机构:建银国际

评级:Outperform

目标价:19港元

Internet services monetization in the fast lane. Xiaomi’s internet services are still in their early stage of monetization. Average revenue per MIUI user in 3Q18 (ARPU) was RMB 21.1, a 29.4% YoY increase but still far below the level of other global internet giants. We look for internet services revenue at Xiaomi to grow 70%/27% in FY 18F/19F, underpinned by continuous optimization of the recommendation algorithm, increasing user engagement and higher pre-installation.

Smartphones moving to the high-end. One of Xiaomi’s smartphone strategies has been to strengthen its presence in the mid- to high-end market. By promoting high-end models like the Mi 8, Xiaomi’s smartphone ASP increased 13% YoY to RMB 1.1k in 3Q18. On top of 37%/12% YoY shipment growth in FY18F/19F, we expect ASP to expand 11%/10% YoY in FY18F/FY19F on the back of product portfolio optimization in mainland China and rapid expansion in Western Europe.

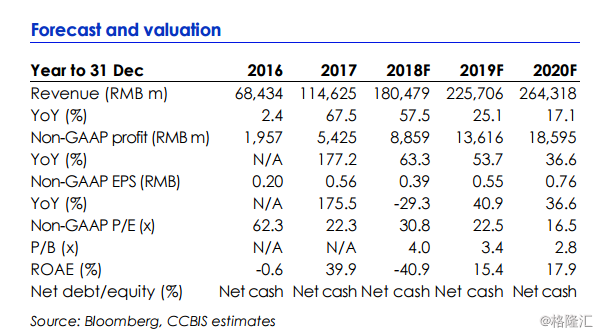

Upgrade to Outperform and raise target price to HK$19.00. We slightly raise our FY18-20F non-GAAP earnings forecasts 1-4% to reflect our higher sales and margin assumptions. We raise our target price from HK$15.50 to HK$19.00, with our new target based on 30x 2019F non-GAAP earnings, up from 25x to reflect strong earnings momentum and better investment sentiment.We like Xiaomi for its leading position in IoT and in the smart phone industry and the considerable monetization potential of internet services.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员