作者:市川新田三丁目

Sometimes clients are puzzled that I recommend bond ETFs such as the iShares Core U.S. Aggregate Bond ETF (AGG) or the Vanguard Total Bond Market ETF (BND).

有时候我的一些客户对我推荐诸如iShares美国核心债券综合回报交易所交易基金AGG或Vanguard美国全债交易所交易基金BND这样一些基金的做法感到困惑不解。

That’s not surprising, considering that, according to Morningstar data as of Feb. 6, 2019, these two ETFs were bested by 79% and 77% of their peer group over the past 10 years. Thus, these are bottom-quartile funds over 10 years—and those percentages might even be worse after correcting for survivorship bias.

客户感到不理解没啥值得奇怪。根据基金行业绩效评级机构Morningstar提供的截止到2019年2月6日的数据,在过去十年里上述两只基金在回报方面分别跑输了79%和77%的同类型基金。也就是说,这两只基金的绩效在过去十年里属于同类基金中最低的四分之一档,如果根据幸存者偏差情况进行修正,绩效排名甚至会更低。

Let me explain why I recommend these funds.

These two bond ETFs follow slightly different versions of the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks the investment-grade U.S. dollar-denominated, fixed -rate, taxable bond market. I’ve heard countless times this is proof indexing doesn’t work for bonds. Not so fast, I respond.

下面我来解释一下,为啥我要推荐这两只基金。

这两只债券类交易所交易基金均以彭博巴克莱美国债券市场综合回报指数作为业绩参考基准,只是BND跟踪的指数是在彭博巴克莱美国债券市场综合回报指数的基础上略有调整,彭博巴克莱美国债券市场综合回报指数追踪的是美元标价,投资级别,固定利率票息,收入应纳税的债券市场的走势。我曾无数次地听到有人说这两只债券类交易所交易基金的业绩跑输同类型基金说明指数型投资不适用于债券投资,我的回应是:且慢下结论。

Morningstar’s peer group for comparison purposes comprises high-quality, moderate-duration bond funds, which these ETFs certainly are. But the peer group takes on far more credit risk than ETFs that follow this index.

Morningstar筛选了一组用于业绩比较的基金,均为高信用评级,中等久期的债券基金,但是业绩对照组基金所承担的信用风险比跟踪彭博巴克莱美国债券市场综合回报指数的基金要高得多。

For example, AGG is 64% U.S. government (Treasury and agency) backed, while the peer group averages only 45%. And AGG is 73% AAA-rated versus the peer group of 40%. Most importantly, AGG has 0% junk versus the peer group averaging nearly 6%.

比如,AGG的投资构成中有64%是美国国债和美国机构债等以美国政府信用为担保的债券,而业绩对照组基金持仓美国政府担保债券的比例平均只有45%;AGG持仓的债券中有73%为AAA评级,而业绩对照组持仓的债券中只有40%为AAA评级。重点在于,AGG不持有垃圾级债券,而业绩对照组的垃圾债持仓均值为6%。

Why Should You Care?

为啥要多留意?

The purpose of bond ETFs is to be the portfolio’s shock absorber. You want your bonds to do well when stocks tank. The more credit risk a bond fund takes, the more it behaves like a stock fund.

持仓债券类交易所交易基金的目的是在投资组合中发挥风险缓冲的作用。投资者寄希望于持仓的股票走势不佳的时候投资组合中的债券会表现良好。一只债券基金中信用债券的比例越高,其回报表现就越像一只股票型基金。

In 2008, when stocks plunged, AGG gained 7.9%, while the peer group lost 4.7% and junk lost an average of 26.4%. Then, the 10-year bull began. 2018 was the first year U.S. stocks lost value since 2008, though that loss was small, with the S&P 500 total return (including dividends) losing only 4.38%. Yet in a year with even a small loss, AGG bested its peer group, gaining 0.10% versus the peer group, which lost 0.50%.

当美国股市在2008年出现大跌之时,AGG的净值上涨了7.9%;而业绩对照组基金的净值损失幅度为4.7%,垃圾债的平均跌幅为26.4%。在那之后,10年期美国国债的大牛市开始了。2018年是2008年以来美国股市首次以下跌年线报收的一年,尽管跌幅并不大,如果算上分红,标准普尔500指数在2018年总回报只下跌了4.38%。但即使在这样一个股市跌幅不大的年份里,AGG也取得了0.1%的正回报,而业绩对照组的平均回报率为-0.5%。

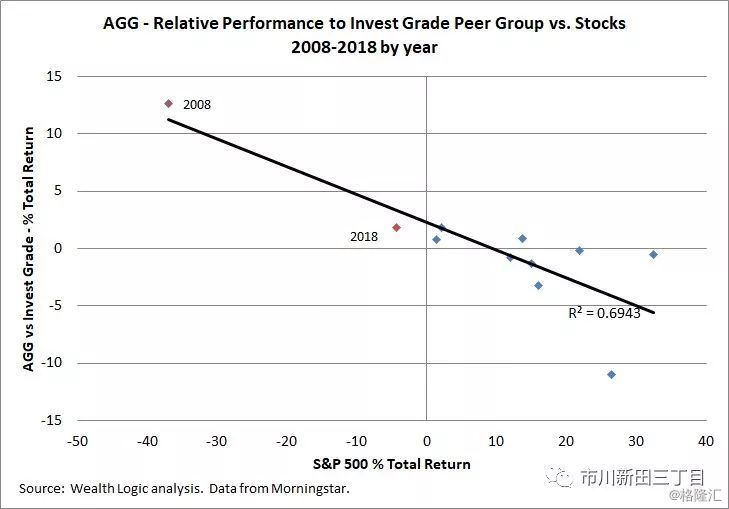

The chart below shows how poorly AGG performs relative to peers when stocks have large gains, but also shows how well they perform versus peers when stocks plunge or are even flat.

下图显示在股票行情大涨的年份,AGG的回报率远远赶不上业绩对照组,但在股市大跌甚至走势平坦之年,AGG的回报率远超业绩对照组。

The bottom line is that you want your bonds to behave differently than stocks. You want to be able to use your bonds to rebalance and buy more equities. In fact, I believe that rebalancing boosts returns. So, if someone tells you bond indexing doesn’t work, don’t fall for it.

关键点在于,投资者希望所持仓的债券走势会与股票不同,这样就能用投资组合中的债券对整个投资组合的投资做再平衡调整,从而买进更多的股票。实际上,我认为这种再平衡调整会增加整个投资组合的的回报。因此,如果再听到有人说指数化债券投资策略作用不大,一定不要轻信这种话。

My Advice

我的建议

The past 10 years have been a raging bull market, which is unlikely to continue for the next 10 years. I recommend taking risks with equities and building a boring fixed-income portfolio of high-quality bond funds and CDs. When stocks tank, and they eventually will, you’ll be glad you did.

美国债券市场已持续了10年的荣景不太可能在未来10年持续下去。我的建议是在持仓股票的同时构筑一个看似无味的固定收益投资组合,组合中包括银行大额定期存单以及跟踪高评级债券走势的基金。如果股票市场遭遇大跌,大跌总有一天会来,届时各位投资者将会为自己当初的先见之明感到欣慰。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员