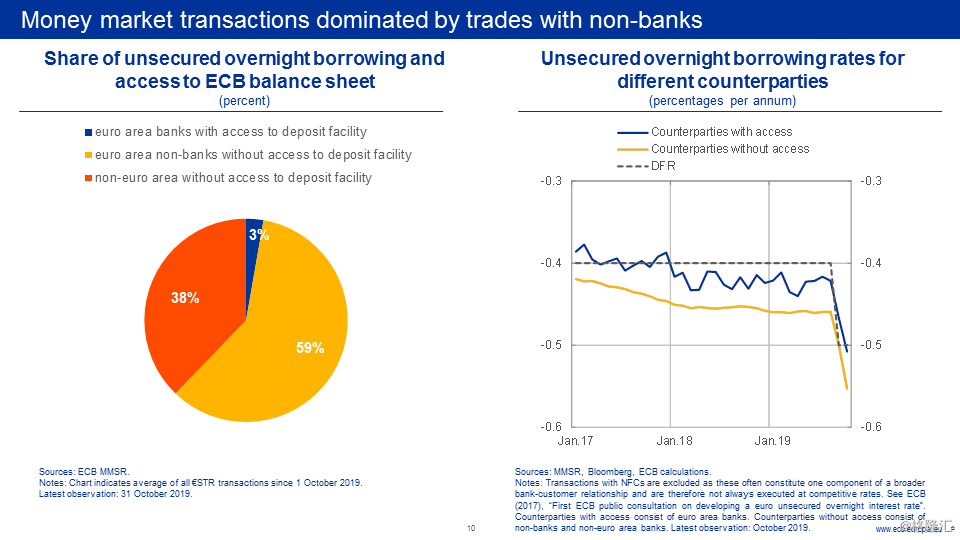

The implications of this feature can be best appreciated when looking more closely at the trades underlying the €STR. You can see this on the left-hand side of my next slide.

当更仔细地研究€STR的基础交易时,可以最好地理解此特征的含义。您可以在我的下一张幻灯片的左侧看到这一点。

Today, almost 60% of €STR transactions are with euro area non-banks – typically, asset managers, pension funds, insurance companies or corporate treasurers – and most of the remainder is accounted for by non-euro area entities. Just 3% of trades are currently between euro area banks.

如今,€STR交易中将近60%是与欧元区的非银行机构(通常是资产管理公司,养老基金,保险公司或公司司库)进行的,其余大部分由非欧元区实体承担。目前只有3%的交易是在欧元区银行之间进行的。

In other words, the significant accumulation of excess liquidity in the euro area banking sector in response to the non-standard monetary policy measures implies that the overwhelming share of money market transactions currently take place between entities that have access to the deposit facility and those that do not.

换句话说,由于采取了非常规货币政策措施,欧元区银行部门积累了大量富余流动性,而货币市场交易的很大一部分份额是在那些没有存款便利工具使用权的机构与拥有该工具使用权的机构之间进行的。

As a result, €STR borrowing rates often reflect the rates charged by euro area banks on deposits by entities without access to the ECB deposit facility. You can see this on the right-hand side.

结果,€STR欧元的借款利率通常反映了欧元区的银行对无法获得欧洲央行存款便利工具的实体的存款所收取的利率,请看右图。

Non-bank and non-euro area entities are prepared to pay rates below the deposit facility rate, and below the rates offered by those with access to the facility, for two main reasons. First, because internal risk management rules restrict their choice of counterparties to those with the lowest credit risk. And, second, because alternative safe investments, such as short-term government bonds, are often even more costly.

非银行和非欧元区实体所支付的利率低于存款便利工具利率,也低于能够获得存款便利工具的实体所支付的利率,这有两个主要原因所致。首先,因为内部风险管理规则将其交易对手的选择限制在信用风险最低的交易对手中。其次,因为替代性的安全投资,例如短期政府债券,往往成本更高。

The changeover from EONIA to the €STR made visible the pricing impact of differences in who can hold central bank reserves. This also means that the €STR is a better and more transparent indicator of prevailing market conditions than EONIA, as it helps deliver a more comprehensive picture of the interactive effects of our actions and policy framework.

从EONIA到€STR的转换使得谁可以拥有中央银行准备金(触达权)的差异对价格的影响非常明显。这也意味着,与EONIA相比,€STR是反应当前市场状况的更好,更透明的指标,因为它有助于更全面地了解我们的行动和政策框架的互动影响。

But it also implies a possible risk that the €STR might be less under our control than EONIA was. Changes in the €STR are essentially a function of three main factors: the level of ECB policy rates, the level of excess liquidity and the distribution of this excess liquidity across sectors.

但这也暗示了可能存在的风险,我们对€STR的控制力可能比起EONIA来更弱。€STR的变化本质上是三个主要因素的函数:欧洲央行政策利率水平,富余流动性水平以及这些流动性在各个部门之间的分布。

All else being equal, a decline in the demand for liquidity services by non-banks – for example, due to a sudden increase in risk aversion – might lead to upward pressure on the €STR at the same level of excess liquidity. Also, a decline in excess liquidity can be expected to lead to faster upward pressure for €STR, even in the absence of changes in policy rates.

在所有其他条件相同的情况下,对非银流动性服务的需求下降(如风险厌恶的突然增加),可能导致在流动性过剩水平相同的情况下,€STR的压力增大。此外,即使政策利率没有变化,富余流动性的减少也可能导致€STR的上升压力更快。

It is these factors that may be a cause of concern in the current context of interest rate volatility. But I would not be overly worried today for three main reasons.

在当前利率波动的情况下,可能正是这些因素引起了人们的关注。但是由于三个主要原因,我现在还不会太担心。

First, we are a long way from expecting any reductions in excess liquidity in the euro area. In fact, as of November, the ECB’s renewed net asset purchases of €20 billion per month will further increase excess liquidity.

首先,我们距离欧元区富余流动性的减少还有很长的路要走。事实上,在11月,欧洲央行每月重启资产净购买,规模为200亿欧元/月,这将进一步增加富余流动性。

The Governing Council is committed to continue net purchases for as long as necessary to reinforce the accommodative impact of our policy rates, and to end shortly before we start raising the key ECB interest rates, which in turn will depend on inflation robustly converging towards our aim. Even beyond the end our net purchases, we will continue reinvesting the principal payments from maturing securities for an extended period of time, which will keep excess liquidity abundant.

欧洲央行理事会致力于在必要的情况下继续进行净购买,以加强我们政策利率的宽松影响,并在我们开始提高关键欧洲央行利率之前不久终结,这反过来将取决于通货膨胀向我们目标收敛的强度。甚至在净购买期结束之后,我们将继续将到期证券的本金再投资持续较长时间,这将使富余的流动性保持充裕。

Second, the experience of the Federal Reserve has highlighted that policymakers have the tools to respond quickly and efficiently to signs of market volatility. In particular, central banks always have the option to broaden access to the liability side of their balance sheet to a wider set of financial intermediaries, which would automatically make it easier to control rates

其次,美联储的经验表明,决策者拥有快速有效地应对市场动荡迹象的工具。特别是,中央银行始终可以选择将其资产负债表的负债方触达权扩大到更多的金融中介机构,这将自然的使利率控制变得更加容易。

And, third, the remarkable stability of the EONIA-€STR spread over the past two years or so suggests that regulatory costs related to the leverage ratio, and competition between banks to offer liquidity storage services to entities without access to the deposit facility, are strong inertial forces that help mitigate large and abrupt swings in the €STR, in both directions.

第三,过去两年左右的时间里,EONIA-€STR的利差所表现出的显着稳定性表明,与杠杆率有关的监管成本,以及银行之间为无法使用存款便利工具的实体提供流动性存储服务的竞争。这种强大的内生性力量可帮助缓解€STR的较大幅度且突然的双向波动。

结论

All this means, and with this I would like to conclude, that large aggregate excess liquidity levels are no insurance that central banks will always find it easy to steer short-term interest rates.

综上所述,总体上大幅度的富余流动性并非中央银行总能简单控制短期利率的保证。

Liquidity supply may have become less elastic in both the euro area and the United States, for different reasons though: in the United States because of concentration among banks, in the euro area because of fragmentation across countries, and in both cases because of the growing role of intermediaries without access to central bank balance sheets. This calls for central banks to err on the side of caution and leave a sufficient buffer in the financial system with a view to forestalling risks of unwarranted upward pressure on short-term interest rates.

出于不同的原因,欧元区和美国的流动性供给弹性可能减弱了:在美国,由于银行之间的集中度问题;在欧元区,由于国家之间的分化问题;以及在两种情况下,无法触达中央银行资产负债表的中介机构变得更重要的因素。这就要求各国央行要更为审慎,并在金融体系中留出足够的缓冲空间,以期防止出现不必要的短期利率上行压力的风险。

The launch of the €STR has been a welcome step in providing a more complete picture of the actual borrowing conditions facing euro area banks. If policymakers in the future consider the impact of changes in excess liquidity on the level of the €STR to be less desirable, they could consider expanding access to the liability side of central bank balance sheets to other actors in financial markets.

欧元€STR的推出是可喜的一步,可以更全面地了解欧元区银行面临的实际借贷状况。如果政策制定者将来认为富余流动性变化对€STR的影响不那么理想,他们可以考虑将中央银行资产负债表的负债方的触达权扩大到金融市场的其他参与者。

Thank you.

谢谢。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员