来源:市川新田三丁目

Credit markets often move before the equity markets, and this can offer helpful information about the near-term path of equity prices. In general, I like to see credit confirming what the equity markets seem to be saying. When credit stalls, like it is now, I take notice.

信用债市场通常会走在股市的前面,这就为预测近期股市的动向提供了有用的信息。总之,我喜欢通过信用债市场的走势来验证股市想传达的信息。因此如果信用债市场的涨势出现停滞,我就会多加注意,当前的情况就是如此。

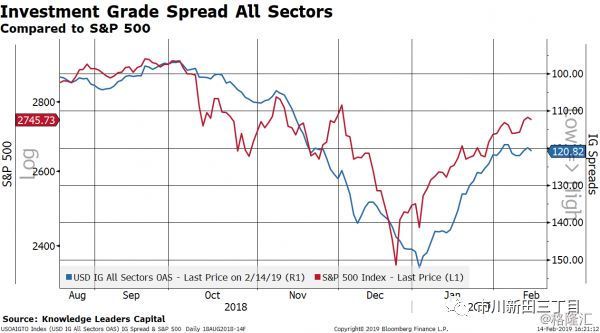

Investment grade spreads recovered about 30bps between January 3 and February 5, 2019. They have since widened out by about 2bps while the equity market is mostly flat.

在2019年1月3日至2019年2月5日期间,美国投资级公司债的信用利差水平回落了约30个基点,2月5日之后美股基本上是持平的,与此同时投资级公司债的信用利差只扩大了约2个基点。

下图中红线为标准普尔500指数,蓝线为美国投资级公司债的信用利差走势,注意信用利差的水平显示在图的右轴,指标是倒过来的,趋势线上行表示信用利差的水平在收窄。

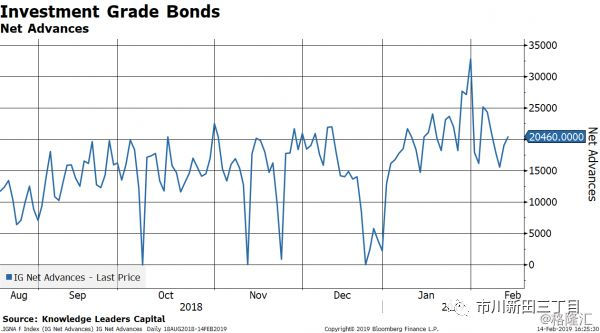

January was a strong month for corporate bonds of all stripes. After troughing at zero, net advances in the investment grade space surged to about 32,000 by the end of January. Net advances have since slipped back to about 20,000, a still healthy level.

2019年1月份各类评级的美国公司债均走势强劲,2018年12月投资级公司债的日内净上涨数量为零,到了2019年1月末,日内净上涨的数量最多时达到约32,000,虽然之后回落至20,000左右,但仍处于较好水平,见下图。

Bond traders were quite active in January after December’s chill. In the second half of December, trading volumes plunged as bonds fell, but they surged back to almost $35 billion per day at the end of January.

在2018年12月的行情遇冷后,近期美国公司债市场的交易员表现得相当活跃。2018年12月的后半月美国公司债市场的成交量随着行情下跌而大幅缩水,但2019年1月末的日均成交量又重回350亿美元左右的水平。

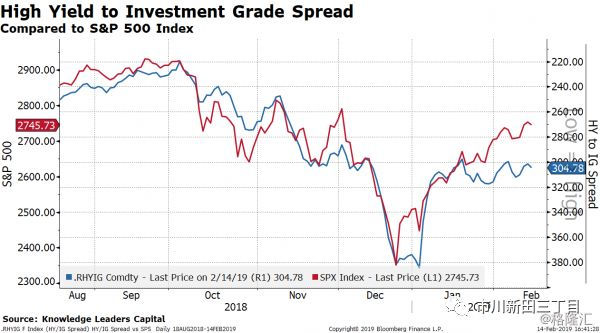

Because high-yield bonds trade more like stocks, I like to compare the relative spread between IG and HY to the S&P 500. High yield spreads stopped narrowing relative to investment grade on January 18, 2018.

由于高收益债的走势更像股票,因此我喜欢将美国投资级公司债和高收益债收益率之间的利差与标准普尔500指数的走势进行对比,下图显示,美国投资级公司债和高收益债收益率之间的利差自2018年1月18日以后已不再收窄。

The divergent signs coming from credit are still early days but worth watching given that the US investment grade credit universe is over $6 trillion, roughly 3x the market value at the last recession and almost 10x the size of the 2001 recession.

考虑到美国投资级公司债当前的市场总量已超过6万亿美元,见下图,等于2008年上一次经济危机时的三倍左右,约为2001年经济衰退期间的10倍,因此虽然美国信用债市场的走势尚未出现背离的迹象,但值得高度关注。

The BBB weight, the lowest rung in investment grade, now constitutes 56% of the $6 trillion investment grade market, the highest in history.

BBB级是投资级公司债中评级最低的一档,见下图,如今在美国投资级公司债未到期余额中的占比为56%,创下历史最高纪录。

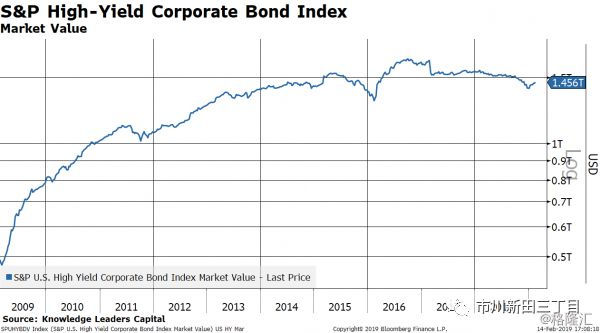

The high-yield market is only about $1.5 trillion, so a wave of credit downgrades could add significantly to this universe of credit, dragging down prices.

美国高收益债市场的规模只有1.5万亿美元,见下图,因此如果未到期的公司债遭遇一波评级下调将有可能给高收益债市场带来巨大的供给压力,拉低整个高收益债市场的成交价水平。

The longer the credit markets stall and diverge from equity markets, the more worried I become of a retesting sequence in the equity markets.

美国信用债市场滞涨并与美股走势背离的时间越长,我就越担心美国股市未来会出现回调。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员