作者:市川新田三丁目

Uber. Lyft. Zip-Car. Bird. Airbnb.

Rideshare. Carshare. Bikeshare. Homeshare.

It's no secret that the “sharing economy” has staked a firm position in our everyday language.

提起Uber、Lyft、Zip-Car、Bird、Airbnb这些名字,就会令人想起共享出行、共享租车、共享单车、共享住宿等新生事物,人所共知如今在我们的日常用语中与“共享经济”有关的词汇已牢牢占据了一席之地。

Over the past decade, the network of sharing economy businesses has grown significantly, expanding its reach across many industries and countries. These companies, almost all of which remain privately held, have re-shaped traditional business models and created exciting solutions for consumers. Capitalizing on the demand for convenience, flexibility, and unique experiences, companies in this space have paved new paths and built wide-ranging networks of individuals actively participating in the sharing economy.

在过去十年里,共享经济的业务网络增长迅猛,触角已伸向很多行业和国家。这些几乎都还未上市的共享经济平台公司重塑了传统的商业模式,为消费者带来了激动人心的解决方案。凭借大众消费者对便利性、灵活性和独特体验的追求,各个平台公司在共享经济领域被不断创新路径,拓宽应用网络,吸引更多的个人消费者积极参与其中。

In its infancy, the sharing economy faced many doubts regarding consumer adoption. After successfully disproving that notion, it then faced reservations about its longevity, as some believed it might be a phase backed exclusively by younger generations. In recent years, however, participants in the sharing economy have managed to alter the narrative, forcing traditional companies to answer how they will keep up with the “sharing shift.”

在共享经济诞生之初,有很多人质疑该模式是否会得到消费者的认可。在成功的反击了这些质疑后,又冒出来共享经济能否持续下去的声音,因一些人认为该模式只能得到年轻一代的青睐。但在最近几年里,参与到共享经济中的人数之多终于改变了这一论调,并迫使各类传统企业不得不思考应如何做才能赶上“共享经济的转型大潮”。

In the world of hospitality, major hotels chains have faced pressure to join the sharing economy. With Airbnb — a pioneer of the sharing economy — primed for a potential 2019 IPO, the pressure isn't likely to subside anytime soon.

在住宿行业里,几家主要的连锁酒店均面临被迫加入“共享经济”的压力。随着共享住宿行业的先驱Airbnb预计将于2019年首发上市,传统酒店遇到的压力不太可能在短期内出现减弱。

Airbnb’s Upcoming IPO Adding Pressure to Hurting Hotel Chains?

Airbnb的即将上市会给连锁酒店带来更多压力吗?

In mid-November, Airbnb announced that its third quarter revenue exceeded $1 billion, the strongest quarter in company history. In January 2019, the company reported it was profitable on an EBITDA basis for the second year in a row, a significant accomplishment for any unicorn start-up. Additionally, it expects 500 million guest arrivals by the end of Q1 2019.

2018年11月中旬,Airbnb公布2018年3季度的营业收入超过10亿美元,为该公司历史上最大幅度的增长。2019年1月,该公司公告已连续第二年实现息税摊销折旧前利润数为正,这个成绩对于任何独角兽创业公司来说都是一个伟大的成就。此外,该公司还预测到2019年1季度末该公司的注册用户数将达到5亿。

In June 2018 reports surfaced that Airbnb would be ready to IPO as soon as June 2019. Coincidentally, the three major U.S. hotel chains began a seven-month slide at about the same time, underperforming the S&P 500 by an average of 10% at year-end. While there are many factors contributing to underperformance over that period, the continued shift toward a sharing economy is certainly on investors’ minds.

该公司在2018年6月发布的财报中首次披露最快将于2019年6月份实现首发上市。巧合的是在此期间,三家美国连锁酒店巨头的股价出现下跌,截止到2018年底,三家酒店的股价跑输标准普尔500指数的幅度平均为10%。股价表现不佳的原因有很多,但在投资者看来,传统经济模式持续向共享经济的转型才是根本原因。

下图中,蓝线为标准普尔500指数的走势,绿线为万豪国际集团股价,黄线为希尔顿酒店集团股价,紫线为凯悦酒店集团股价

As a leader in the sharing economy and competitor to traditional hospitality companies, Airbnb has slowly forced global hotel brands to reimagine their business models and invest resources to address the change in consumer demands. They are all facing the decision whether to enter, exit, or remain on the sidelines of the sharing economy.

作为共享经济行业的领导者以及传统住宿行业的挑战者,Airbnb渐渐促使全球酒店行业内的大公司重塑各自的商业模式,并加大投入以适应消费需求的变化。这些传统企业在面临共享经济模式的时候都有加入、退出或继续做个旁观者的选项。

Hotels and Homeshares

传统酒店业试水共享住宿业务

In the spring of 2018, Marriott International began a homeshare pilot in London with roughly 200 residences in its portfolio. Operating under Tribute Portfolio Homes, Marriott believed it could deliver a better product by leveraging its strong brand and loyal customers.

万豪国际酒店集团于2018年春季在伦敦推出了一项住宿共享计划,有大约200套房屋参与其中,计划的名称为Tribute Portfolio Homes,该项目的主页为http://tributeportfoliohomes.com/

In Marriott’s Q3 2018 earnings call, President and CEO Arne Sorenson gave investors an update on the London trial. “So we’ve been pleased with the pilot so far…the first wave of the pilot was really about assessing what happened in London. And we saw really good results…it looked like it was accretive to our total business in the market, with by the way good synergy with hotel bookings too.”

在2018年3季度万豪国际的业绩说明会上,董事会主席兼首席执行官Arne Sorenson将伦敦项目的最新情况向投资者做了通报。“我们对业务试点迄今为止取得的进展感到欣喜。。。第一波试点实际上是评估一下伦敦地区的情况。至于真正的好结果应该是什么,我们认为应该是与酒店的预订业务互相促进,能够对我们在市场上的整体经营业绩有提振作用。”

After success in Phase 1, Marriott has moved into Phase 2, which includes three additional cities: Paris, Lisbon, and Rome. Adding four European markets to its homeshare portfolio in less than a year highlights its recognition of the changing landscape in the industry and its dedication to keeping up with consumer demands.

在取得了第一阶段的成功后,万豪国际已经开始在第二阶段的试点中增加了三个城市:巴黎,里斯本和罗马。在不到一年的时间里在四个欧洲城市开展住宿共享业务试点,彰显出万豪对于本行业发生的变化具有很高的认知以及有决心跟上客户需求变化的脚步。

Marriott is not the first of its competitors to try its hand at home sharing. Hyatt’s first encounter with the sharing economy came in 2014 when it made a significant investment in onefinestay, an upscale rival to Airbnb. It exited its position after French company Accor acquired onefinestay for $168.4 million. In a second run at home sharing in mid-2017, Hyatt placed a minority investment in Oasis, a high-end home booking company based in Miami, Florida. After incorporating Oasis into its rewards program in March 2018, Hyatt suddenly parted ways last October as Vacasa, a U.S.-based vacation-rental management company, acquired the company for an undisclosed amount.

万豪不是业内首家试水住宿共享业务的公司,凯悦酒店集团在2014年在业内第一个吃了螃蟹,当时投下大手笔的onefinestay项目成了Airbnb的一个强劲竞争对手,但在法国雅高酒店集团以1.684亿美元收购onefinestay后,凯悦退出了住宿共享业务。凯悦第二次尝试进入住宿共享业务是在2017年中,当时在一家总部位于佛罗里达州迈阿密市的高端住家预定公司Oasis中做了一个小股东,在2018年3月将Oasis纳入旗下的优惠答谢计划中后,凯悦突然又一次改弦更张,于2018年10月将Oasis卖给了一家做度假酒店分享业务的美国公司Vacasa,交易金额未经披露。

While its investments were short-lived, Hyatt proved its willingness to explore unique opportunities and assimilate home-share companies into its portfolio and rewards program.

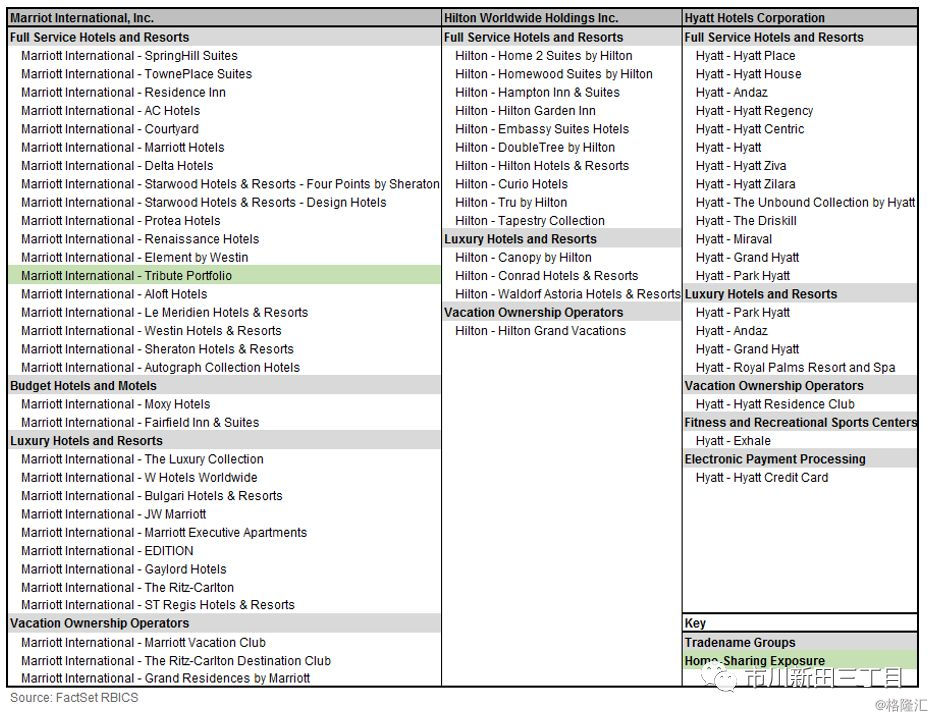

Hilton remains one of the holdouts. The firm believes it should not place a focus on homeshare at this time as its operations are different from companies like Airbnb. As it stands today, Marriott is the only one of the three companies with exposure to homeshares in its brand portfolio.

虽然凯悦酒店集团两次投资的时间都不长,但显示出该公司有抓住难得的机遇,将从事住宿共享业务的公司纳入经营范围和优惠答谢计划的意愿。但希尔顿酒店集团仍按兵不动,该公司认为当前不应将重点放在分享住宿业务上,因为该公司的业务模式与Airbnb这样的公司并无共同之处。到目前为止,万豪是三大酒店集团中唯一一家以品牌的名义经营住宿共享业务的公司。

Hotel Companies Have Limited Exposure to Home-Sharing

酒店业巨头程度有限地开展了共享住宿项目

Lessons from the Past

历史经验说明什么

Airbnb prides itself in its community of renters and hosts. History has shown how a strong community, tied to a disruptive company, can overhaul an entire industry. Amazon and its Prime members changed retail forever. Netflix and its subscribers transformed media content and consumption. Airbnb could soon find itself on a similar trajectory as it rapidly expands its global footprint and diversifies its revenue streams.

Airbnb以能够成为汇聚租客和出租人的共享社区为傲。历史经验见证过一个蓬勃壮大的社区再加上一家具有颠覆性的公司是如何让整个行业翻天覆地的。亚马逊公司携手其高级会员群体让零售行业从此变了天,耐飞公司及其订阅者一起改变了媒体内容的制作和消费模式,Airbnb可能很快也会走上同样的路,迅速在全球各地开疆拓土,收入来源日益多元化。

Will an Airbnb IPO a have major effect on hotel chains? Probably not, at least not immediately. But just as many large retailers fell behind or closed their doors trying to catchup to the e-commerce giants, at some point in the future some hotel companies may find themselves wishing they had placed a greater investment in the sharing economy.

Airbnb的首发上市会给连锁酒店行业带来重大影响吗?也许不会,至少眼前还见不到。但正如很多大的零售商要么业绩跌入深渊,要么纷纷关张实体店努力追上电子商务巨无霸的脚步一样,在将来的某个时点一些酒店业巨头会发现自己也会变得愿意在投资共享经济方面出手阔绰。

交易思路:

随着共享经济模式大行其道,当一个传统行业中出现一个共享经济平台颠覆者之时,该行业中传统大佬们的业绩和股价往往就开始江河日下了,与此形成鲜明对比的是共享经济平台公司的股价却一飞冲天。

以下为亚马逊与美国传统百货及连锁超市企业的股价2015年初至今的走势对比,图中高高在上的黑线为亚马逊的股价,期间涨幅为446%;紫线为沃尔玛超市的股价,期间涨幅为10%;绿线为塔吉特超市的股价,期间跌幅为5.56%;蓝线为梅西百货的股价,期间跌幅为61.85%。

如果在2015年初建立一个对冲交易策略:买进时价为30万美元的亚马逊股票,同时分别借入各10万美元市值的沃尔玛、塔吉特、梅西百货等传统行业大佬的股票并做空,整个投资组合的初始风险总敞口为零。四年后,这笔多空对冲交易的总盈利为110万美元,当然还要扣除借股票做空所需支付的利息,但这笔交易大赚是无疑的。

按照同样的思路,是否可以考虑在Airbnb爱彼迎上市后,同样建仓一个多空对冲交易头寸,做多Airbnb+做空万豪、凯悦、希尔顿的股票?拭目以待,等6月份Airbnb上市后看看当时的市场情况再说吧。

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员