来源:市川新田三丁目

The US Federal Reserve (Fed) performed a remarkable 180-degree turn between December and January. On December 19, the Wall Street Journal’s opinion page was titled “Powell to Markets: Take That,” with the subtitle “The Fed says more rate increases are coming, so get used to it.” Just a month later, the same page was titled “The Fed Apologizes,” with the subtitle “Powell continues his rehabilitation tour, and the markets applaud.”

在2018年12月份和2019年1月份的两个月之间,美联储在政策立场方面来了个180°的大转弯。2018年12月19日华尔街日报言论版文章的标题是“鲍威尔说给市场听:接受现实吧!”,副标题是“联储表示未来还会加息,适应了就好了”仅仅一个月后,还是这个言论版,文章主标题已变成“联储低头了”,副标题是“鲍威尔继续给市场疗伤,市场欢呼雀跃”。

Fed Chair Jay Powell carries the torch of the “Fed put,” in other words, like Yellen, Bernanke and Greenspan before him. The stock market swoons, the Fed turns dovish.

换句话说,联储主席鲍威尔也像其前任耶伦、伯南克和格林斯潘一样高举起“美联储看跌期权”的大旗。联储转向鸽派立场,股市又一次陷入痴狂。

This biting criticism contains more than a kernel of truth. But it does not mean that the Fed won’t hike again.

这个辛辣的批评是有一些道理,但是这并不是说联储不会再次加息。

The Fed decided to pause because it thinks it prudent, and because it can. Inflation remains under control and—argues the Fed—so does financial stability. Therefore, slowing or even halting policy normalization carries no risks—and the Fed can afford to wait.

联储为啥决策暂停加息,因为联储认为这样做是明智的,也有能力做到这一点。当前美国的通胀增速得到有效控制,联储也强调了金融稳定的必要性。因此,减慢甚至终止货币政策正常化的进程不会带来风险,联储完全等得起。

I agree that financial risks are broadly under control; but this points to more rate hikes, not rate cuts, in my view. Hear me out.

US consumers are in stronger financial health than previously thought. Most importantly, our research shows that they are much less vulnerable to stock market fluctuations than they used to be.

我认可金融风险总体上得到有效控制的观点,但我认为这将带来更多的加息,而不是降息,且听我细细道来。美国消费者的财务状况比以往认为的更健康,更重要的是,我们的研究表明美国消费者对股市波动的承受能力要远超以往。

THE FINANCIAL HEALTH OF THE CONSUMER IS MUCH STRONGER THAN ORIGINALLY THOUGHT. THE US SAVINGS RATE REMAINS HIGH.

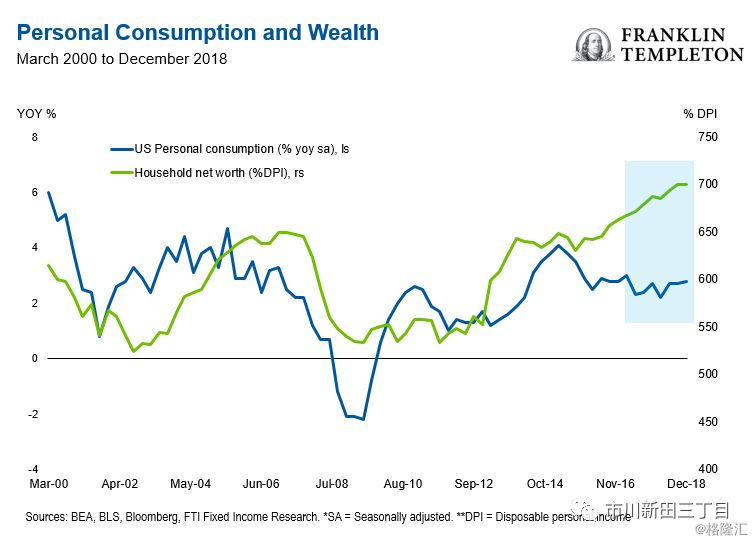

美国人的储蓄率仍居高不下,图中绿线为2000年至今美国家庭财富净值与个人可支配收入之间的比率,蓝线为美国个人消费的年增速

Consider: Revised data from the National Income and Product Accounts (NIPA) show that the household savings rate has remained broadly constant (at a healthy [6%]) over the last five to six years, even as household net worth surged to a record high: 700% of disposable income. By comparison, when household wealth rose strongly in the run-up to the global financial crisis, the savings rate dropped from 6% to a mere 2%.

想想看,美国商务部公布的全美收入和总产值账户NIPA的数据修正值显示美国家庭的储蓄率总体上保持稳定,储蓄率在过去5到6年的时间里一直保持在6%,虽然在此期间美国家庭财富净值与个人可支配收入之间的比率猛升至700%的历史新高。相形之下,2008年金融危机前夕美国家庭财富净值也同样经历过大幅上涨,但当时的储蓄率却从之前的6%跌至只有2%。

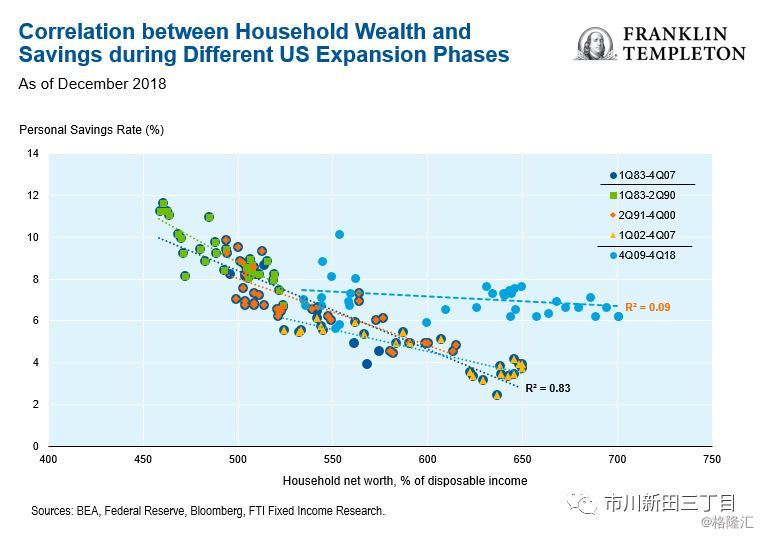

The historical correlation between household net worth and personal savings has broken down after the financial crisis. In other words, the wealth effect is not as strong as it used to be: an increase in wealth no longer leads the household sector to meaningfully raise their consumption.

从历史上看,美国家庭财富净值与个人储蓄率之间一直存在着密切的相关关系,但在2008年金融危机后这种相关关系出现破裂,也就是说,财富效应不再像以前那样强,美国家庭不再因财富的增加而大幅增加消费开支。

Increased levels of wealth inequality play an important role here: greater inequality means the recent rise in net worth goes disproportionately to the benefit of richer households, especially as it has been driven by rising values of financial assets. Richer households have a lower propensity to spend more as their wealth increases. The 2006 housing bubble in contrast was much more egalitarian, benefiting a wide range of households that, in response, dissaved and consumed more.

财富分配的不平等带来重大影响:财富不平等状况的恶化意味着美国家庭净财富近期新增加的部分更多地流向富裕家庭,尤其是当财富的增加主要来自于金融资产估值上升的情况下,即使财富增加但富裕的美国家庭增加开支的意愿并不强,相反,2006年美国房地产市场的泡沫却更“雨露均沾”,各个阶层的美国家庭均受益于房价的上涨,相应地,少储蓄多消费的情况更多一些。

This lack of dependence on the wealth effect puts household consumption on a very sustainable footing, supported by rising income levels and less exposed to the gyrations of equity markets.

由于对财富效应的依赖程度不高,因此美国家庭消费的增长动能非常持久,收入水平增加以及受股票市场的周期性变化影响较少等因素也对消费增长起到支持作用。

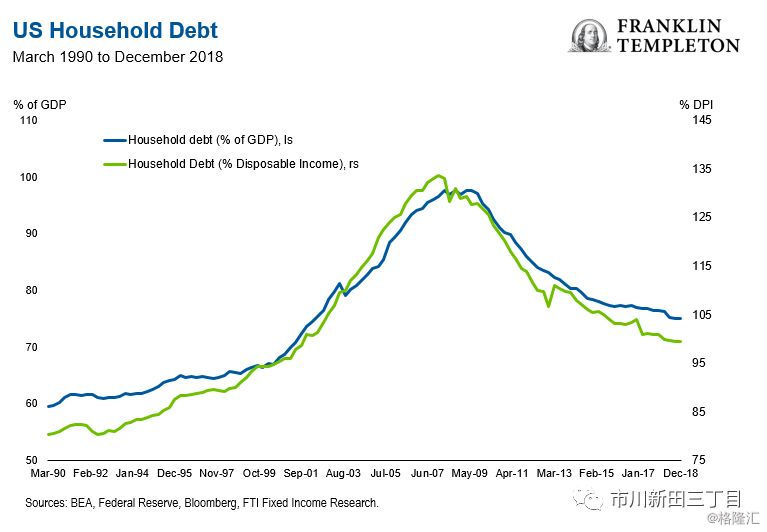

US consumers also face a considerably lower debt burden than before the financial crisis: household debt is about one-third below the 2008 peak, both as a share of GDP (gross domestic product) and as a share of disposable income. Household debt and mortgage debt service ratios have dropped to record lows, and consumer delinquency rates as a share of total bank loans are less than half what they were in 2009 (2.3% vs. 4.9%).

美国消费者的债务负担也远低于2008年经济危机以前,当前家庭债务总量与GDP以及与个人可支配收入的比率均比2008年的最高水平低了差不多三分之一。美国家庭债务和按揭贷款的偿债比率也降至历史最低,当前消费贷款逾期余额占银行贷款总量的比率为2.3%,比2009年时4.9%的水平低了一半还多。

IS THE WEALTH EFFECT DEAD? SINCE THE END OF THE GREAT RECESSION, THE WEALTH AND SAVINGS RELATIONSHIP IN THE US HAS BROKEN DOWN.

财富效应风光不再?2008年金融危机以来,美国家庭财富净值与个人可支配收入之间的比率与个人储蓄率之间的相关关系不再紧密

These data convey one clear message: the Fed has little reason to fear that further monetary policy tightening will harm household consumption. Consumers enjoy high net wealth levels, high savings rates and low debt service ratios, and their consumption decisions don’t seem to react much to changes in net wealth, especially if driven by stock prices. The Fed can hike some more, and consumers will take it in stride, even with some correction in equity markets.

这些数据传达了一个明确的信息:联储没有理由担心,货币政策的进一步紧缩会损害美国家庭的消费状况。美国消费者正受益于净财富的增长,储蓄率的增加以及家庭债务负担水平的下降,美国家庭在消费方面的决策似乎不会因净财富水平的变化而受到过多影响,尤其是在净财富的变化主要是来自股价波动的情况下。联储完全可以再加几次息,消费者对此将安之若素,虽然股市可能会有一些调整。

The Fed said it wants to be prudent and take the pulse of domestic growth, the global economy and US financial conditions. Take the robust financial health of US households together with a red-hot labor market feeding healthy wage gains, and you get a very resilient outlook for private consumption—the primary domestic growth engine. Global growth has weakened somewhat, but Europe’s economy still marches above potential and China’s runs at a respectable 6% pace. Barring any major shocks, we are looking at a very moderate deceleration in global growth, not a sharp slowdown. As for domestic financial conditions, they had tightened mostly because of the drop in equity markets, which have since turned around—and which seem to have limited impact on consumption, as shown above.

联储表态将谨慎行事并把握好国内经济增长,全球经济状况以及美国金融市场的融资状况等方方面面的情况。如果把美国家庭财务健康状况良好以及就业市场一片红火带来收入稳定增长等情况结合在一起看,就会作出美国个人消费前景非常乐观的判断,个人消费是美国国内经济最主要的增长源。当前全球经济增长态势多少有些回落,但欧洲经济的增速仍超过潜在增长率,中国经济增速仍达到可观的6%。如果没有大的冲击,全球经济将非常缓慢地减速,而不是快速下行。受前期股市下跌影响,美国国内融资市场的状况大幅收紧,但近日股市有所回暖,消费方面由此受到的负面影响似乎并不大,见上图。

In the coming months, I expect the global economic outlook to prove more resilient than markets now predict, making equity investors less prone to panic. I believe the Fed will then deliver two more rate hikes—because it would be the prudent thing to do—and because it can.

我的判断是,未来几个月将证明全球经济抗风险的能力会比当前市场所预测的更强,股市投资者不大可能出现恐慌。我认为联储未来会再加两次息,理由是联储认为这样做很稳妥,而且联储也能做到这一点。

If you think that Powell has just promised there won’t be any more hikes, consider: Bill Dudley, who until last year was head of the New York Fed, has said that “…last week’s announcements do not have significant implications for the interest rate outlook.”

如果你还在以为鲍威尔不久前做出的是不再加息的承诺,那就想想去年底刚刚卸任纽约联储行长一职的Bill Dudley最近说过的话:“。。。鲍威尔上周所做的表态对未来的利率前景没有太大的影响。”

Ultimately, economic fundamentals will drive the show; that’s what we should be watching.

但归根到底,美国经济的基本面才是重中之重,也是我们最应该关注的点。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员